Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue ”The 2 types of crypto investors”

If you haven’t yet, subscribe to get access to this post, and every post

In today's newsletter:

💡 Is Lido ($LDO) Undervalued?

📣 MicroStrategy offered $875 million of convertible senior notes

📈 Ethereum validators are at ATHs

Let’s dive in!

💡 Insight

Is Lido ($LDO) Undervalued?

Staking is the process of locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network.

However, once a user stakes their tokens, they are often locked and become illiquid, meaning they can't be easily accessed or sold.

Liquid staking aims to solve this problem by providing stakers with a tokenized representation of their staked assets. This token can be traded, used as collateral, or otherwise utilized in the DeFi ecosystem, making the staked assets "liquid."

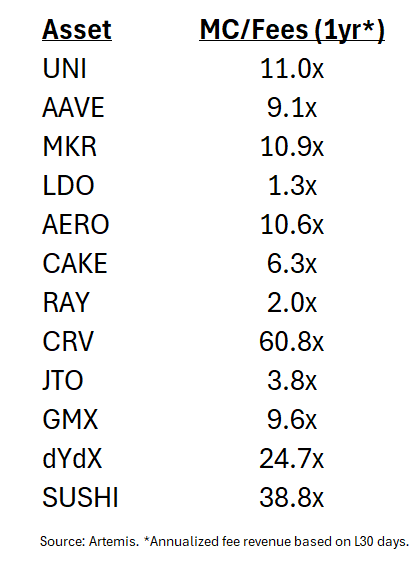

Lido (LDO), the biggest liquid staking protocol by Total Value Locked ($25B), presents an intriguing financial profile:

The protocol is currently leading the staking protocol ecosystem with approximately $25 billion in Total Value Locked (TVL).

It generates an impressive $800 million in annualized fees.

Its market cap stands at only $1 billion.

A few observations:

The fee-to-market cap ratio is remarkably low, resulting in a MC/Fees Ratio of just 1.3x. This figure is considered exceptionally low in both cryptocurrency and traditional equity markets.

Market Dominance: Lido maintains a significant market share, managing roughly 30% of all staked Ethereum (ETH). This dominant position provides a substantial competitive advantage.

Growth Potential: As Ethereum and other supported networks continue to expand, Lido's TVL and revenue streams may see further growth.

Want to invest in a diversified portfolio of useful products and protocols like $LDO?

This portfolio is focused on fast-growing useful protocols and products.

If you want to win in crypto on easy mode, you should hold a lot of these types of assets.

📣 News

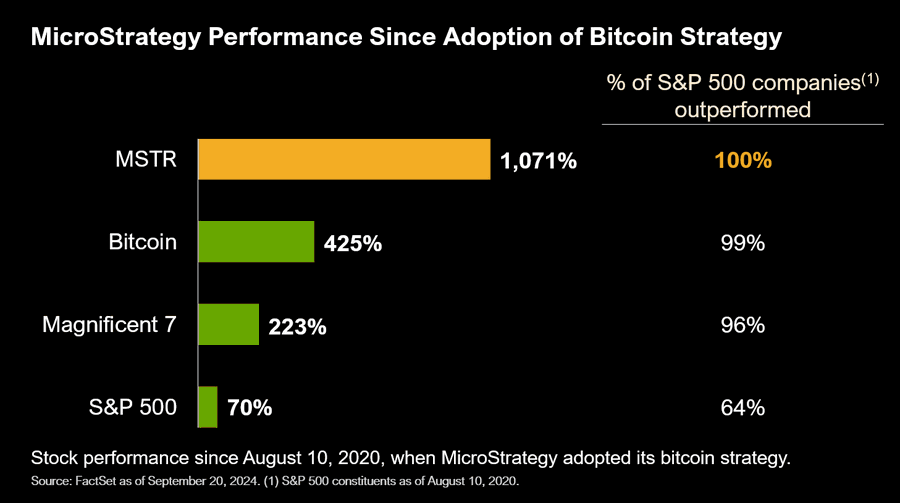

MicroStrategy offered $875 million of convertible senior notes

The company has been raising debt funds to buy Bitcoin, through convertible senior notes.

📈 Signal

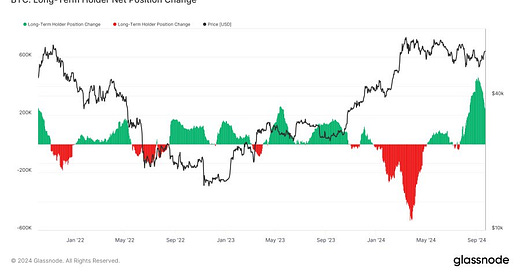

Long-term Bitcoin holders are buying!

Over the last 2 months, long term holders have accumulated more BTC than in any other period in the past 3 years.

Take action 👀💸

Here are 5 investing opportunities related to BTC that we could outperform:

1️⃣ Mining Stocks

As well as gold miners, also bitcoin mining companies amplify the market trend, for better or for worse.

Historically mining companies get leveraged exposure to the price of bitcoin. In other words,

If Bitcoin goes up, Bitcoin miners go 3x+ up.

If Bitcoin goes down, Bitcoin miners go 90% down.

In the last bull market, RIOT and MARA (bitcoin mining stocks), outperformed bitcoin by 3x and 9x respectively.

2️⃣ MicroStrategy

MicroStrategy is the largest Bitcoin holding public company, more than the US government.

It’s a software company that provides solutions and business intelligence to companies.

They have got nothing to do with crypto or Bitcoin but they’re consistently outperforming the market since 2020.

3️⃣ Stacks

Stacks is a blockchain platform that extends Bitcoin's functionality, enabling smart contracts and decentralized applications (dApps) on Bitcoin.

It leverages Bitcoin's security while offering more programmability, aiming to create a decentralized internet and digital economy.

4️⃣ Badger

BadgerDAO is a decentralized autonomous organization designed to bridge Bitcoin with decentralized finance (DeFi). It enables the use of Bitcoin as collateral across different blockchains, fostering its integration into various DeFi platforms.

Historically, Badger amplifies BTC market trends, for better or for worse.

5️⃣ Bitcoin Scaling Protocol

Layer-2 networks are secondary frameworks built atop the main blockchain (Layer-1) to enhance its scalability and transaction speed.

A few weeks ago we shared this solution, a protocol that enables users to move assets across Bitcoin Layer 2s efficiently.

Here are the basics:

Market Cap: $41M

TVL: $2.56M

X Community: 43k

Down 98% from all-time high

Investors: Coinbase Ventures, Arrington Capital, NGC, Morningstar Ventures, Moonrock Capital, Spark Digital Capital

Markets: Houbi, MEXC, KuCoin, Gate, CoinEx

Whenever you're ready 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our most popular premium posts:

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

That’s all for today!

Cheers