💡 7 DeFi plays you need to know

PLUS: MAGA surges by 46.9% after Donald Trump survives assassination attempt

Welcome to another free edition of Altcoin Investing Picks.

I hope you enjoyed our last issue ”The Current State of Crypto in 5 Graphs”

In today's newsletter:

💡 7 DeFi plays you need to know

🚀 MAGA surges by 46.9% after Donald Trump survives assassination attempt

📈 Alpha Signal: VC Funding

7 DeFi plays you need to know

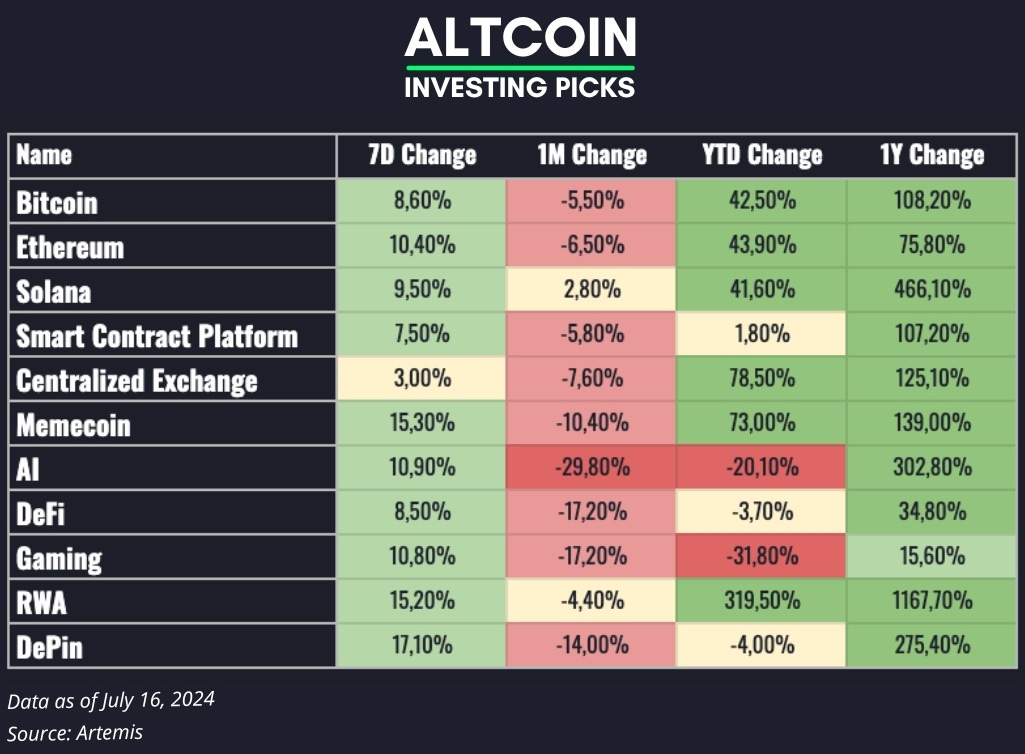

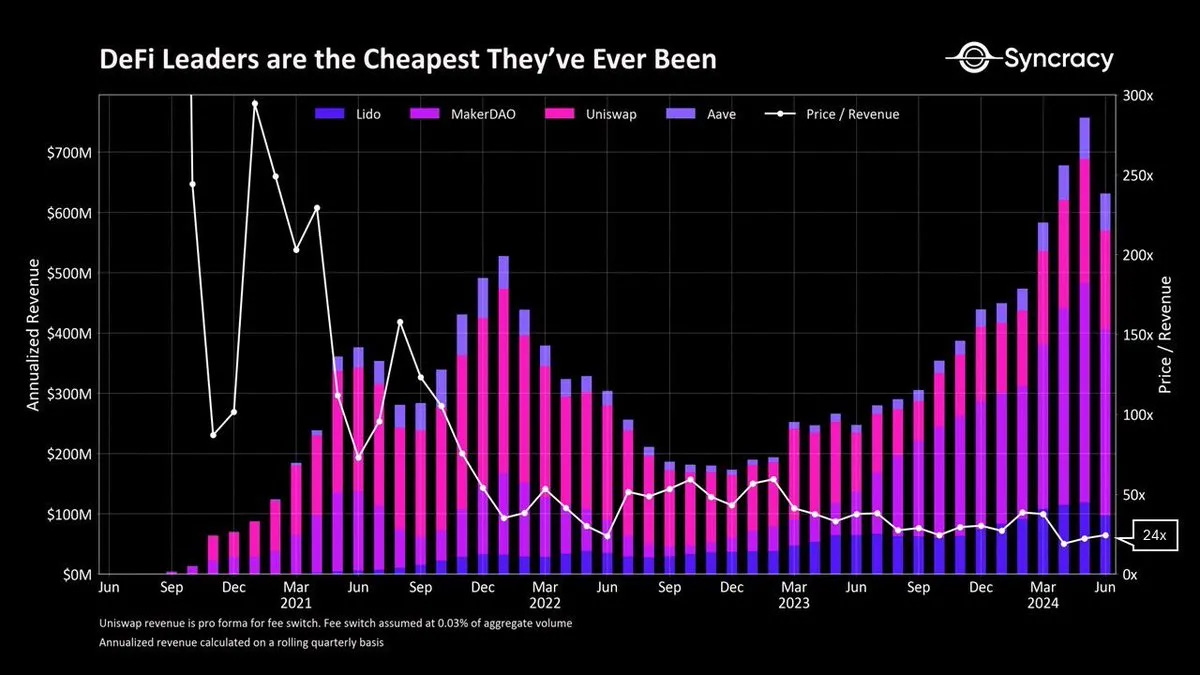

Today DeFi leaders are generating all-time high revenues across the board while valuations are the cheapest in history.

Moreover…

BlackRock, the largest asset manager, plans to apply to MakerDAO's $1b tokenized investment plan:

Considering the growth of the RWA sector after BlackRock's involvement, DeFi could see the same or even greater growth.

Here are 7 DeFi plays you need to know for this cycle:

Uniswap

AAVE

Lido DAO

Ethena Labs

Pendle

Synthetix

Compound

Let’s dive in!

1/ Uniswap ($UNI)

Uniswap is a decentralized finance (DeFi) protocol centered around its automated market-making (AMM) decentralized exchange (DEX) that sources liquidity for swapping crypto assets. The protocol comprises various immutable, non-upgradeable smart contracts, each with different features for the underlying AMM architecture.

Market Cap: $6.25B

P/F Ratio: 11.1x

Current Price: $8.31

Down from ATH: -81.37%

Up from Cycle Low: +145.19%

1Y ROI: +41.53%

1Y ROI vs BTC: -31.47%

2/ Aave ($AAVE)

Aave is a liquidity management protocol allowing users to borrow/lend crypto assets on supported networks, like Ethereum, Avalanche, and Arbitrum.

Market Cap: $1.57B

P/F Ratio: 3.8x

Current Price: $105.78

Down from ATH: -83.88%

Up from Cycle Low: +129.94%

1Y ROI: +30.09%

1Y ROI vs BTC: -37.04%

3/ Lido DAO ($LDO)

Lido is primarily a liquid staking solution for Ethereum and Polygon. Products offered include liquid staking derivative token contracts and other auxiliary smart contract infrastructure to support native token staking services.

Market Cap: $1.55B

P/F Ratio: 1.5x

Current Price: $1.75

Down from ATH: -75.77%

Up from Cycle Low: +329.87%

1Y ROI: -27.17%

1Y ROI vs BTC: -64.85%

4/ Ethena Labs ($ENA)

Ethena Labs (Ethena) offers USDe, a synthetic US dollar (USD) that aims to be a crypto-native “Internet Bond” that is censorship-resistant, scalable, and stable.

Market Cap: $717M

P/F Ratio: 3.7x

Current Price: $0.421

Down from ATH: -71.91%

Up from Cycle Low: +19.68%

1Y ROI: /

1Y ROI vs BTC: /

5/ Pendle ($PENDLE)

Pendle is a protocol initially deployed on Ethereum that provides a market for the yields of supported yield-bearing tokens. Pendle facilitates this market by splitting yield-bearing tokens into principal and yield tokens and offering liquidity pools by which these tokens can be traded. In doing so, Pendle offers a market for fixed and floating rates of supported yield-bearing tokens by which users can earn fixed yield, long yield, and provide liquidity to the Pendle pool for the underlying token.

Market Cap: $675M

P/F Ratio: 117x

Current Price: $4.38

Down from ATH: -40.93%

Up from Cycle Low: +32.01%

1Y ROI: +371.52%

1Y ROI vs BTC: +127.56%

6/ Synthetix ($SNX)

Synthetix is a decentralized finance (DeFi) platform that provides liquidity for a range of permissionless derivatives, including perpetual futures, options, and parimutuel markets, across Ethereum Virtual Machine (EVM) compatible chains. The platform features a set of composable and decentralized smart contracts. Users can stake collateral via the Synthetix staking decentralized application (dApp) to contribute liquidity to the ecosystem, earning weekly inflation incentives and trading fees.

Market Cap: $615M

P/F Ratio: 78.9x

Current Price: $1.88

Down from ATH: -93.34%

Up from Cycle Low: +34.11%

1Y ROI: -29.59%

1Y ROI vs BTC: +65.97%

7/ Compound ($COMP)

Compound Finance is a decentralized money market and lending protocol built on Ethereum, Compound III supports base assets (e.g., USDC, WETH, etc.) on Ethereum, Polygon, Base, and Arbitrum. Compound III has dynamically adjusted interest rates, which are algorithmically determined based on the supply and demand dynamics within the market.

Market Cap: $503.1

P/F Ratio: 6.1x

Current Price: $49.85

Down from ATH: -94.2%

Up from Cycle Low: +88.46%

1Y ROI: -35%

1Y ROI vs BTC: -70.23%

MAGA ($TRUMP) surges by 46.9% after Donald Trump survives assassination attempt.

CoinGecko recently introduced this new category into its indexing platform, containing all politics-related cryptocurrency projects, which can be related to world leaders, politicians, movements, charity-focused projects, or political agendas.

PolitFi is considered a bridge between politics, finance, and community. The current selection of tokens in the category is largely meme coin-based, but some have serious proposals surrounding them.

The primary example in PolitiFi is MAGA ($TRUMP), a Donald Trump-themed meme coin that surged from $6.31 to $10.36 resulting in its market capitalization growing from $293 million to $469 million in less than 45 minutes.

📈 Alpha Signal: VC Funding

Following the smart money gives you an edge on the market for three reasons:

you can spot emerging trends & sectors

you can get insight into the level of interest and confidence in the ecosystem

you can track specific tokens that are most likely to take off in the future

Historically, VC funding reaches ATH near the top of every cycle.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our most popular premium posts:

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

😂 Meme of the week

That’s all for today!

Cheers