Hey everyone,

welcome to Investing Tuesday—our free weekly newsletter where we share investing tactics and market insights.

I hope you enjoyed last week’s issue on How to Pick Micro Crypto Projects and our valuation checklist.

Today, we’re going to talk about how to analyze altcoins quickly with ratios and which ones we have used in our latest trades.

Ratios can make your life a lot easier as an investor

They can rate and compare one asset against another that you might be considering investing in.

In other words, they are a powerful way to invest wisely without the hassle of doing time-consuming fundamental analysis and research.

Most ratios are best used in combination with other metrics, especially network trend indicators.

For instance, these are two high profitable trading ideas that we shared with our premium subscribers last month.

GNOSIS (+12% in 5 days)

Very attractive valuation: MC/LTV of 1.84 with a TVL of $216,08m (Polygon’s is $830,68m)

Usage growth higher than all chains (no ETH) in the last year: LTV Change (1Y) +69% (vs +9%)

High-growth Usage Trend: LTV Change (1M): +40%

BENQI (+76% in 14 days)

Avalanche Trend: in the last month, Avalanche has grown +137% in Daily Active Users (3rd top gainer out of the top 20 protocols) and +90% in market cap (4th top gainer) and BENQI is the active protocol with the highest TVL on the Avalanche blockchain ($329m) followed by AAVE ($201m) and Trader Joe ($79m).

Valuation: BENQI has a total value locked of $329,320,000 and a Market Cap of only $33 millions, than means a MC/TVL of just 0.10!

Utility: in a bullish market cycle sustained by fundamentals, this kind of protocol could gain lots of attention and explode in terms of active users and volume.

So…

Fundamental analysis is used to determine a token’s intrinsic value so it can be compared with its market value.

Ratios rate and compare one asset against another.

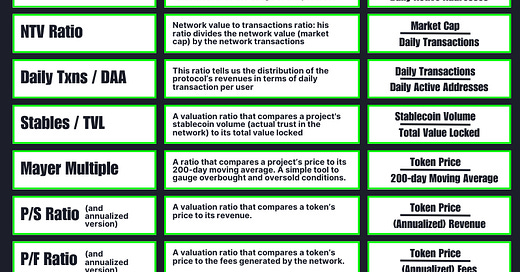

Here are 9 ratios every crypto investor should know:

Whenever you’re ready

That’s it for today.

Whenever you’re ready, here’s how AIP Premium can help you:

Tactical trades: short term bets that leverage hot narratives and market trends.

Bitcoin Beaters: undervalued blockchains we think will outperform BTC in the long term.

Micro Quality Altcoins: high-growth micro altcoins we think are willing to be tomorrow's market leaders.