Hey Investor 👋🏻

welcome to a free edition of Altcoin Investing Picks.

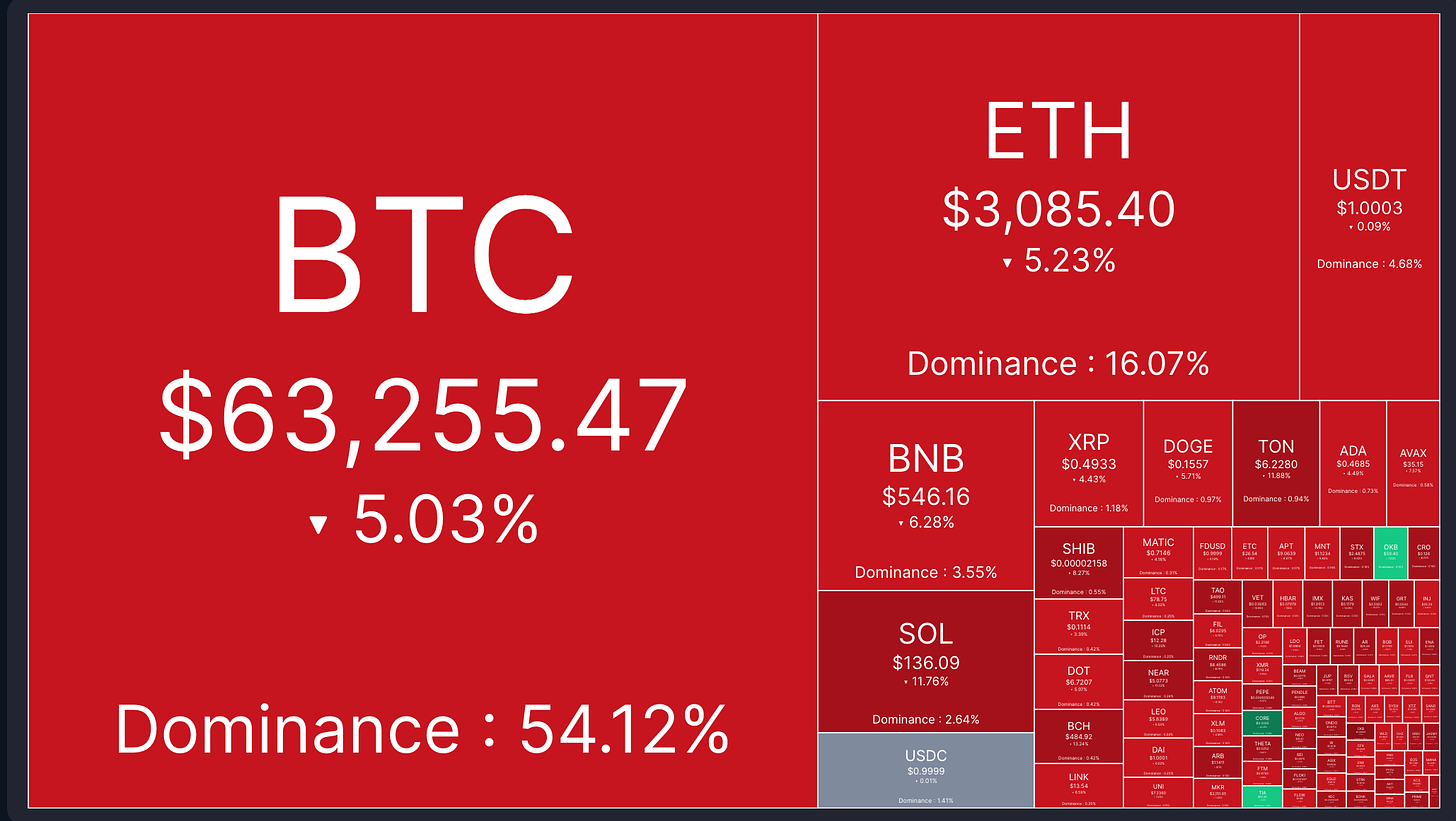

The crypto market got hit in the last few days.

Here are the probable causes:

Iran attacked Israel over the weekend (link)

Pre-halving retrace (link)

Over $B in futures positions were liquidated (link)

But is now the time to buy? Or will things get worse?

Today we'll look at economic indicators, monetary policy, and crypto fundamentals.

Let’s dive in!

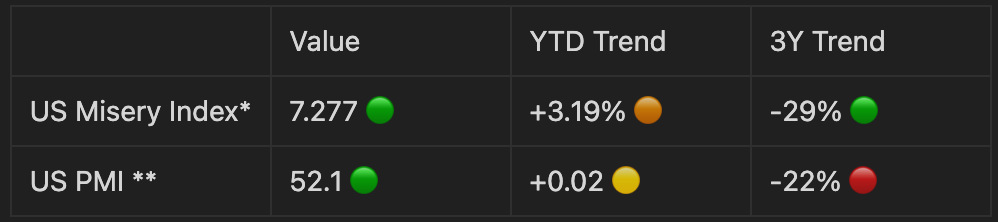

Economic Indicators

*The US Misery Index is released by the Bureau of Labor Statistics. This metric is calculated by adding the US inflation rate and the US unemployment rate. The misery index can be used as a gauge at how the economy is doing. Because of the components, this indicator tends to be at its highest when inflation or unemployment has increased

** The S&P Global Composite PMI Output Index, tracks business trends across both manufacturing and service sectors. The index is based on data collected from a representative panel of over 800 companies and follows variables such as sales, new orders, employment, inventories and prices. A reading above 50 indicates expansion in business activity while below 50 points to contraction.

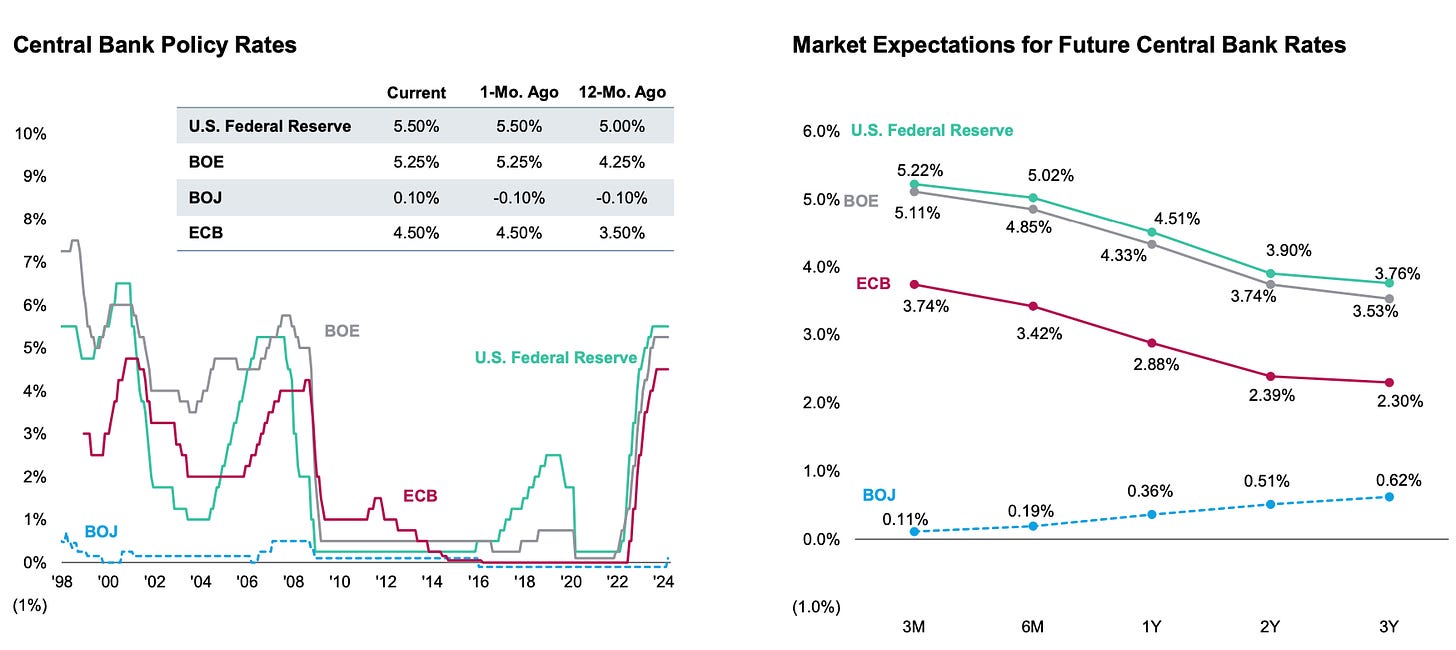

Monetary Policy

Central Bank Rates: 🟠

Market Expectations: 🟢

Crypto Fundamentals

Fear & Greed Index: 🟢

Our View

The (U.S.) economy is holding up well and the retracement of the last few days was predictable based on the crypto market cycle.

Crypto fundamentals are strong.

We stick with our plan by accumulating micro altcoins and by investing in our tactical portfolio to maximize the post-halving bull run.

Hong Kong approves crypto ETFs

In the recent hours, spot ETFs on Bitcoin and Ethereum proposed by China Asset Management, HashKey and Borsera Capital were approved in Hong Kong.

The approval of spot ETFs on Bitcoin and Ethereum for the Asian market has been taken by the Security and Futures Commission (SFC), the equivalent of the U.S. SEC for Hong Kong.

Why hasn't the market gone crazy since this news?

Other countries adding BTC ETFs is no doubt bullish but the flows from these products are tiny compared to big fishes like BlackRock.

That’s all for today!

Thanks for reading

P.S. Whenever you’re ready

If you want to level up your crypto journey, consider subscribing to the premium package.

You’ll get weekly picks, tactics, and access to our watchlists and ratings.

Here are some of our most popular premium posts: