📈 Current Market Trends - December 24

We track actionable metrics highlighting the current trends of the crypto market and broader economy.

In partnership with

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

Every Thursday, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

Just like traditional markets, though, crypto goes through its own cycles – and these price cycles are remarkably consistent, including their timing between peak-to-trough bottoms, price recoveries and subsequent rallies to new cycle highs.

Every month, we track actionable metrics highlighting the current trends of the crypto market and broader economy.

This data is an educational resource to better understand market cycles. While these trends often correlate well with crypto performance, the analysis should not be used as a short term trading strategy.

Let’s dive in!

Macro Trends

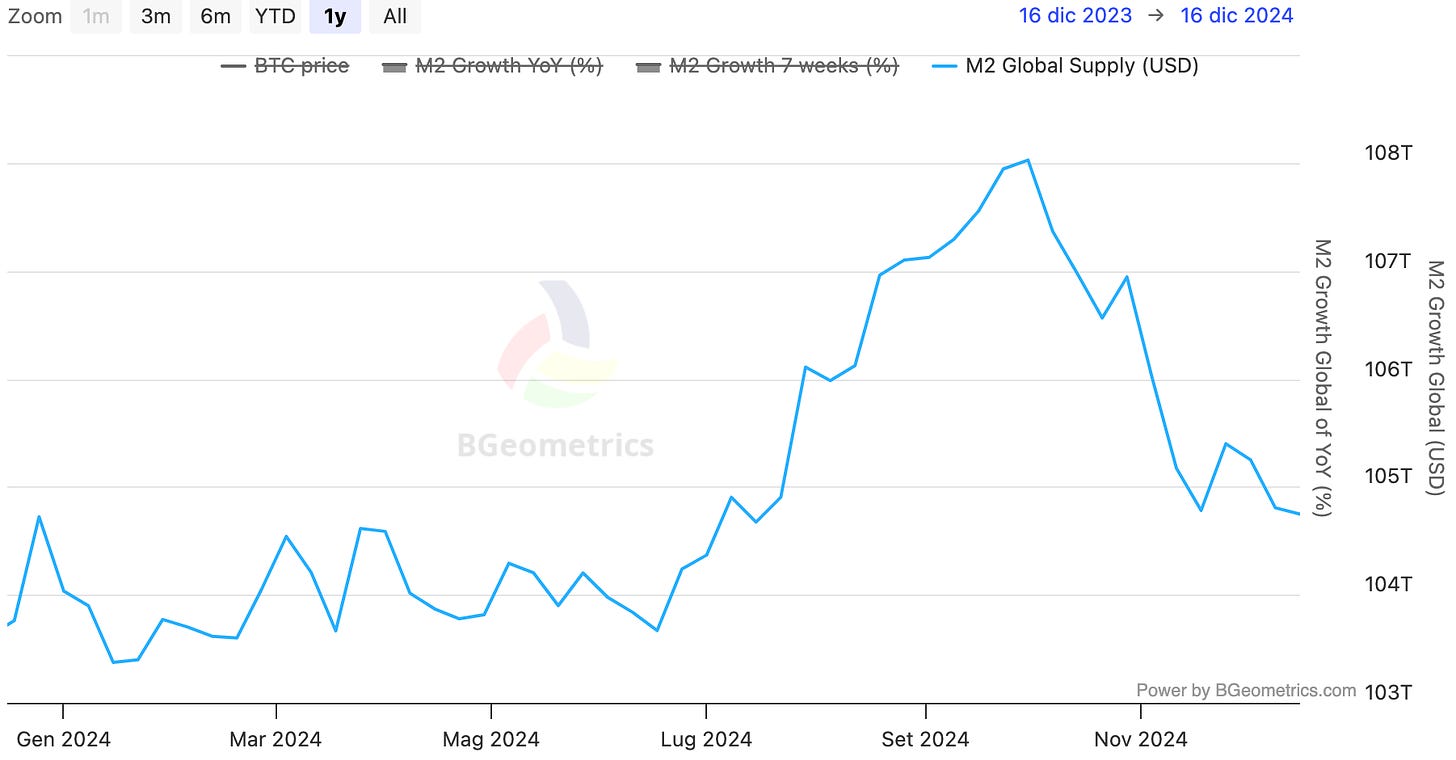

M2 & Global Liquidity → 🟡

The global money supply (M2) growth chart shows the money supply growth of the top 21 central banks. If global liquidity is increasing it means that major central banks are making more money available to their country. They do this by reducing interest rates or by purchasing government bonds and other securities to increase the money supply.

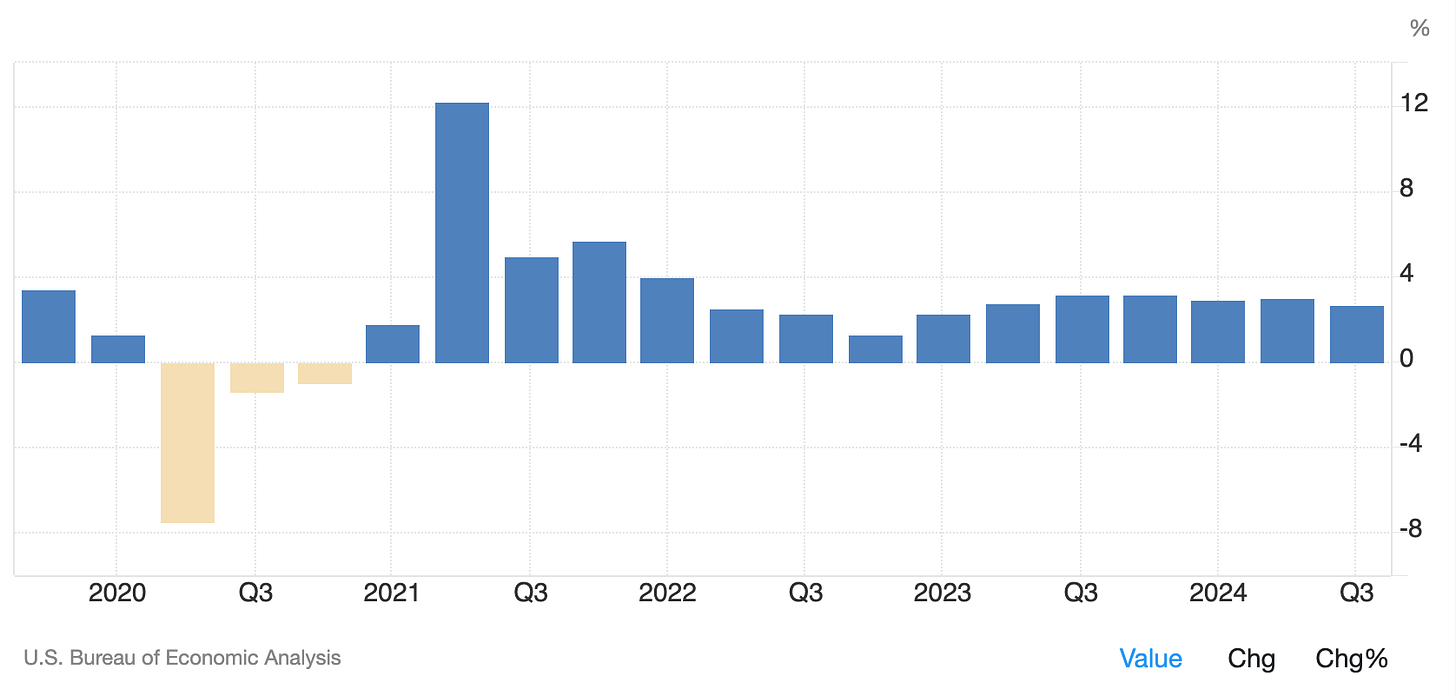

GDP Annual Growth Rate (US) → 🟡

The GDP in the United States expanded 2.7% year-on-year in the third quarter of 2024 , slowing slightly form a 3% rise in the previous period, the advance estimate from the BEA showed. GDP Annual Growth Rate in the United States averaged 3.16 percent from 1948 until 2024.

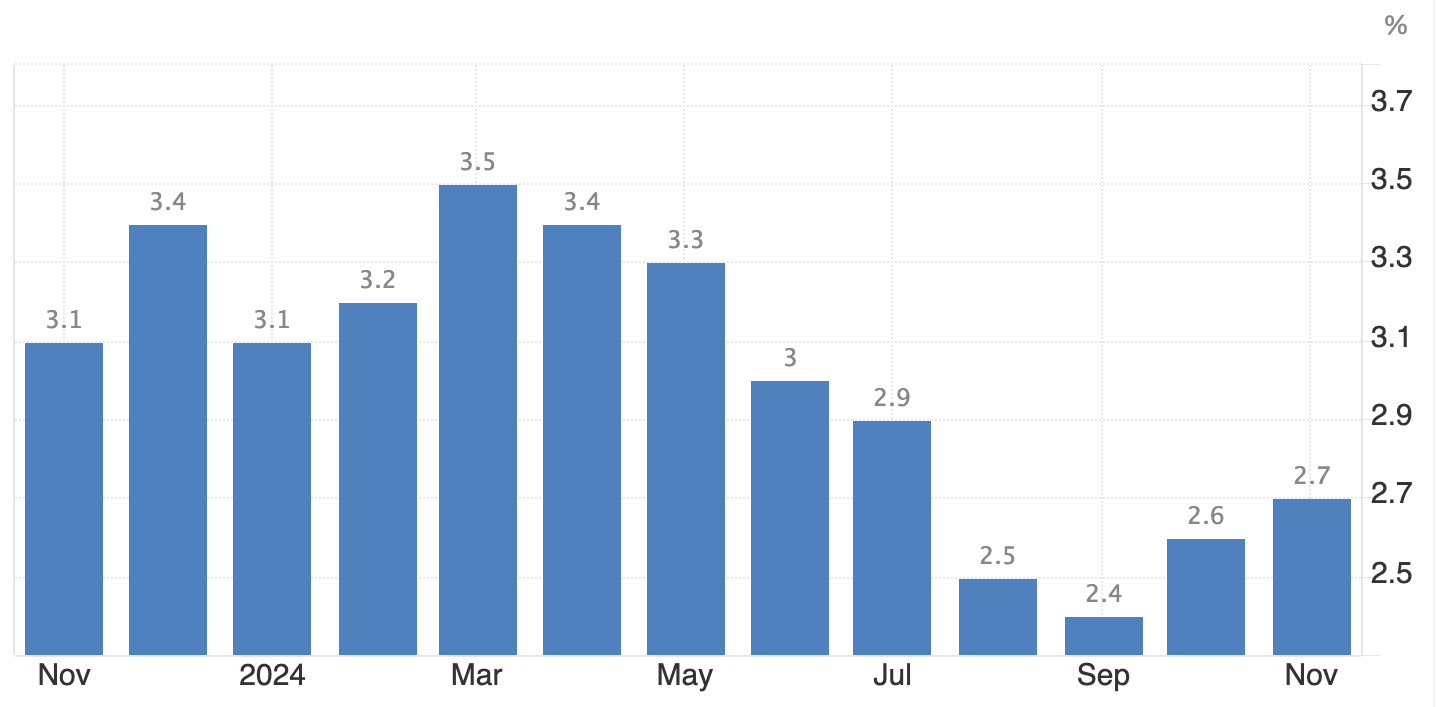

Annual Inflation Rate (U.S.) → 🟢

The annual inflation rate in the US rose for a 2nd consecutive month to 2.7% in November 2024 from 2.6% in October, in line with expectations.

Composite PMI (U.S.) → 🟢

The S&P Global Flash US Composite PMI rose to 56.6 in December 2024 from 54.9 in November, preliminary estimates showed. The reading pointed to the strongest performance of the private sector activity since March 2022, prompted by a surge in services (58.5, the highest since October 2021, vs 56.1) while the manufacturing downturn deepened (48.3, the lowest in three month, vs 49.7).

The index is based on data collected from a representative panel of over 800 companies and follows variables such as sales, new orders, employment, inventories and prices. A reading above 50 indicates expansion in business activity while below 50 points to contraction.

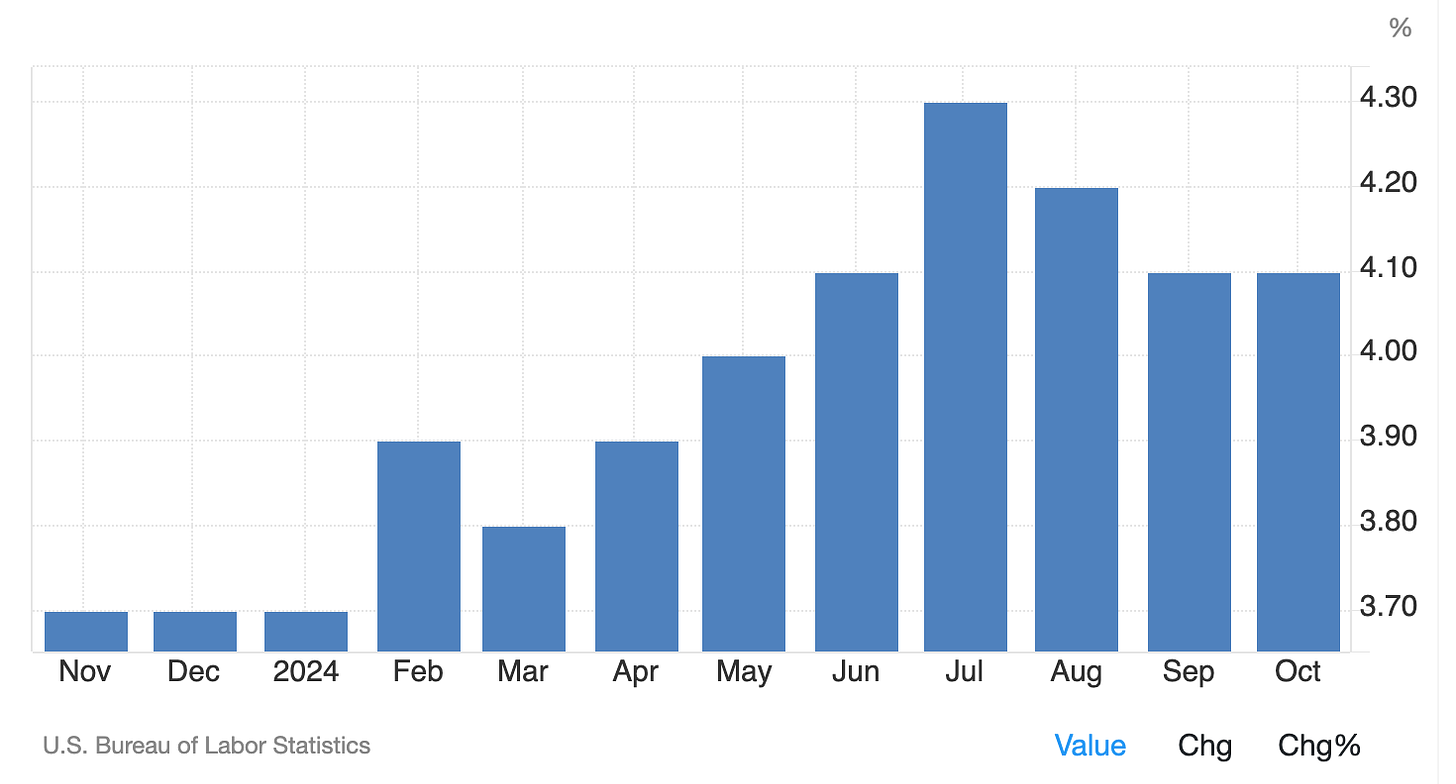

Unemployment Rate (U.S.) → 🟡

The unemployment rate in the United States went up to 4.2% in November of 2024 from 4.1% in the prior month, in line with market expectations.

In partnership with

Small cap and micro cap stocks have been getting crushed over the last couple of years. There are a ton of gems that are trading at huge discounts.

Get under-the-radar stocks with huge growth potential. Every week in your inbox.

Crypto Trends

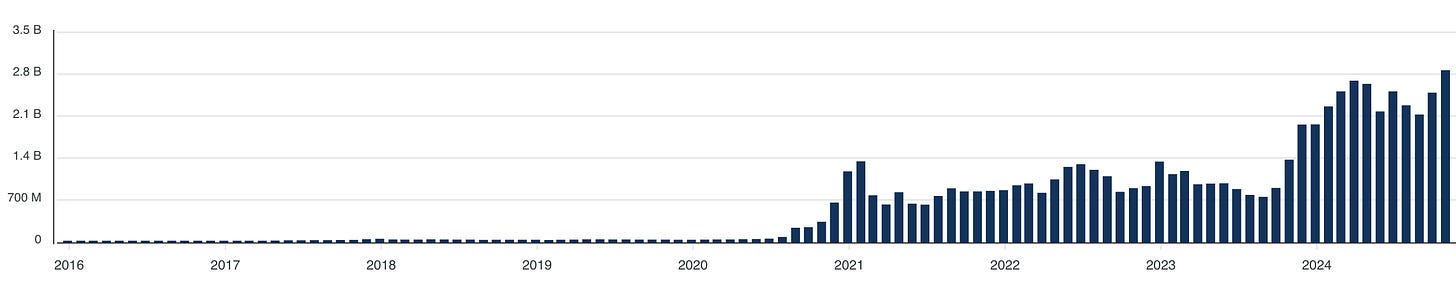

Stablecoin Market Cap → 🟢

The supply of stablecoins is a vital indicator of market confidence and functionality. As the crypto market continues to evolve, maintaining a healthy stablecoin supply will be essential for supporting liquidity, fostering innovation, and ensuring overall market stability.

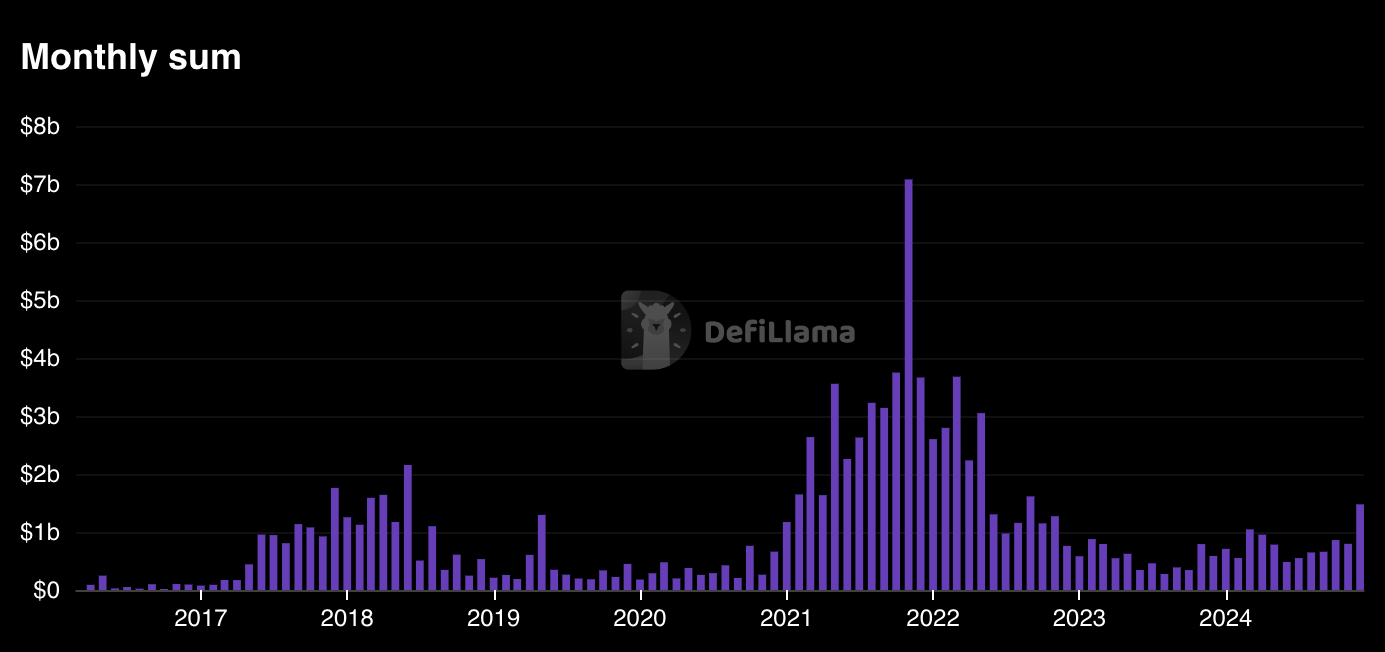

Total Value Locked → 🟢

TVL represents the total value of all assets deposited, staked, or locked into DeFi protocols and smart contracts. Measured typically in U.S. dollars, it provides a clear snapshot of the amount of capital invested in DeFi platforms at any given time.

Active Addresses → 🟢

Active Addresses represents the number of unique blockchain addresses participating in transactions each day or month. Monitoring DAA offers valuable insights into user engagement, network activity, and overall market sentiment.

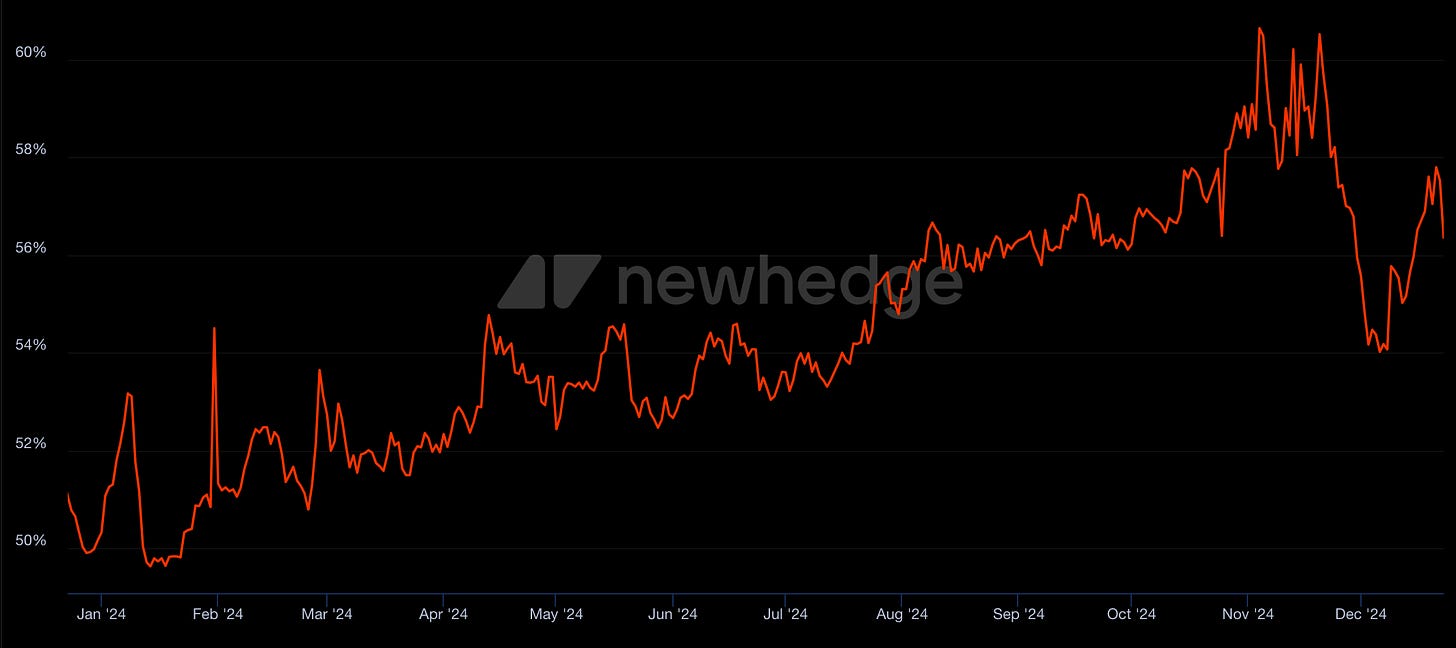

Bitcoin Dominance → 🔴

This metric represent the percentage of the total cryptocurrency market capitalization that is attributed to Bitcoin. A high dominance percentage suggests that investors prefer the relative stability of Bitcoin over more volatile altcoins, indicating a risk-averse environment.

BTC dominance is currently at 56.35%. It was closer to 40% when the cycle peaked out.

Transactions → 🟢

Daily Transactions represents the total number of transactions processed by a blockchain network within a 24-hour period. Understanding and monitoring daily transactions provide valuable insights into user engagement, network activity, and overall market dynamics.

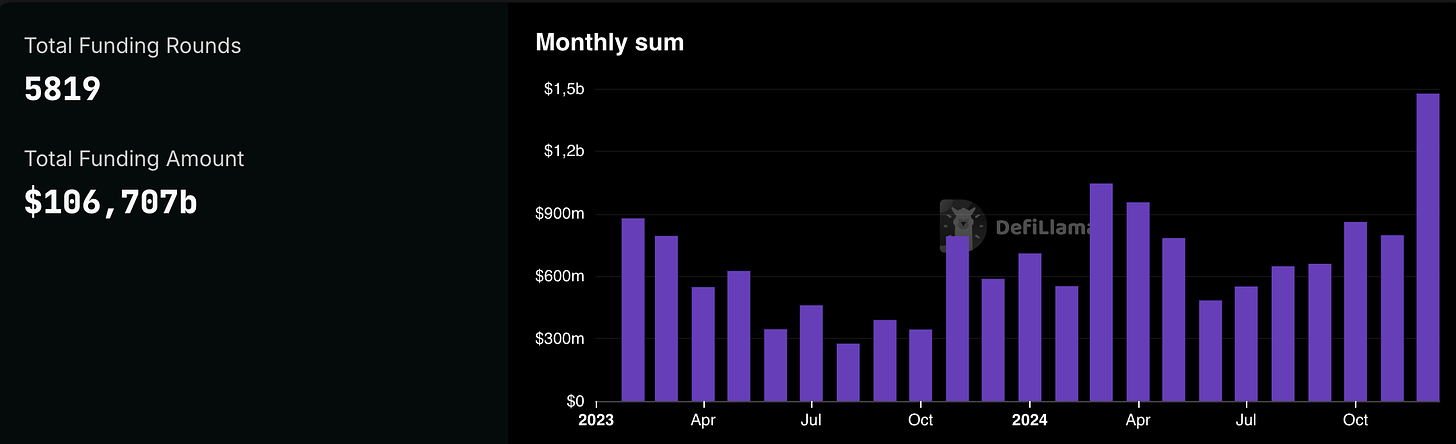

Total Funding Rounds → 🟢

Historically VC funding reaches ATH near top of every cycle. According to this data we’re still far from the peak of the bull market, but the trend is growing.

That’s all for today!

Cheers