ETH + L2s: how to build a profitable portfolio

In today’s newsletter, we share an actionable report for building an ETH-based portfolio.

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every Thursday, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

ETH + L2s: how to build a profitable portfolio

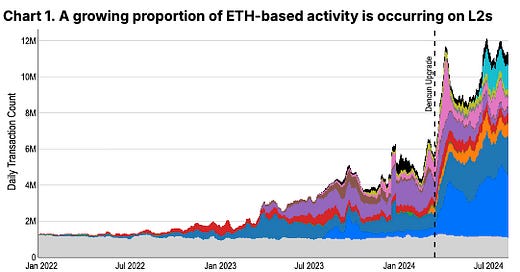

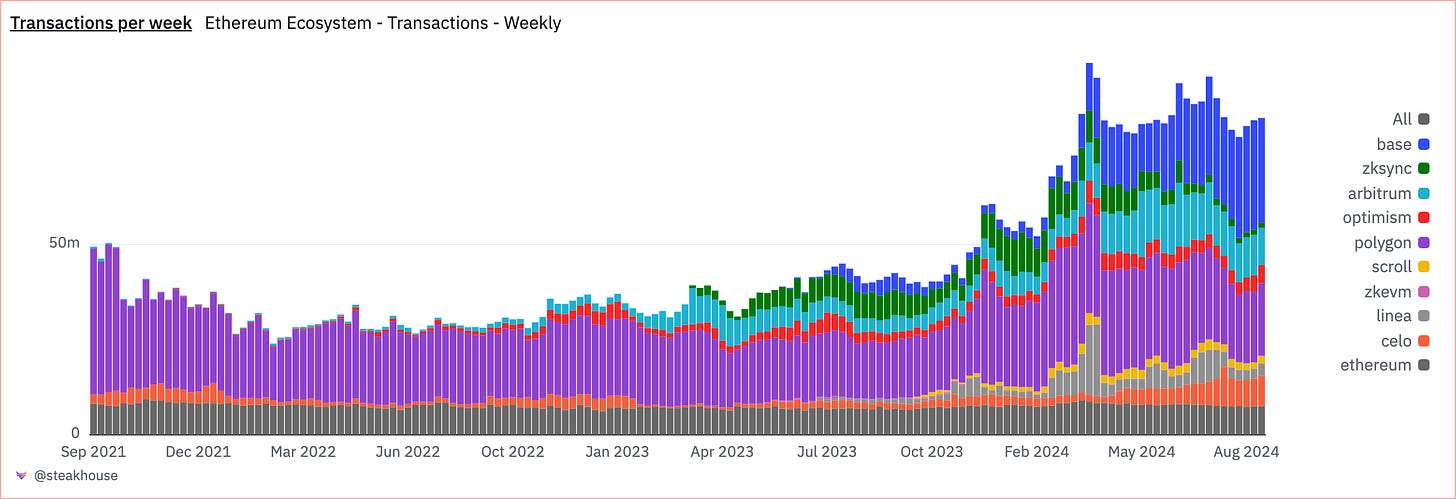

As we were saying in the last issue, Ethereum is scaling via layer 2, and the activity is booming: the number of active wallets and weekly transactions is increasing, and DEX trading volumes have been rising for a year straight 👇🏻

If you've been following us for a while, surely you know that we are bullish on Ethereum.

We’ll leave you with some stats below:

Ethereum is 8 years old and currently has over 115 million non-zero wallet addresses while the internet had about 147 million users in 1998 — 15 years after its inception.

Only Google reached $10 billion in fees faster than Ethereum.

Over 35% of the circulating supply of ETH is currently held in smart contracts on-chain (earning yield) — pointing to the utility of ETH as a productive asset.

The energy consumption of an Ethereum transaction equaled over 100,000 VISA transactions in December 2021 but was much lower after the Merge.

Ethereum holds 56.72% of Total Value Locked among DeFi protocols.

But should you own ETH? A basket of L2s? Or both?

In today’s newsletter, we share an actionable report for building an ETH-based portfolio.

Let’s dive in!