Welcome to another free edition of Altcoin Investing Picks.

I hope you enjoyed our FREE Blockchain Investing Guide.

In today’s newsletter:

📈 How much can you make in a bull market?

⏲️ ETH is cooking

👤 Retail hasn’t arrived yet

📈 How much can you make in a bull market?

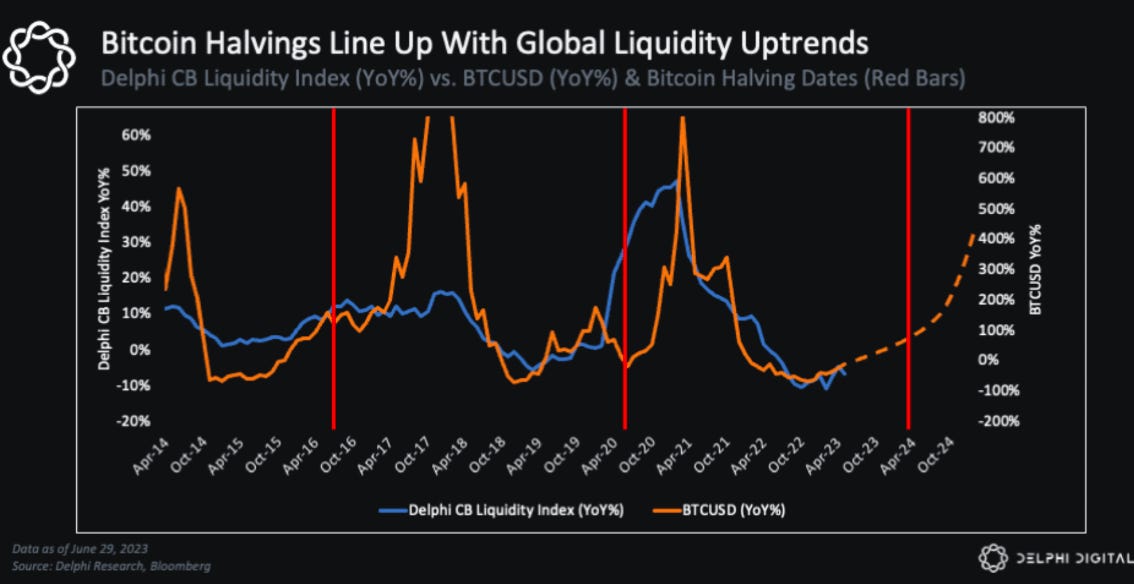

BTC halvings and prices have historically aligned with global liquidity.

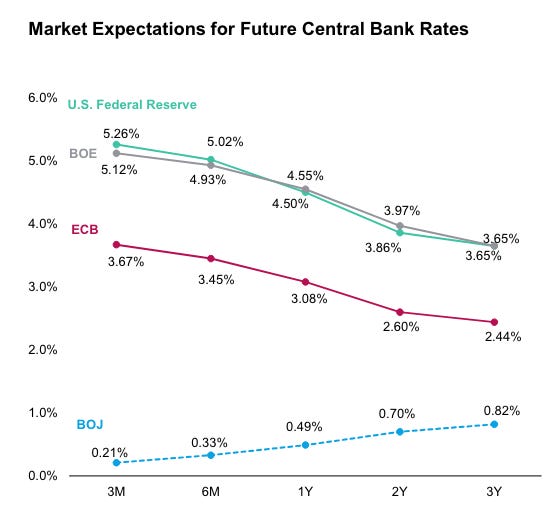

Interest rates in the US are expected to change later this year, while in the EU and Canada, they have already been decreased.

From a macro perspective, this bull market is just heating up.

But to capture all the gains, you must stick to your plan despite the high volatility.

For instance, during the 2015-2017 bull market, over 13 different 20%+ pullbacks happened.

So, expect plenty more dips over the next 12-18 months, and don’t let a 20% dip buck you off the ride.

Now let’s talk about gains.

How much can you make in a bull market?

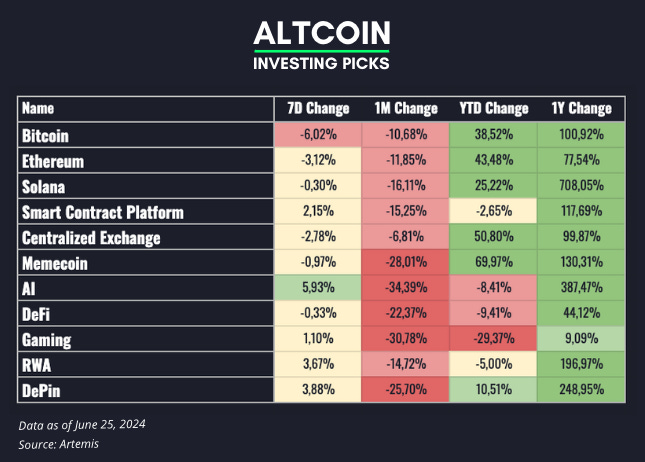

From mid-October 2023 to mid-March 2024, the market had a strong rally and most altcoins did great.

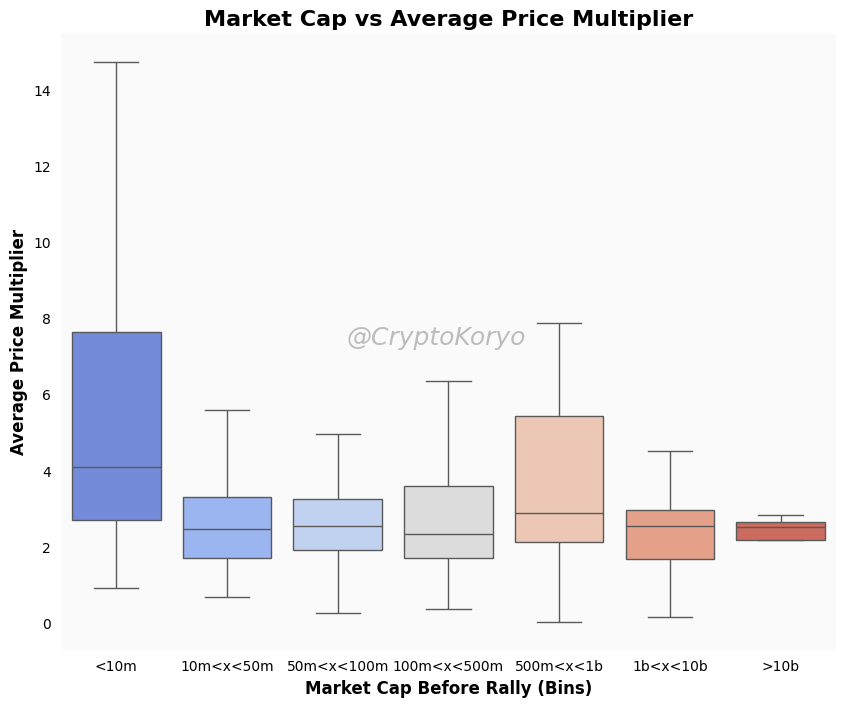

On average, the top 1000 assets by market cap did a 2.7x during that period.

But, when only considering the average, there isn't a huge difference between the different market caps, unless you look at <$10m projects (which had significantly higher average returns).

In fact, Solana, NEAR, and AGIX all did around 8x during that period although their size differences, while most of the 20x+ returns were captured by projects with an initial market cap around ~$10m like $OM (71x), $AIOZ (100x) and $BONK (340x).

💪🏻 The good news

You can use these pullbacks to your advantage.

Here is a collection of our best tactics and portfolios to take action.

Tactics:

Portfolios:

Thesis: if you want to win in crypto on easy mode, you hold a lot of these types of assets.

Risk Level: Medium to Low

Thesis: a cross-chain ecosystem is the only way that blockchain applications and crypto protocols can have a true vision of reaching their full market potential.

Risk Level: Medium to High

Thesis: Micro Altcoins carry the potential for massive returns that don’t exist in other asset classes. Not even in the major tokens.

Risk Level: High

⏲️ ETH is cooking

We've indicated multiple times that we believe Ethereum should be a (very) key component of a successful (low-risk) strategy in this cycle.

Here are 3 interesting charts:

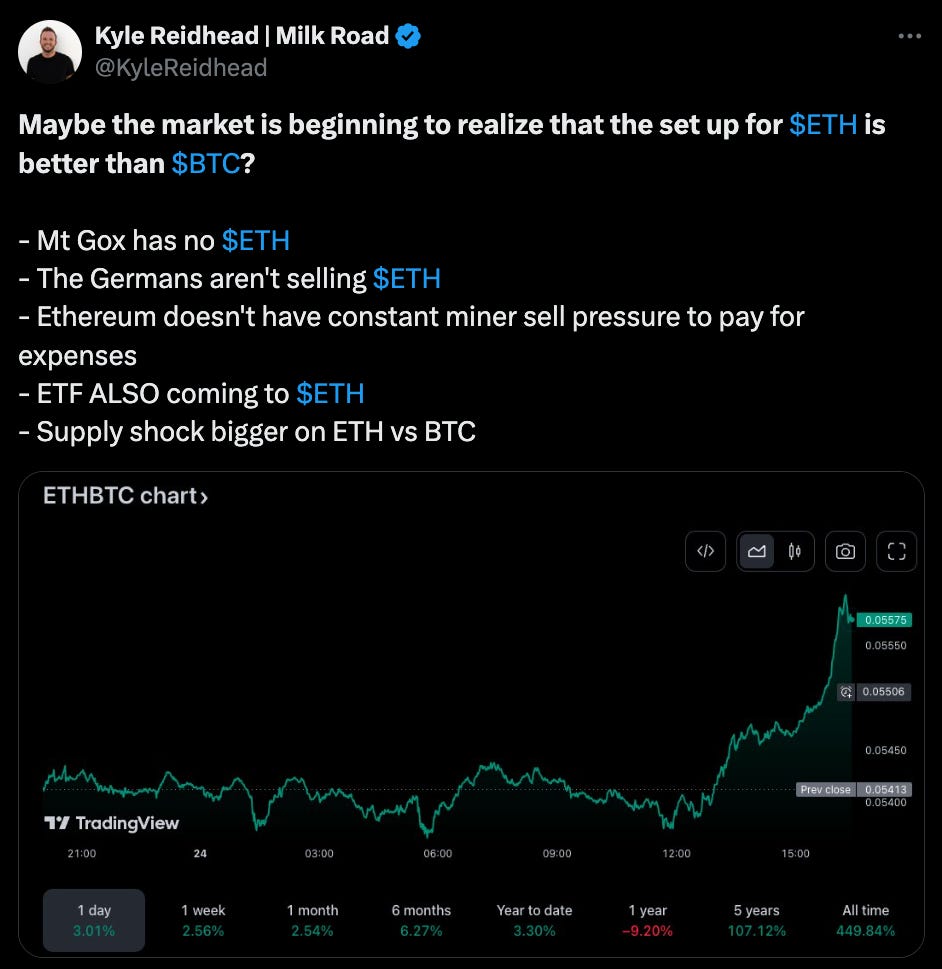

1. ETH is well-positioned

2. On a year-to-date basis, Ethereum is outperforming Solana in USD terms.

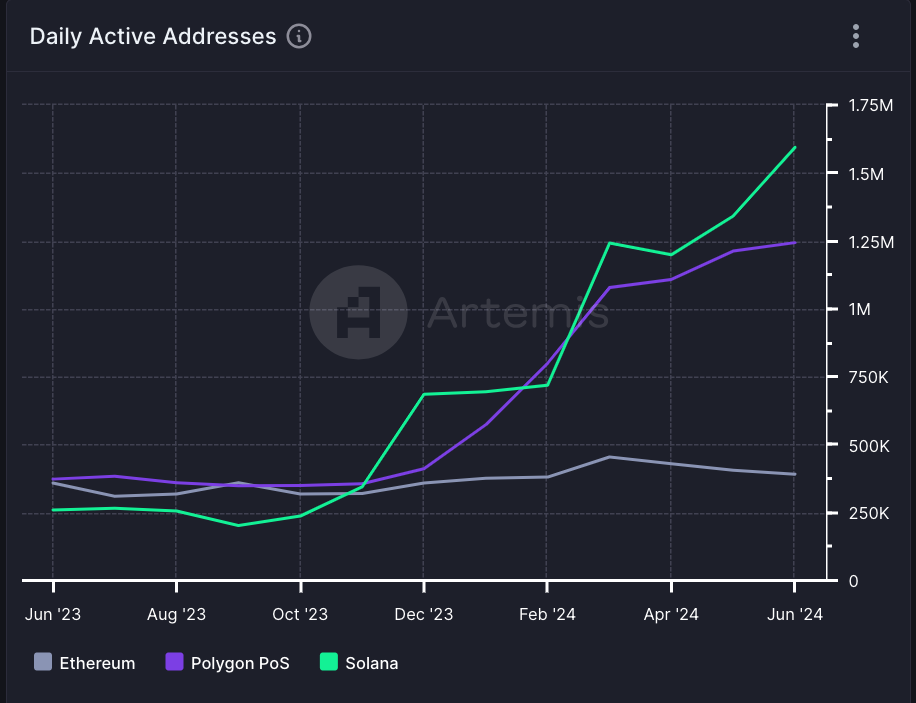

3. ETH is scaling with L2s: The Polygon PoS Chain now has almost the same daily active addresses as the Solana network.

👤 Retail hasn’t arrived yet

Massive pumps in crypto are powered by retail people aping into coins.

But retail hasn’t arrived yet.

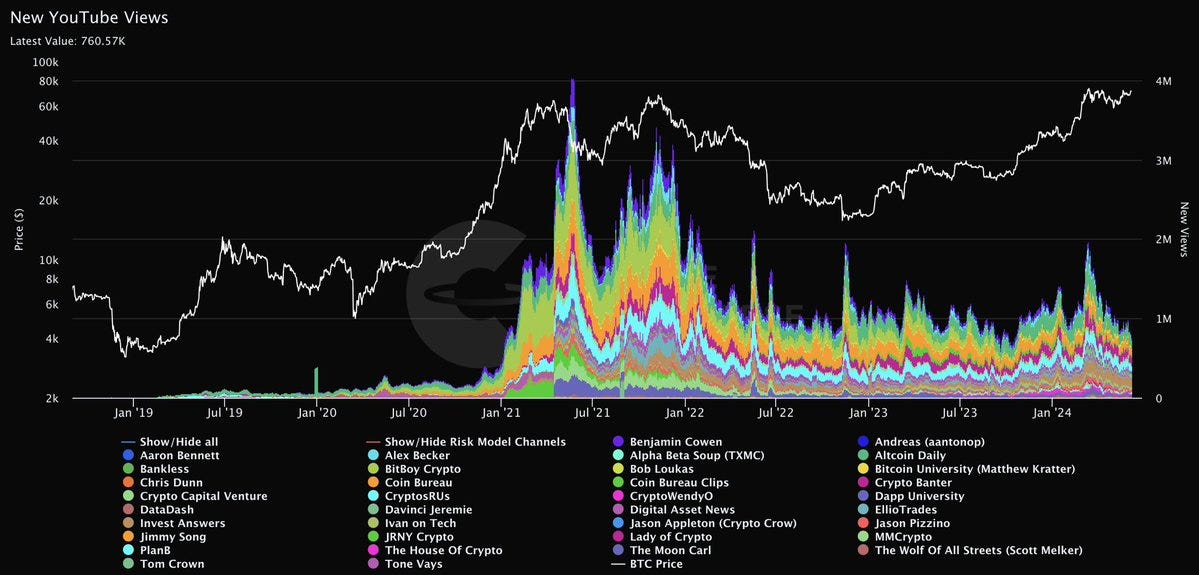

When $BTC was at $70k during 2021, we had 4M views per day on YouTube for crypto content. But $BTC at $70k in 2024 only attracts 800k views per day.

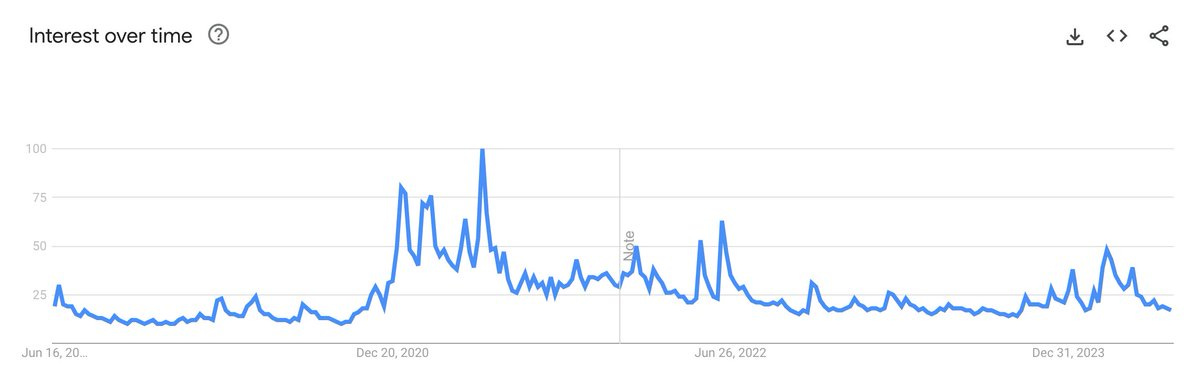

Furthermore, Bitcoin interest on Google which is a proxy for measuring the current interest of retail investors, is far from 2021 peak levels.

Our Take:

The most persistent narratives of the past year (DePin, Modularity, Restaking) are narratives that are hard to explain to retail investors.

Retail investors will return stronger as more "social" narratives (SocialFi, Telegram dApps, GameFi, NFTs, Betting) take the headlines.

P.S. Whenever you’re ready

If you want to level up your crypto journey, consider subscribing to the premium package

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

That’s all for today

Cheers