Welcome to another free edition of Altcoin Investing Picks.

I hope you enjoyed our last issue ”When in doubt, zoom out”

In today's newsletter:

🥱 How to be a boring crypto investor

📍 Where we are in the cycle

📈 Alpha Signal: Google Trends

🥱 How to be a boring crypto investor

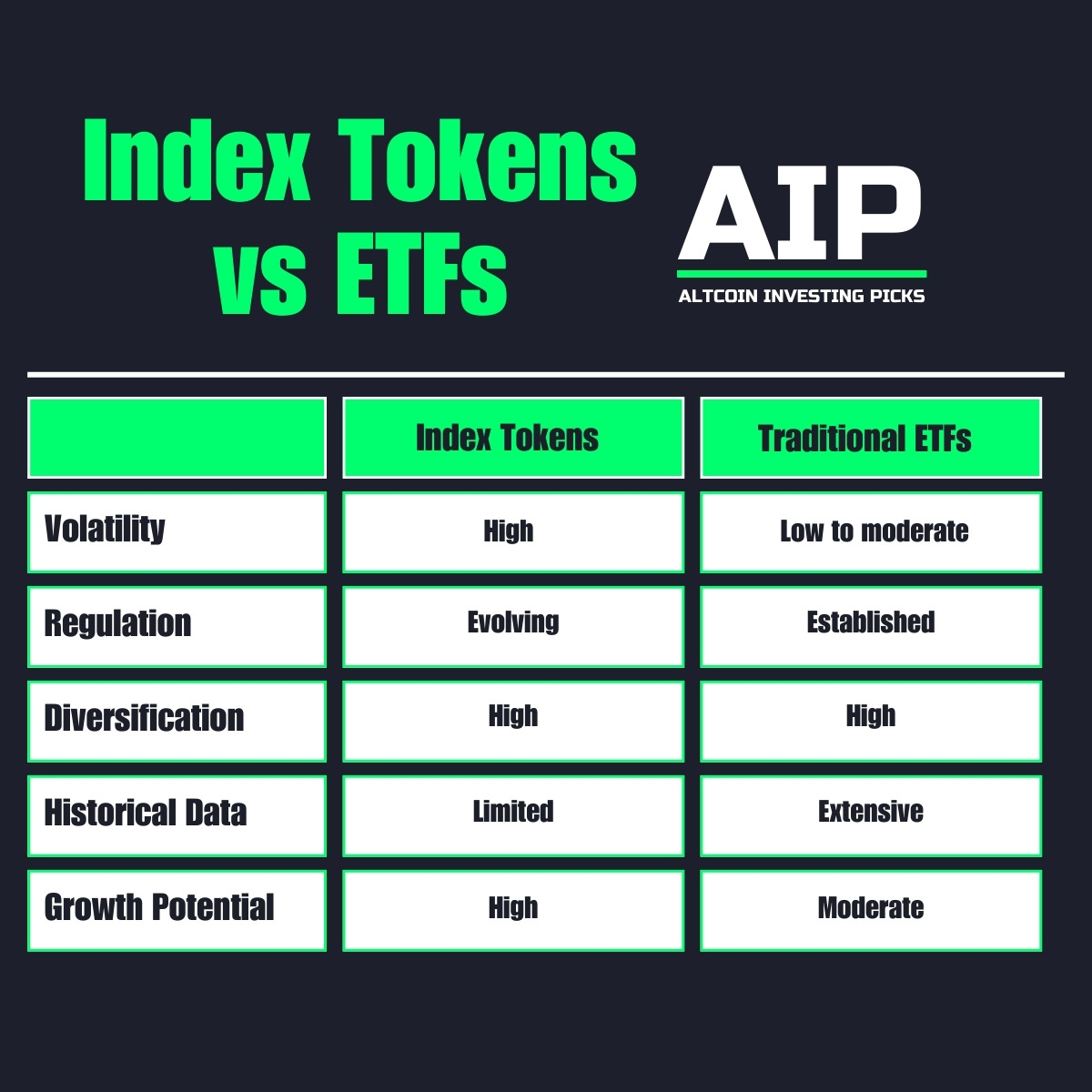

Investing in crypto can seem exciting, but sometimes the best strategy is to be boring. By focusing on index tokens, you can enjoy the benefits of the crypto world without the stress of constant market watching.

Index tokens are like a basket of different crypto assets bundled together. Instead of buying individual tokens, you get a mix, which helps spread out your risk.

Indices also allow investors to instantly diversify their holdings while reducing exchange fees and other hidden costs that come with manually managing a diversified portfolio. This simplifies the investment process, especially for newcomers.

They’re similar to the S&P 500 – which is an index of the top 500 publicly traded companies in the US.

However, these tokens are far from risk-free, and the pitfalls of these investments aren’t always obvious, particularly to newer investors.

The primary disadvantage of index fund tokens is their lack of flexibility — traders can’t change the composition of underlying assets to react to market changes, limiting their ability to fight back against losses.

Another point to note with these tokens is that they often do not outperform portfolios that invest directly into the underlying tokens. At best, most index funds provide equal returns, except in the case of leveraged index funds.

Depending on your risk tolerance, time horizon, and expected returns, there are a number of indexes to choose from:

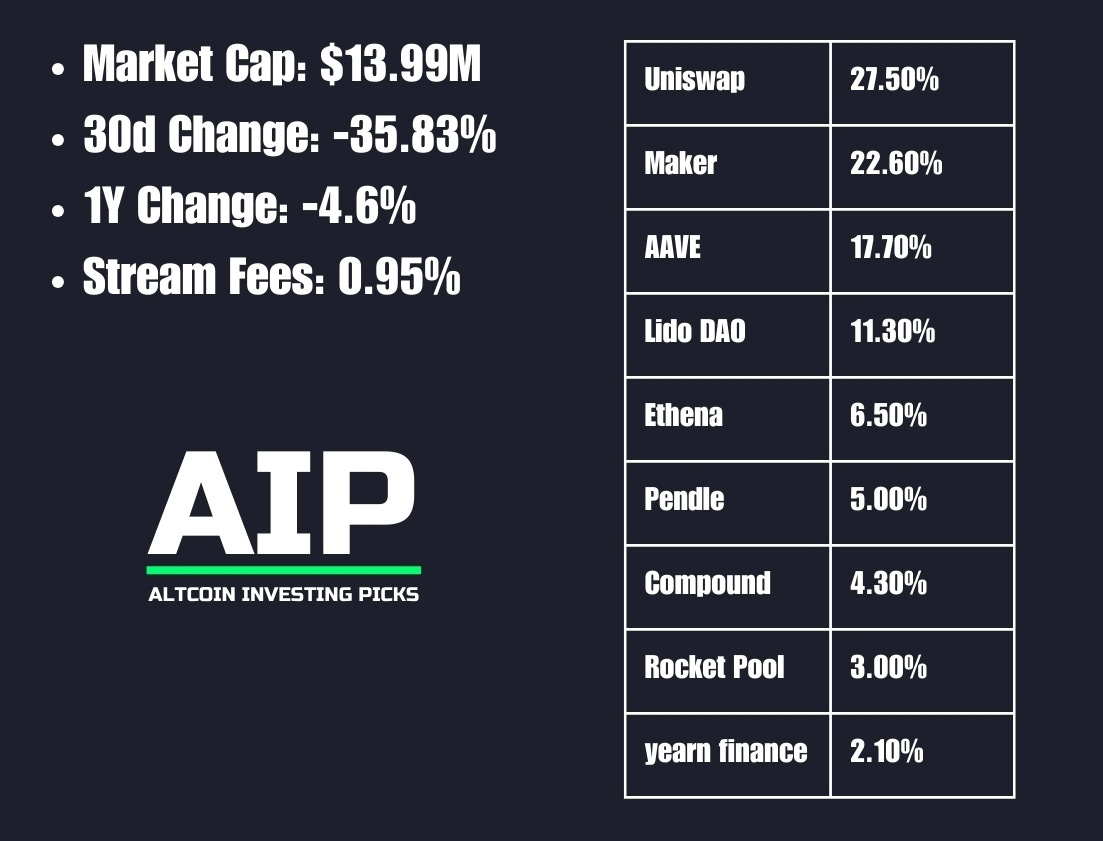

1. DeFi Pulse Index ($DPI)

The DeFi Pulse Index (DPI) is a capitalization-weighted index that tracks the performance of some of the largest protocols in the decentralized finance (DeFi) space. The index is weighted based on the value of each token’s circulating supply. The DeFi Pulse Index aims to track projects in DeFi that have significant usage and show a commitment to ongoing maintenance and development.

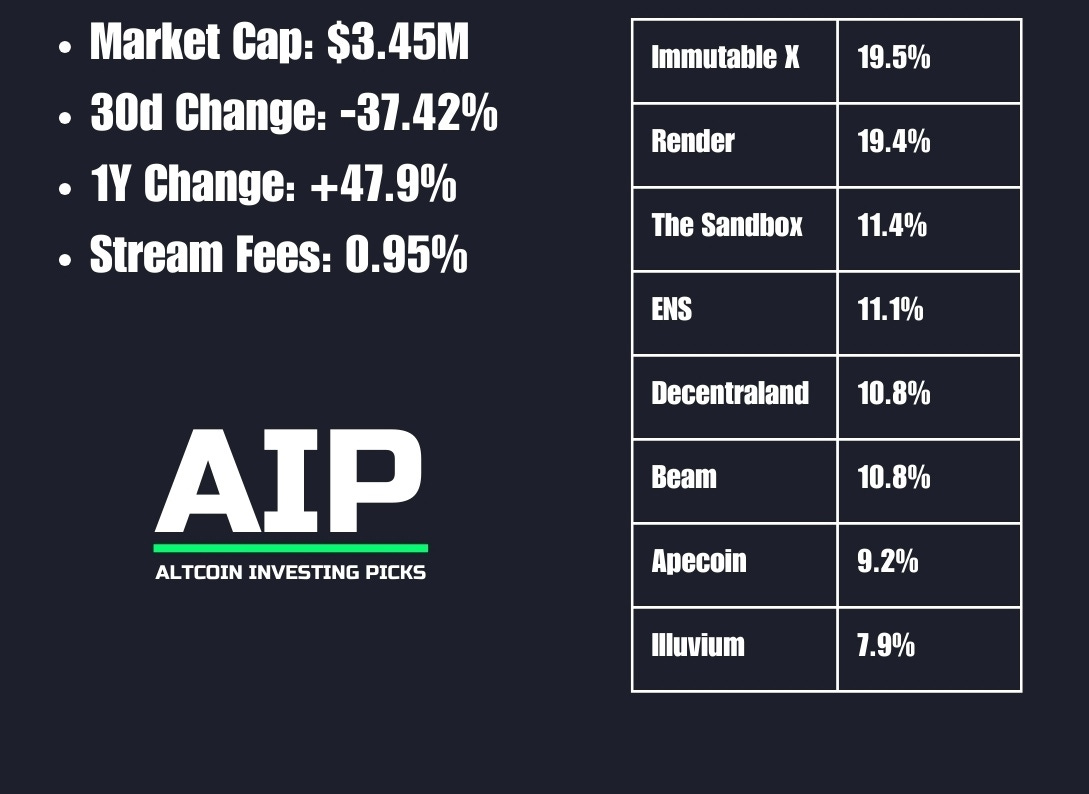

2. Metaverse Index ($MVI)

The Metaverse Index (MVI) is designed to capture the trend of entertainment, social activity and business moving to take place in virtual economies, powered by NFTs and blockchain technology. The MVI uses a combination of the square root of market cap and DEX liquidity to arrive at the final index weights.

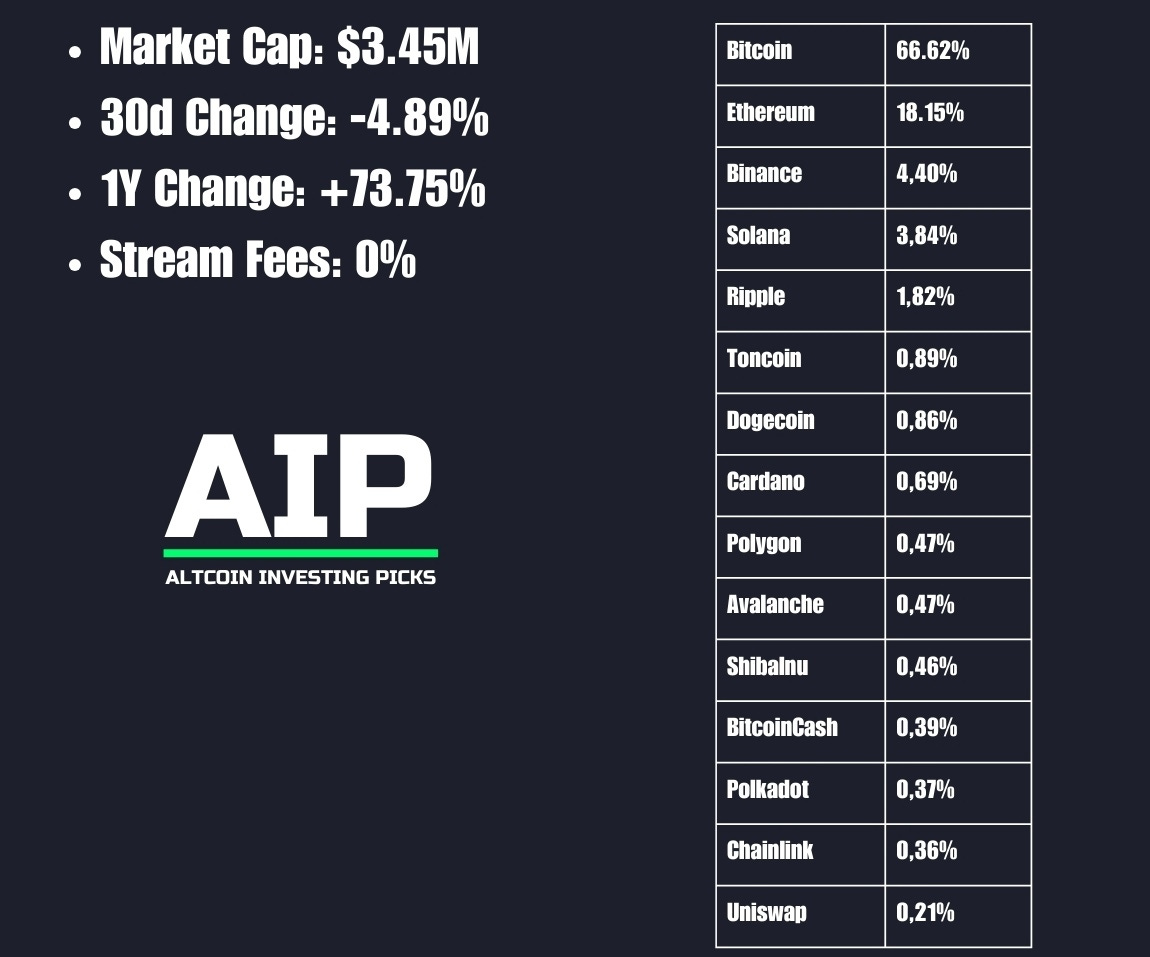

3. Alongside CryptoMarket Index ($AMKT)

AMKT is a market-cap weighted basket of 15 assets, rebalanced and reconstituted quarterly.

[Not available to US residents].

📍 Where we are in the cycle

Recognizing where we are in the Bitcoin market cycle can be empowering.

History suggests we’re right on track, but it’s always important to stay informed and adaptable as the market evolves.

If you look at Bitcoin market cycles, as measured from the low, you can see we are at the same spot we are normally at in this phase of the cycle.

📈 Alpha Signal: Google Trends

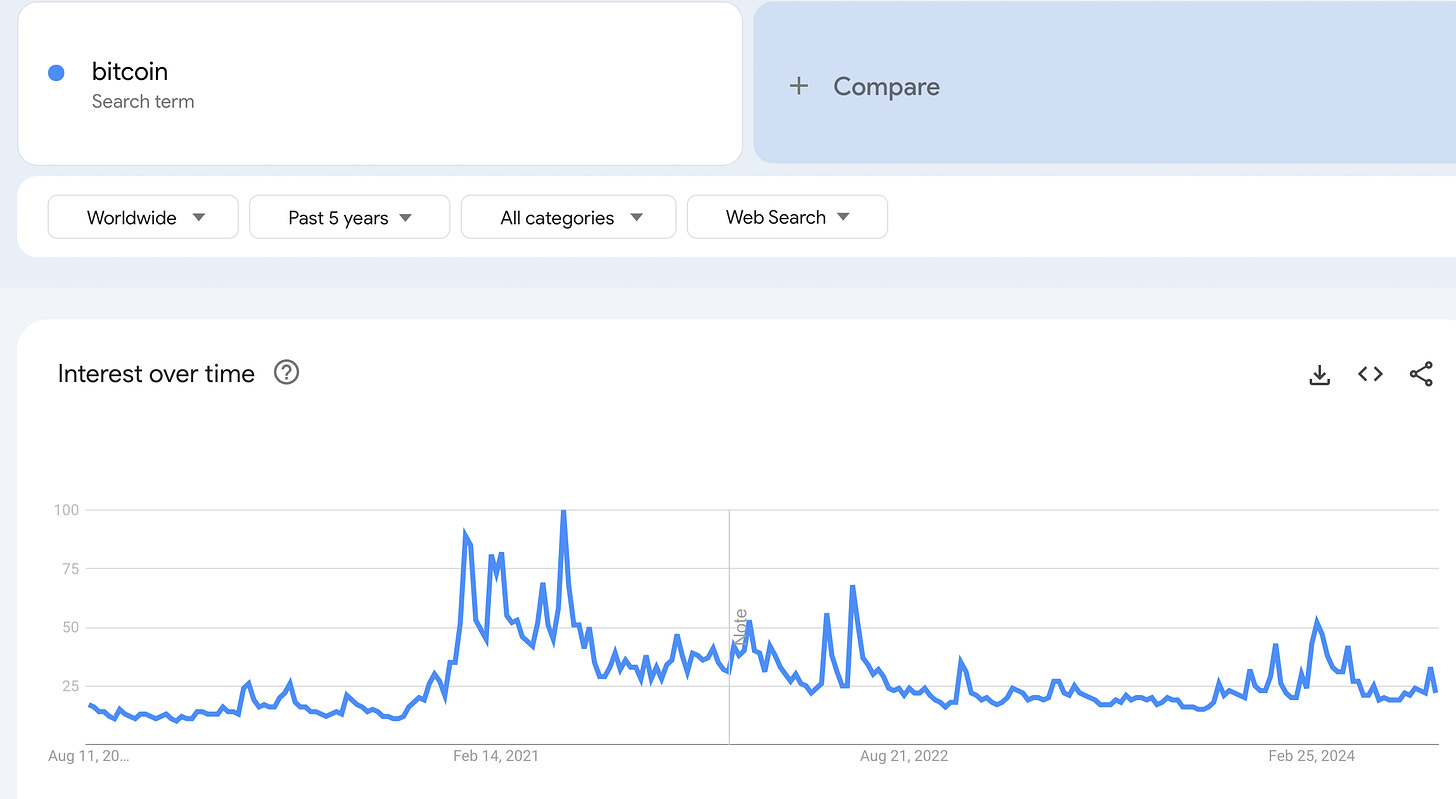

Bitcoin interest on Google is a proxy for measuring the current interest of retail investors. We are still far from 2021 levels but I would use 50/100 as a baseline to make serious exit considerations (we’re now at 22).

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package. By upgrading to Premium, you full access to our entire library of analysis, picks & portfolios.

Here’s what premium subscribers got lately:

And here are some of our most popular premium posts:

That’s all for today!

Cheers