How to build a realistic financial plan w/ crypto 💸

3 steps to plan and invest in crypto like a pro

Hey Investor 👋🏻

I’m Luca and welcome to a new edition of Altcoin Investing Picks.

Every Thursday, I send exclusive tips & opportunities to help you make (more) money with altcoins.

Today I want to talk about how to build a realistic financial plan with crypto.

Let’s dive in!

Crypto can be a useful ingredient in a modern portfolio

The rise of cryptocurrencies has introduced a new dimension to financial planning.

Once considered a niche asset, digital currencies like Bitcoin, Ethereum, and many others have become mainstream, offering significant potential for diversification and growth.

As of June 2024, the total market capitalization of cryptocurrencies stands at approximately $2.5 trillion, with Bitcoin and Ethereum representing around 70% of this value.

The adoption rate of cryptocurrencies is growing, with an estimated 575 million users worldwide, up from 432 million at the start of 2023. This growth is driven by increased institutional interest, technological advancements, and broader acceptance of digital currencies.

However, the volatility and regulatory uncertainties surrounding cryptocurrencies necessitate a careful and realistic approach to financial planning.

So here are 3 steps to build a realistic crypto financial plan like a pro:

Step 1: Assess Your Risk Tolerance

Cryptocurrencies are known for their high volatility. For instance, Bitcoin's price fluctuated from a high of $64k in April 2021 to a low of $29k in July 2021, illustrating the potential for significant gains and losses. This volatility is influenced by various factors, including market sentiment, regulatory news, and macroeconomic trends.

Think about if you opened up your account to find it lost 40-50% of its value.

How would you feel about that?

Given the nascency of crypto, we don’t have as many risk assessment tools available as we could have with traditional asset classes, especially since the whole ecosystem is considered “risky”.

However, there are some principles we can apply to decide how much and where to invest our capital.

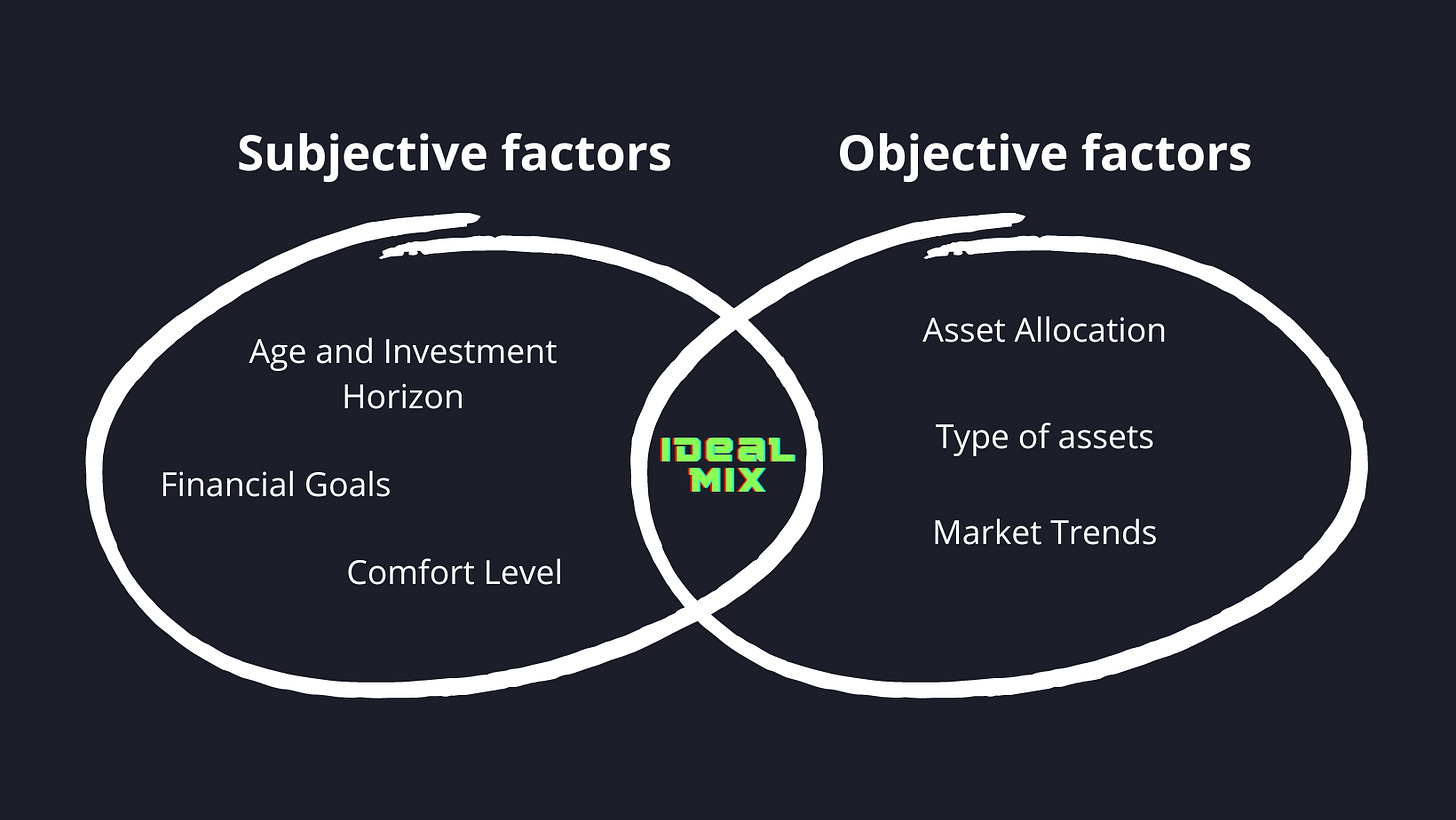

Let’s split these factors into two buckets: subjective and objective.

Subjective factors

Age and Investment Horizon: younger investors with a longer investment horizon can typically afford to take more risks.

Financial goals: determine your financial goals and how much you can allocate to high-risk investments.

Comfort level: assess your comfort with the potential for significant losses.

Objective factors

Asset Allocation: the total market value of the circulating supply of all cryptocurrencies is around 2.6 trillion while the Global Equity and Bond Markets are respectively $109 and $133 Trillion. Consequently if you invest more than that 2% of all your assets in crypto, you are likely overweighting (I’m doing so).

Type of assets: big blockchains such as BTC, ETH, and SOL are the safest way to invest in crypto. Sector protocols and mid-to-large-cap meme coins are a great way to diversify and gain alpha, while micro altcoins are the riskiest investments but can potentially make x1000.

Market trends: Just like traditional markets, crypto goes through its own cycles – and these price cycles are remarkably consistent, including their timing between peak-to-trough bottoms, price recoveries and subsequent rallies to new cycle highs.

So, the key here is to find the ideal mix of subjective and objective factors.

Time to act? Book a 1:1 session with me!

My goal for the session is to get to know you personally – your goals, situation, risk tolerance, etc – and offer personalized and actionable feedback.

I can help you with questions like:

I like your content, but where should I start?

How do I build a realistic crypto investment plan?

How do I get started with crypto investments?

How do I improve my deal flow and filter through the noise?

Step 2: Plan & Allocate

Over the past decade, Bitcoin has provided an average annual return of approximately 230%, despite its volatility, while Ethereum, has returned around 270% since inception.

However, the question is: Will these returns continue in the future? And should you consider other emerging projects to replicate these gains?

Once these protocols mature, their growth rate is reasonably expected to decelerate. The law of large numbers implies that as the market capitalization of Bitcoin increases, achieving the same percentage returns becomes more challenging.

If you are looking for similar returns, you will likely need to move to other projects and plan your investments accordingly.

So, what kind of return are you looking for?

One resource that may be helpful is the below IRR MOIC table, which models the relationship between IRRs, multiples (such as MOIC), and hold time.

For example, these are basic hypothetical return scenarios by type of crypto asset: