🔍 How to include crypto in your asset allocation

PLUS: Whales are accumulating Bitcoin like never before

Hi Investor 👋

I’m Luca and welcome to another free edition of Altcoin Investing Picks.

I hope you enjoyed our last issue ”How To Be A Boring Crypto Investor w/ Index Tokens”

In today's newsletter:

🔍 How to include crypto in your asset allocation

💥 Meme, PolitiFi and RWA are winning

📈 Alpha Signal: BTC Whales

🔍 How to include crypto in your asset allocation

Financial advisors often suggest keeping your crypto investments between 1% to 5% of your total portfolio. This allows you to benefit from potential upsides while minimizing risks.

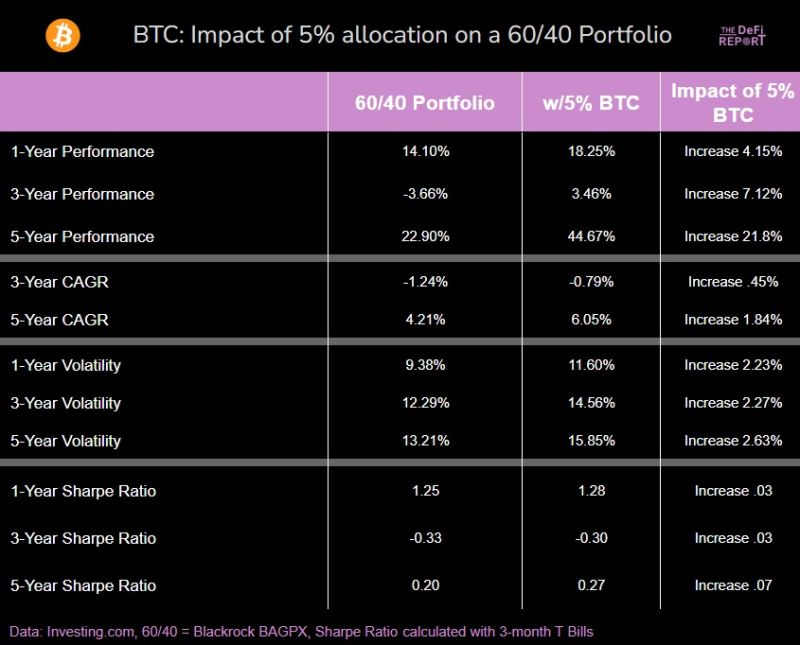

For instance, below you can see that Bitcoin increases risk-adjusted returns when added to a well-diversified portfolio across both short and long-time horizons.

In other words, a 5% allocation boosts returns while modestly increasing volatility.

Moreover, the longer the time horizon, the better the returns look.

In general, your age plays a significant role in how much crypto you should include in your long-term portfolio. If you're in your 20s, 30s, or early 40s, you can afford to take more risks. This means you can allocate a higher percentage to crypto (10-30%).

My personal strategy

Building wealth is not a linear journey, and there are no one-size-fits-all approaches to success.

At the heart of my portfolio lies the barbell strategy, an investment approach that allocates assets between two extreme risk profiles, with minimal or no investment in the intermediate risk categories.

Essentially, this strategy visualizes investment holdings as a barbell: weighty on two ends, representing high-risk and low-risk assets, and light in the middle, reflecting the minimal medium-risk assets. The middle ground, or moderate risk, is typically avoided to minimize losses.

In my overall portfolio, this translate to investing heavily in extremely safe assets (and cash), and high-risk, high-reward assets, like speculative crypto.

In a crypto-focused barbell strategy, the low-risk end comprise established blockchains like BTC, ETH, SOL and TRX.

On the opposite end, the high-risk segment would include micro altcoins and speculative trades.

💥 Meme, PolitiFi and RWA are winning

Crypto is an attention game. To make money with high-risk speculative bets, it’s crucial to bet on projects related to hot narratives.

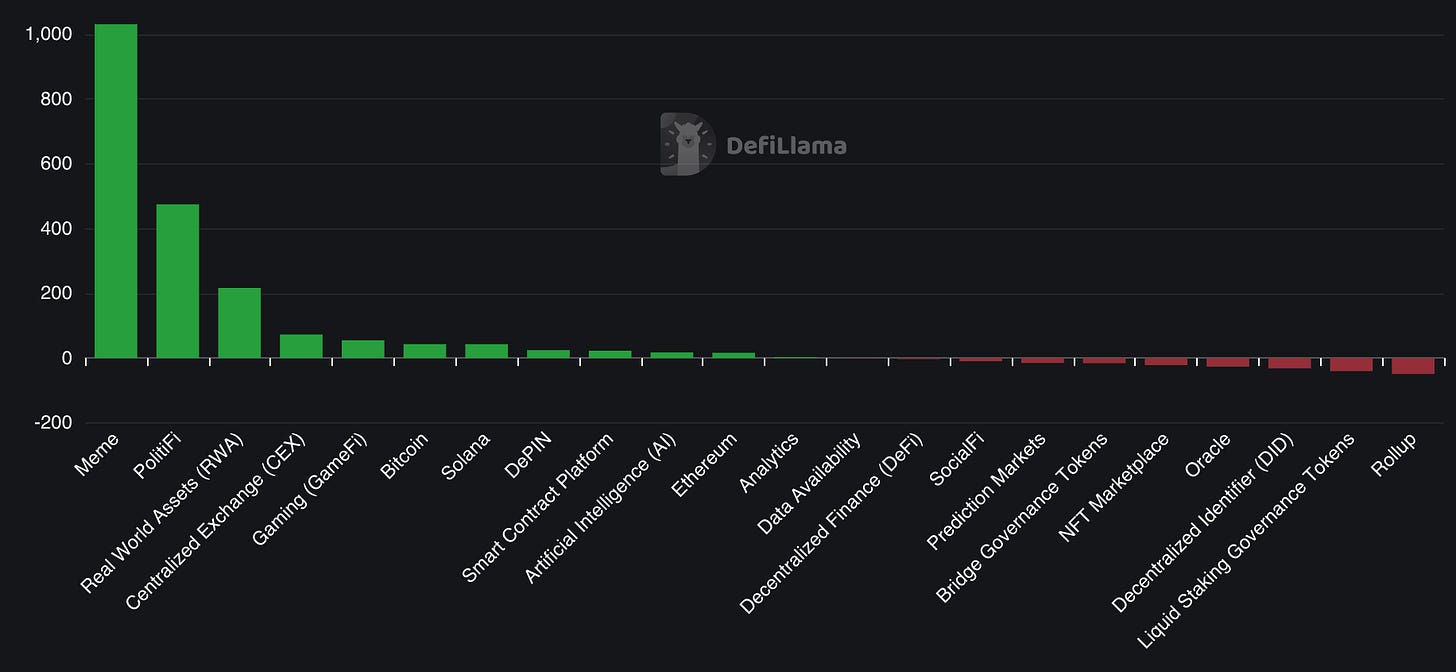

DefiLlama’s Narrative Tracker is one of the best tools to discover and monitor trending narratives.

According to the tracker, Meme, PolitiFi and Real World Assets (RWA) are the top-performing narratives year to date.

📈 Alpha Signal: BTC Whales

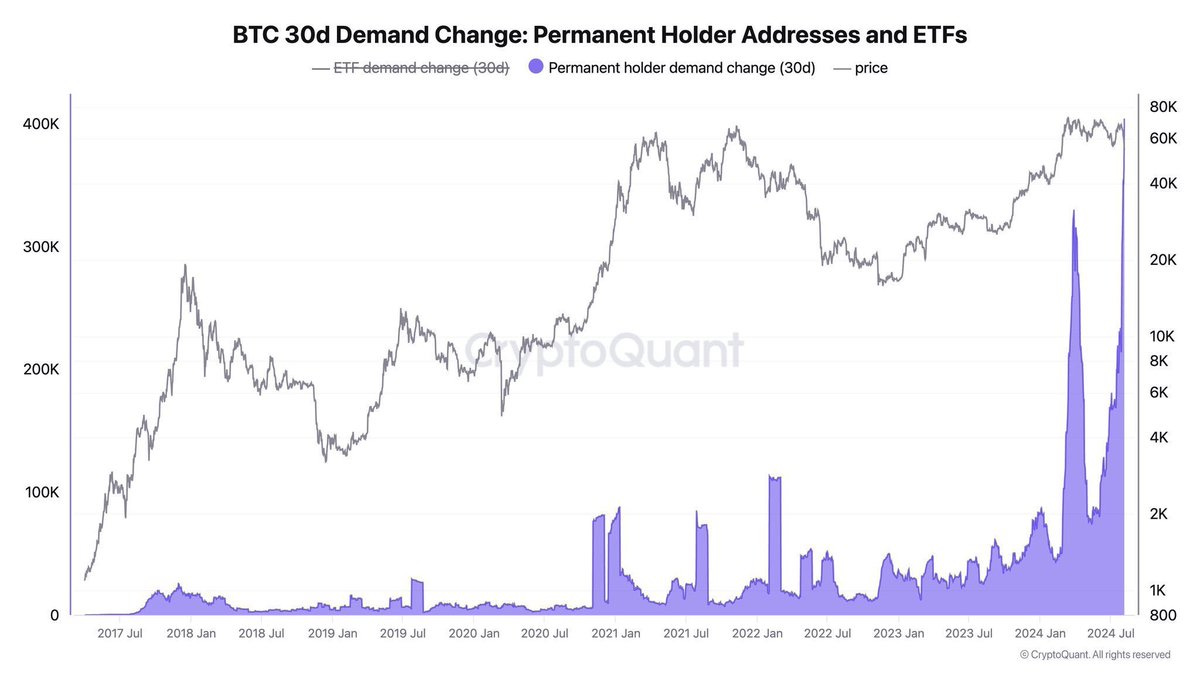

In crypto, whales are investors who holds a large amount of digital assets. Since these players hold large amounts of crypto, their moves can have a significant impact on the market. Tracking whales allows you to see transactions made by whales and use that information to make smarter investment decisions.

Permanent holder demand is at ATH meaning whales are accumulating Bitcoin like never before.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package. By upgrading to Premium, you full access to our entire library of analysis, picks & portfolios.

Here’s what premium subscribers got lately:

And here are some of our most popular premium posts:

That’s all for today!

Cheers