In partnership with

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Use these ratios to pick undervalued tokens”

If you haven’t yet, subscribe to get access to this post, and every post

In today's newsletter:

💡 How to pick high-quality protocols

📣 US interest rate cut in December rises to 74.5% probability

📈 Stablecoins just hit all-time highs

Let’s dive in!

💡 Insight

How to pick high-quality protocols

Blockchains are the technology behind cryptocurrencies like Bitcoin, Ethereum, and Solana.

If you want to win in crypto on “easy mode”, you want to allocate much of your capital to Layer 1s and a bit to the rest.

Here’s a five-step process to pick high-quality protocols:

Step 1: Understand the Basics of Blockchain

Before diving into analysis, it’s essential to understand the foundational elements of blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers. Each block contains a list of transactions, and these blocks are linked together to form a chain.

Key characteristics of blockchains include:

Decentralization: No single entity controls the blockchain.

Transparency: All transactions are visible to anyone on the network.

Security: Cryptographic techniques ensure data integrity and security

The Consensus Mechanism

The consensus mechanism is how a blockchain network agrees on the validity of transactions. Different blockchains use different mechanisms, and understanding these can provide insights into their efficiency, security, and scalability.

Some of the most common consensus mechanisms are:

Proof of Work (PoW): miners solve complex mathematical problems to validate transactions.

Proof of Stake (PoS): validators are chosen based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

Delegated Proof of Stake (DPoS): stakeholders elect delegates to validate transactions and create new blocks.

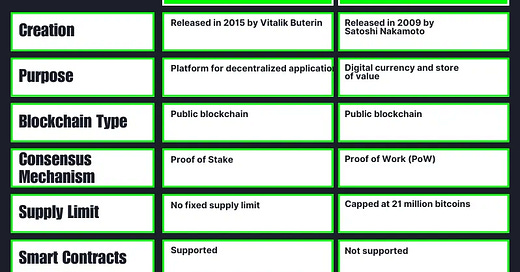

Step 2: ETC vs BTC vs SOL

These two networks are fundamentally different and will ultimately serve different use cases.

Bitcoin is trying to be “internet money.” Its finite supply of 21 million coins and its deflationary nature have contributed to its status as digital gold and a store of value.

On the other side, Ethereum has already proven itself to be the dominant smart contract network. At its core, Ethereum offers a decentralized ecosystem where developers can build and deploy smart contracts and decentralized applications (DApps).

In other words, Ethereum sells block space which can be thought of as immutable accounting entries.

And what about Solana?

Many people think Ethereum is dying slowly because of the rise of better, cheaper alternatives like Solana.

It’s true - transactions on Ethereum can take 30 seconds and cost $10 on average.

On Solana, they cost $0.000069 and are near-instant.

So, Ethereum is expensive, yes. But it’s also highly decentralized and very secure.

Individuals who are moving million-dollar tokenized assets or locking hundreds of thousands of dollars in DeFi protocols won't be going to mind paying a few hundred dollars in transaction fees and waiting for thirty seconds.

In other words, Solana wants to become the king of "consumer" blockchain—a fast, cheap, and mobile-friendly alternative for everybody.

Step 3: Understand blockchain metrics

How can the value of a blockchain's native token be reliably quantified?

Because asset valuation is very subjective, we can do our best to estimate by doing fundamental analysis and letting the market confirm or invalidate our idea.

A good place to start is by identifying the key blockchain metrics in our due diligence process.

In traditional finance, you have to wait for the release of quarterly reports to see the financial statements of a company.

In crypto, you can check the data you want on-chain for any protocol in real-time.

That’s one of the major advantages that crypto has over TradFi.

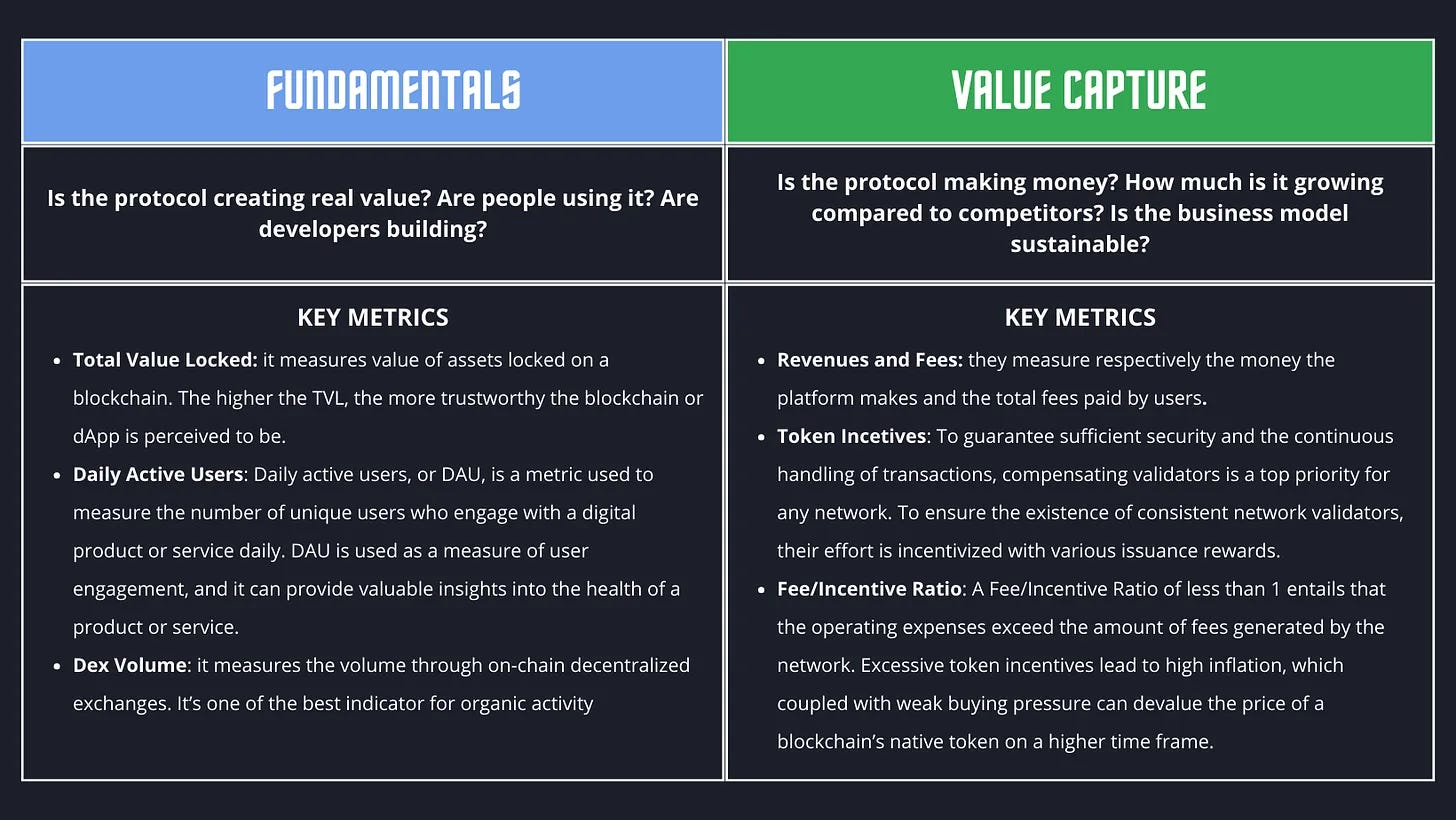

To simplify, blockchain quality metrics consist of 2 buckets:

You can find these and other useful metrics on platforms like Artemis, Growthepie, and Token Terminal.

Step 4: Use Ratios

Ratios can make your life a lot easier as an investor.

They can rate and compare one asset against another that you might be considering investing in.

In other words, they are a powerful way to invest wisely without the hassle of doing time-consuming fundamental analysis and research.

Check out our latest post:

Step 5: Pick the best protocols

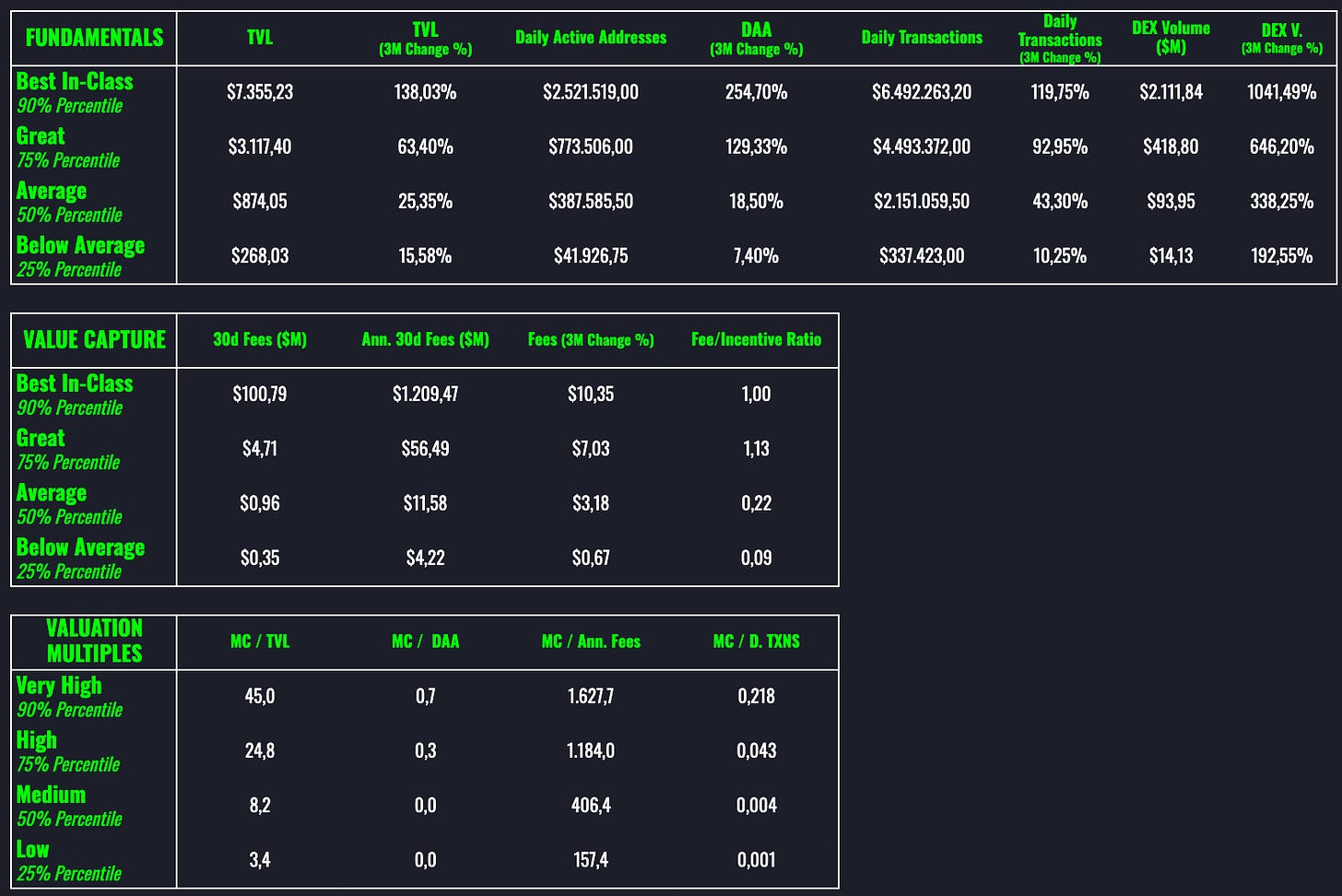

Once you’ve gathered the right data, you need to set benchmarks in order to understand which protocols are best-in-class, great, average and below average.

Take action 🚀

📈 Get undervalued blockchains in your inbox, every month

If you want to level up your crypto journey, consider subscribing to the premium package.

By subscribing, you get access to our monthly ratings where we share the best blockchains to buy based on our value investing framework which aggregates fundamental metrics & value capture metrics discounted by the market multiples.

Moreover, by upgrading to Premium, you’ll get also:

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

📣 Update

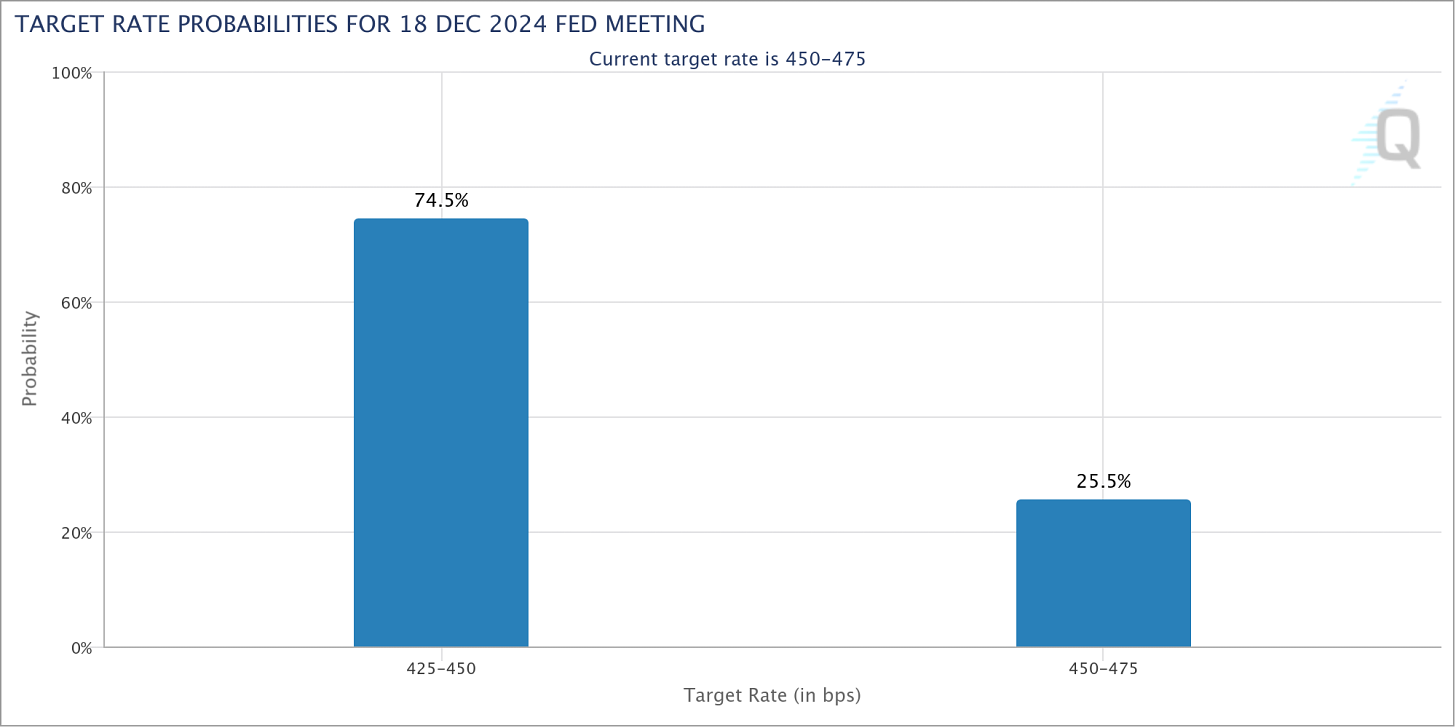

US interest rate cut in December rises to 74.5% probability

CME FedWatch, a tool used to measure expectations for a Federal Reserve rate change, has tipped the likelihood of an interest rate cut in December to 74.5%, up from earlier estimates.

On Monday, Dec. 2, the market tracking tool jumped 8.5 percentage points from its 66% probability on Nov. 29, for the expectation that the Fed would announce a 0.25% rate cut to a target of 4.25% to 4.5% when it meets on Dec. 17 and 18.

Currently, the US central bank has rates set at a target of 4.5% to 4.75% after dropping the rate by 0.75% across two cuts this year, bringing it down from an over 20-year high.

In partnership with Newhedge

Bitcoin's most powerful intelligence platform

Newhedge provides users deep insights on Bitcoin, market-leading research, and access to a unique network of information, people, and tools.

📈 Signal

Stablecoins just hit all-time highs

Stablecoins play a big role in the long-term adoption of blockchain technology.

They’re used for:

Buying more crypto

Earning yield on dollars

Cheap international transfers

Getting out of weak local currencies

As the crypto market continues to evolve, maintaining a healthy stablecoin supply will be essential for supporting liquidity, fostering innovation, and ensuring overall market stability.

And that’s it for today.

Thanks for reading!