Welcome to Investing Tuesday—our free weekly newsletter where we share investing tactics and market insights.

It’s Luca, investor and writer of the newsletter, nice to meet you 👋🏻

Today, I’m going to talk about how to pick undervalued blockchains that will outperform bitcoin in the long term.

Blockchains are platforms on top of which developers can build products and they’re essential for the development of the crypto industry.

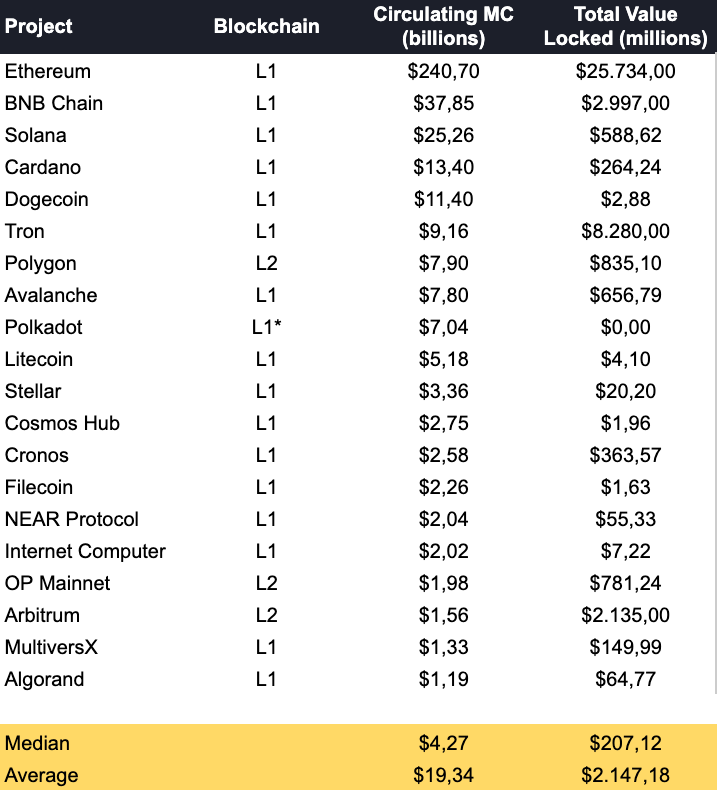

Here are the top 20 blockchains by circulating market cap (excluding Bitcoin):

As platforms, the more developers build, the more they expand their usage and the more revenue they make.

So…

How can we pick undervalued blockchains that will outperform bitcoin in the next years?

In this issue, you’ll learn how to:

Identify the best-in-class protocols

Setting benchmarks

Pick the ones with the most attractive valuations

1. Identifying the best-in-class protocols

How can the value of a blockchain's native token be reliably quantified? Because asset valuation is very subjective, we can do our best to estimate by doing fundamental analysis and letting the market confirm or invalidate our idea. A good place to start is by identifying the key metrics in our due diligence process.

In traditional finance, you have to wait for the release of quarterly reports to see the financial statements of a company.

In crypto, you can check the data you want on-chain for any protocol in real-time.

That’s one of the major advantages that crypto has over TradFi.

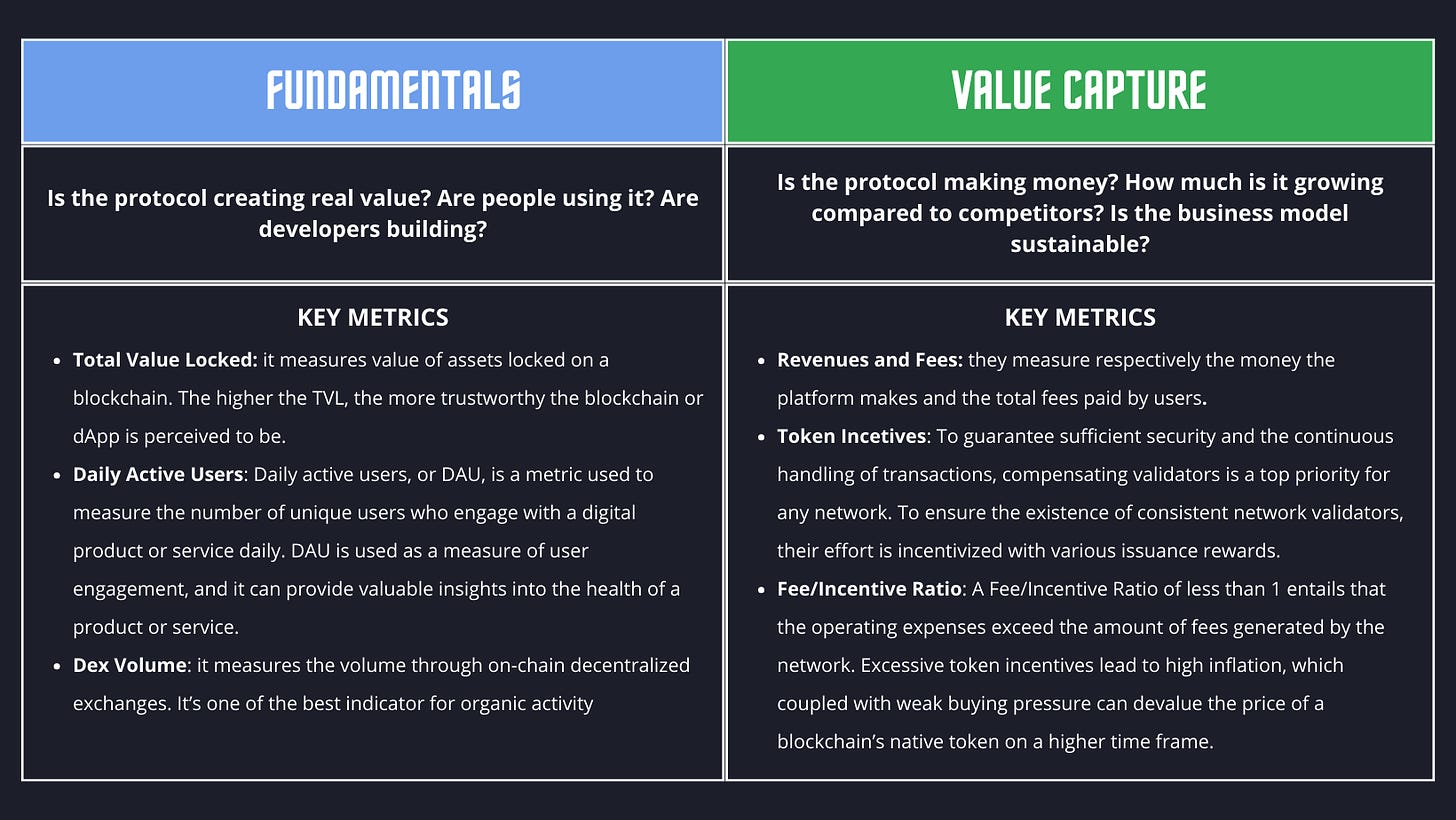

To simplify, blockchain quality metrics consist of 2 buckets:

Fundamentals: Is the protocol creating real value? Are people using it? Are developers building?

Key Metrics: Total Value Locked (TVL), Daily Active Users (DAU), Dex Volume

Value Capture: Is the protocol making money? How much is it growing compared to competitors? Is the business model sustainable?

Key Metrics: Revenue, Fee, Token incentives, Fee/Incentive Ratio

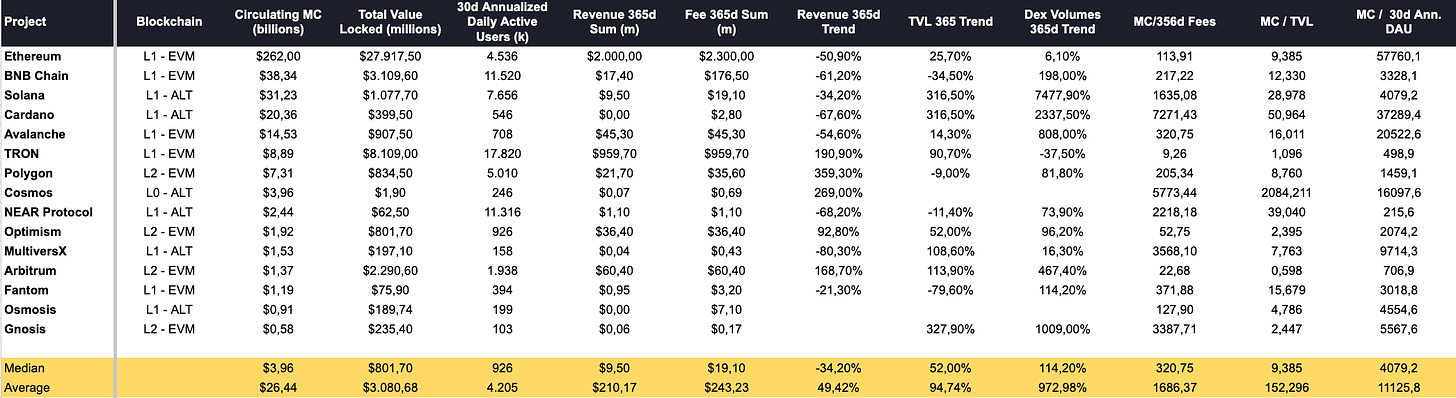

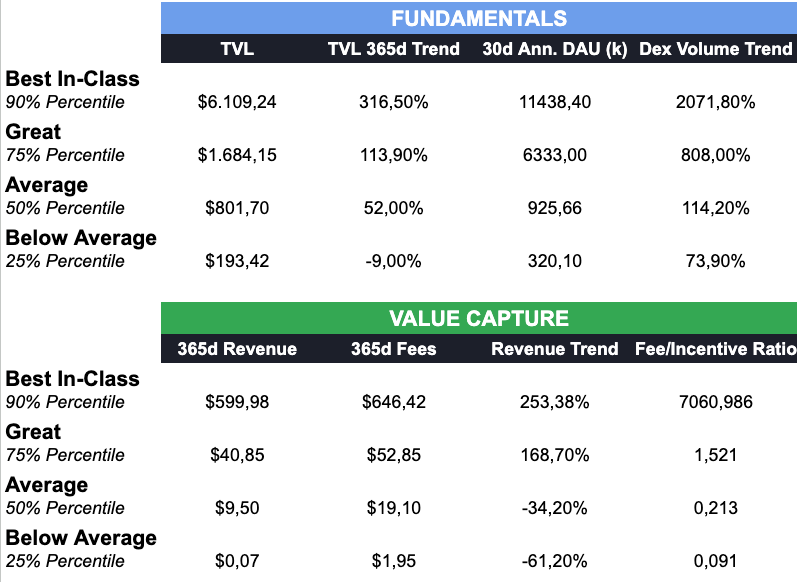

After all these considerations, we should have something like this:

2. Setting benchmarks

Once we’ve gathered the right data, we need to set benchmarks in order to understand which protocols are best-in-class, great, average and below average.

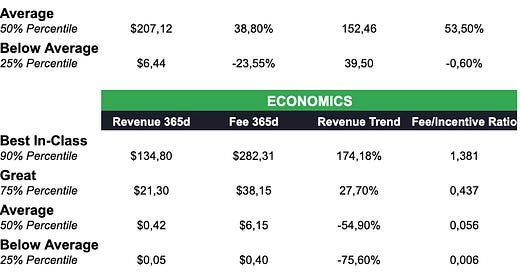

Below you can see the top 20 blockchains benchmarking in terms of value/activity and economics.

Following that, it’s time rank the projects.

According to our analysis, Arbitrum is surprisingly the third best blockchain by quality score.

3. Picking Undervalued Blockchains

Are we done? Not yet.

We found quality so far.

Our ultimate goal here is to pick high-growth projects.

In order to do so, we need to buy quality project with attractive valuations.

Therefore, it’s time to add valuation ratio formulas such as Market Cap/Total Value Locked, Price/Sales and Market Cap/Daily Active Users into our buying decision process.

This could result in us purchasing other altcoins or purchasing the same ones with a modified capital allocation.

Let me explain this.

How would we allocate $10.000 if we were to invest in 5-10 blockchains?

We could chose to distribute the $10.000 evenly or to prioritize the projects with the more favorable valuations.

To Sum Up

Identify top protocols by fundamental analysis: value/activity and economics metrics

Set benchmarks and derive quality ranking

Add valuation metrics into the buying decision process

📈 Get undervalued blockchains in your inbox, every month

By subscribing to our premium subscription, you get access to our monthly list of undervalued quality blockchains to buy, followed by our rankings and analysis.

Ready to become a smarter investor?