Hey Investor 👋🏻

I’m Luca and welcome to a free edition of Altcoin Investing Picks.

I hope you enjoyed last week’s issue “Making Profits w/ PolitiFi Tokens”

Today I want to talk about why I’m bullish on Ethereum.

Let’s dive in!

The Basics of Ethereum

Ethereum stands as a pioneering blockchain platform that extends beyond mere cryptocurrency transactions. At its core, Ethereum offers a decentralized ecosystem where developers can build and deploy smart contracts and decentralized applications (DApps).

This unique infrastructure opens doors to a myriad of possibilities for businesses seeking innovation, efficiency, and trustworthiness in their operations.

In other words, Ethereum sells block space which can be thought of as immutable accounting entries.

Its blockchain is highly decentralized and very secure.

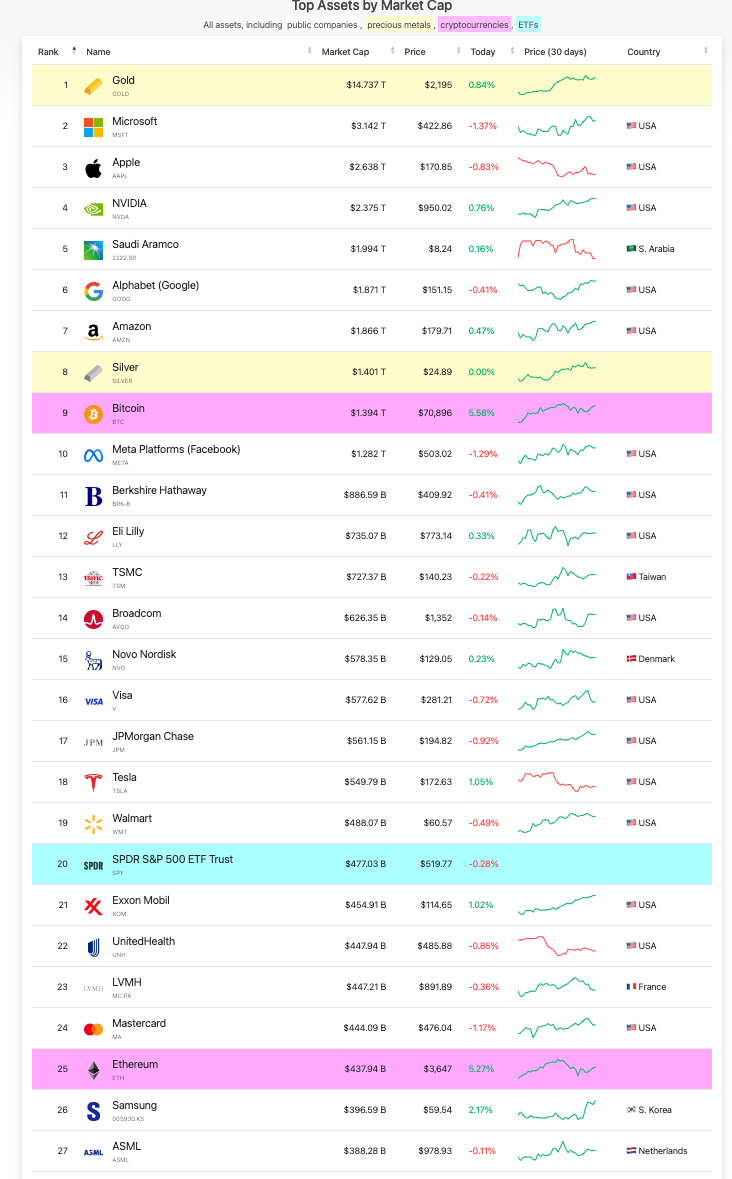

That’s how (& why) the market values its block space 👇🏻

By harnessing the power of its smart contracts, businesses (DApps, tokenization, DeFi, and other Ethereum-based solutions) can enhance transparency, efficiency & security.

In doing so, developers can create new products and services that can natively connect 8 billion people globally. This concept is similar to Facebook or Google leveraging internet protocols such as TCP/IP or SMTP to deliver internet services to users globally.

Some numbers 📈

Ethereum is 8 years old and currently has over 115 million non-zero wallet addresses while the internet had about 147 million users in 1998 — 15 years after its inception.

Only Google reached $10 billion in fees faster than Ethereum.

Over 35% of the circulating supply of ETH is currently held in smart contracts on-chain (earning yield) — pointing to the utility of ETH as a productive asset.

The energy consumption of an Ethereum transaction equaled over 100,000 VISA transactions in December 2021 but was much lower after the Merge.

Ethereum holds 56.72% of Total Value Locked among DeFi protocols.

Sources:

https://www.linkedin.com/pulse/ethereum-2nd-fastest-10-billion-spencer-x-smith/

https://studio.glassnode.com/metrics?a=ETH&m=addresses.NonZeroCount

https://studio.glassnode.com/metrics?a=ETH&m=distribution.SupplyContracts

https://www.statista.com/statistics/1265891/ethereum-energy-consumption-transaction-comparison-visa/

https://defillama.com

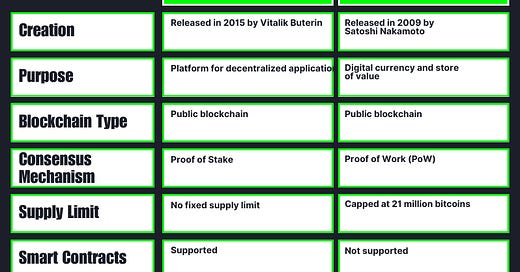

ETH vs BTC

While the market may view Bitcoin as a competitor to Ethereum, we do not see it this way. The two networks are fundamentally different and will ultimately serve different use cases. Bitcoin is trying to be “internet money.” With the digital gold narrative taking hold, this is the primary use case for Bitcoin.

However, Ethereum has already proven itself to be the dominant smart contract network.

5 reasons why we'll see a Spot $ETH ETF soon.

Ethereum is the only crypto asset besides BTC that has a futures market ETF — a prerequisite for the spot ETF.

ETH has a much higher daily trading volume/market cap and a much lower spread than the vast majority of stocks trading in the market.

Since law, in the context of financial markets, is also based on legal precedent, the approval of the same financial instruments proposed for Bitcoin could be a catalyst for those on Ethereum (and the courts already forced the SEC's hand in issuing the BTC ETF).

The CFTC has already stated that ETH is a commodity.

BlackRock CEO Larry Fink had previously acknowledged the benefits of tokenization, stating that he sees tokenized assets as the next generation for markets and last week, and last week, his firm sent shock waves across crypto, unveiling its first tokenized fund issued on a public blockchain!

That’s all for today!

Thanks for reading

P.S some resources for you when you're ready:

1. Premium Newsletter

If you want to level up you crypto investment strategy and and avoid costly mistakes, consider subscribing to the premium package.

Here’s what you’ll get every month:

4x+ Micro Altcoin Picks: micro projects we think are willing to be tomorrow's market leaders.

2x+ Tactical Trade Ideas: short-term bets to make profits from narratives and trends.

1x Value Investing Analysis: undervalued blockchains we think will outperform the market.

1x Monthly Market Analysis: our view on the current market situation supported by data-driven analysis.

2. The Altcoin Investing Course

Everything you need to know to discover, analyze, invest and trade altcoins.

By the end of the course, you'll have a deep understanding of the crypto ecosystem, fundamental analysis, value investing, portfolio management and tactical trading.

The Course:

Part 1: Blockchain Technology

Part 2: The Crypto Money Cycles

Part 3: Goal-based investing strategies

Part 4: Token Analysis: How to pick undervalued blockchains

Part 5: Narrative Trading: How to make (more) money with narratives

Part 6: Micro Altcoin Investing: How to build a portfolio like a VC