Hi Investor 👋

Welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

Before we dive in

🚨 Value Investing Ratings Update

Premium subscribers have full access to the best blockchains to buy based on fundamental & value capture metrics discounted by the market multiples.

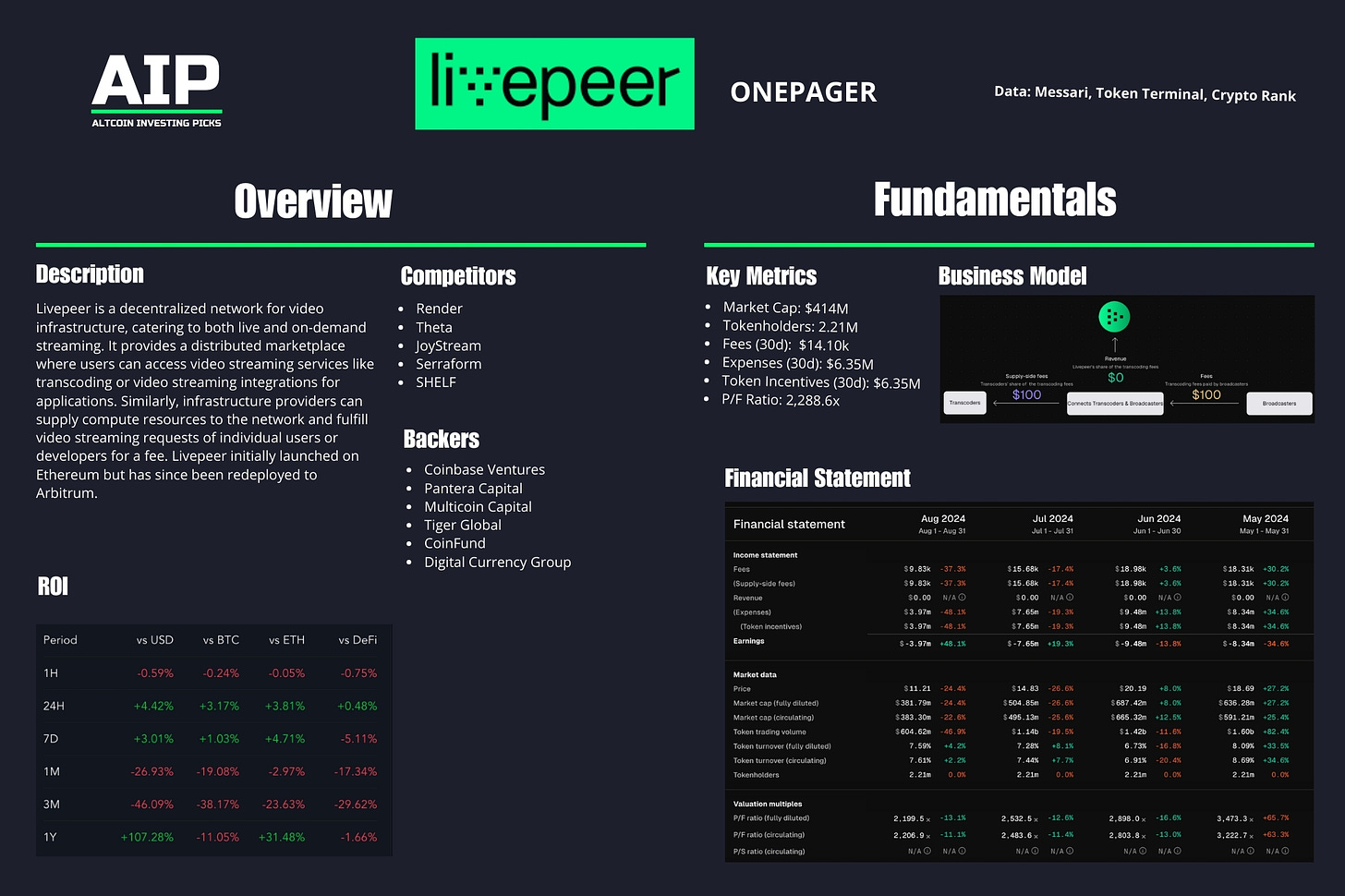

The Livepeer network offers an open and permissionless video infrastructure marketplace for live and on-demand streaming.

The network is designed to reduce transcoding costs for end users by up to 10x.

The LPT token has recently been included in the Grayscale Decentralized AI Fund consisting of native tokens of decentralized AI protocols.

But is it an interesting token? Let’s find out.

Livepeer - The Basics

Industry: Web3 Infrastructure

Vertical: Streaming, Artificial Intelligence

Market Cap: $414M

24H Real Volume: $9.76M

X Community: 46.4k

Current price: $12.12

All-time high: $94.38 (down 87.08%)

Investors: Coinbase Ventures, Pantera Capital, Multicoin Capital, Tiger Global, CoinFund, Digital Currency Group

Markets: Binance, Houbi, OKX, Bitget, Coinbase, Gate, KuCoin, CoinEx, Uniswap

Overview

Here’s a onepager with the essentials of Livepeer:

(Click on the picture to expand)

Tokenomics

The Livepeer Token ($LPT) is the protocol token of the Livepeer network. But it is not the medium of exchange token. Broadcasters use Ethereum's Ether ($ETH) to broadcast video on the network. Nodes who contribute processing and bandwidth earn ETH in the form of fees from broadcasters.

LPT is a staking token that participants who want to perform work on the network stake in order to coordinate how work gets distributed on the network, and to provide security that the work will get done honestly and correctly.

Distribution

As a token that represents the ability to participate and perform work in the network through a DPoS staking algorithm, the initial Livepeer token distribution will follow the patterns of other DPoS systems which require a widely distributed genesis state.

An initial allocation of the token will be distributed to the community at genesis and over the early stages of the network. Receipients can use it to stake into the role of Transcoder or Delegator. A portion will be allocated to groups who contributed prior work and money towards the protocol before the genesis, and a portion will be endowed for the long term development of the core project.

A higher inflation rate would incent more token to be bonded, and a lower rate would lead to more people choosing liquidity rather than participation. It's this liquidity preference vs network ownership percentage tradeoff which should find equilibrium due to a number of economic factors in the network.

Now let’s dive into the most important part:

Is Livepeer an interesting buy?

To understand whether Livepeer is an attractive opportunity, we will calculate its market potential and expected return.

After that, we will provide a summary score (✅ Buy, ➖ Wait, ❌ Sell) that reflects the investment potential of the asset.

Let’s dive in!