Micro AMM Protocol With 20x Potential

Hey everyone,

it’s Pick Day!

Every Saturday, you get deep dives on Quality Micro Altcoins with numerous growth potential included in our watchlist.

Let’s dive in!

Automated Market Makers (AMMs) are smart contracts that enable trading to be decentralized, permissionless, and immediate.

In other words, they operate on a unique model that relies on liquidity pools and mathematical formulas to determine asset prices, offering a decentralized and automated trading experience.

DeFi is basically built on AMMs. AMMs replace traditional intermediaries like centralized order books and market makers to facilitate truly permissionless trading on the blockchain.

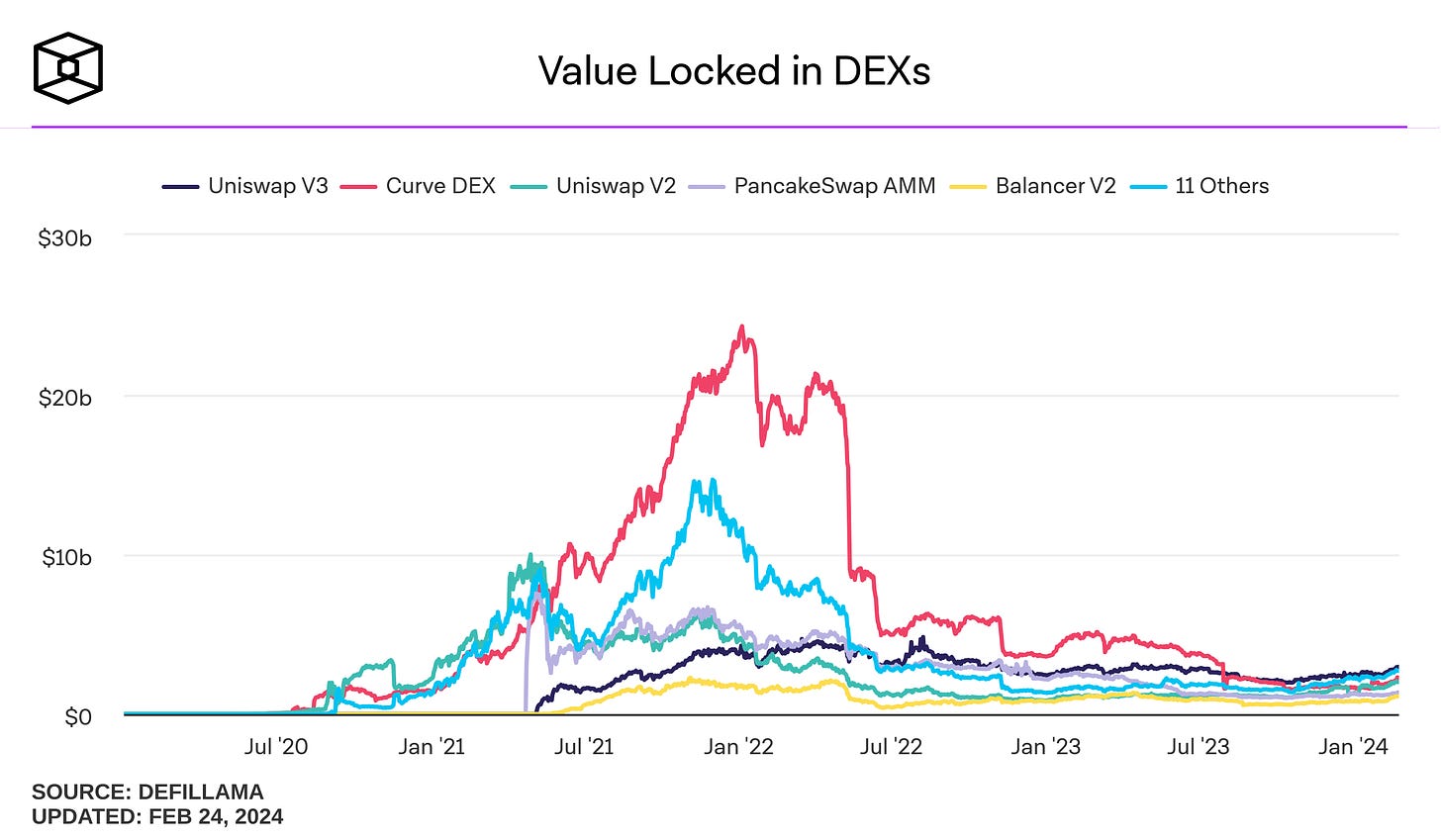

According to DefiLlama, around $13b is currently locked up in DEXs, all of which are powered by some version of an AMM.

With the explosion in activity in the DeFi space, a variety of AMM platforms have emerged, each with its own quirks and features.

Here's a quick rundown to help you navigate the landscape.

Uniswap: The big kahuna of AMMs, known for its simplicity and wide adoption.

Bancor: A pioneer in the space, offering unique features like single-asset exposure.

Aave: Not just a lending platform, but also dipping its toes in the AMM pool.

Curve Finance: applies the AMM model to Ethereum-based tokens but specifically to low-risk Stablecoin pairs or pairs of coins with equal or similar value.

1inch: a DEX aggregator that automatically search across individual decentralized exchanges to find and execute the best price swap for you

Our next pick belongs to this sector and offers a new infrastructure for decentralized finance, powered by a revolutionary Automated Market Making System which goes even further than concentrated liquidity.

Now let’s tell you which project we are talking about and share the full investment case with you: