Solana vs Ethereum: Everything You Should Know

PLUS: Offer Extended for 24 hours 🚨

Many people think Ethereum is dying slowly because of the rise of better, cheaper alternatives like Solana.

It’s true - transactions on Ethereum can take 30 seconds and cost $10 on average.

On Solana, they cost $0.000069 and are near-instant.

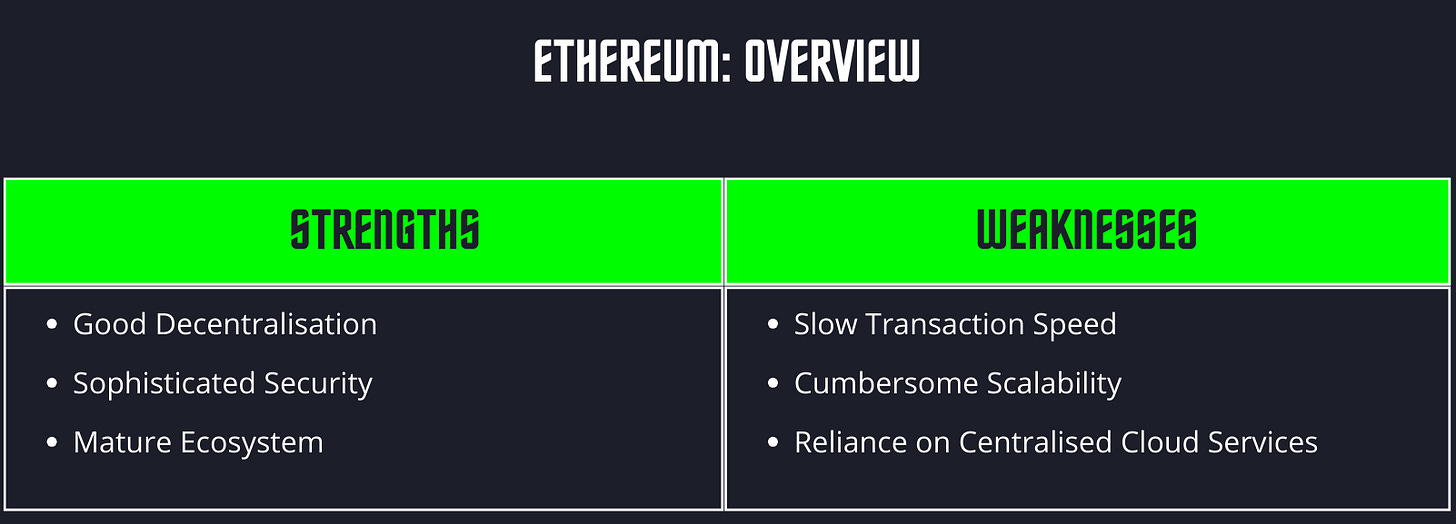

So, Ethereum is expensive, yes. But it’s also highly decentralized and very secure.

Individuals who are moving million-dollar tokenized assets or locking hundreds of thousands of dollars in DeFi protocols won't be going to mind paying a few hundred dollars in transaction fees and waiting for thirty seconds.

In other words, Solana wants to become the king of "consumer" blockchain—a fast, cheap, and mobile-friendly alternative for everybody.

Ethereum does not compete in this space since this is not its purpose. Instead, Ethereum is trying to be the internet's ultimate decentralized and secure consensus layer.

Fundamentals Insights

Since we are data-driven investors, we’re going to look at fundamental metrics.

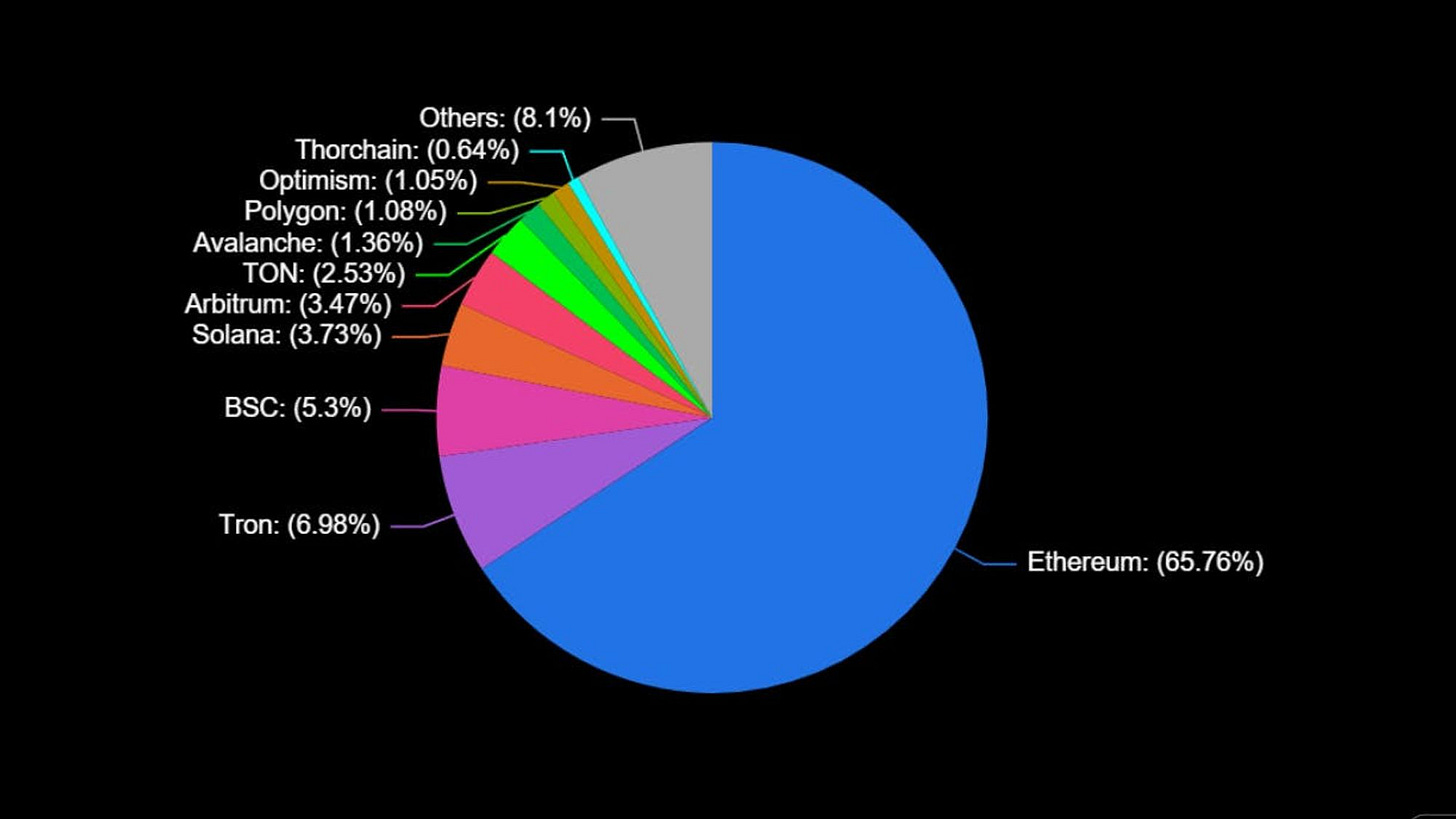

The pie graph above compares the Total Value Locked among blockchains, including L1s and L2s.

Ethereum holds 65.76% of TVL.

On the other hand, Solana only has 3.73%.

From Ethereum's perspective, the metrics should also include rollup activities. They've outsourced execution/scaling of Ethereum to rollups.

So, it’s important to look at the activity of rollups and verify if the Ethereum’s scaling strategy is working.

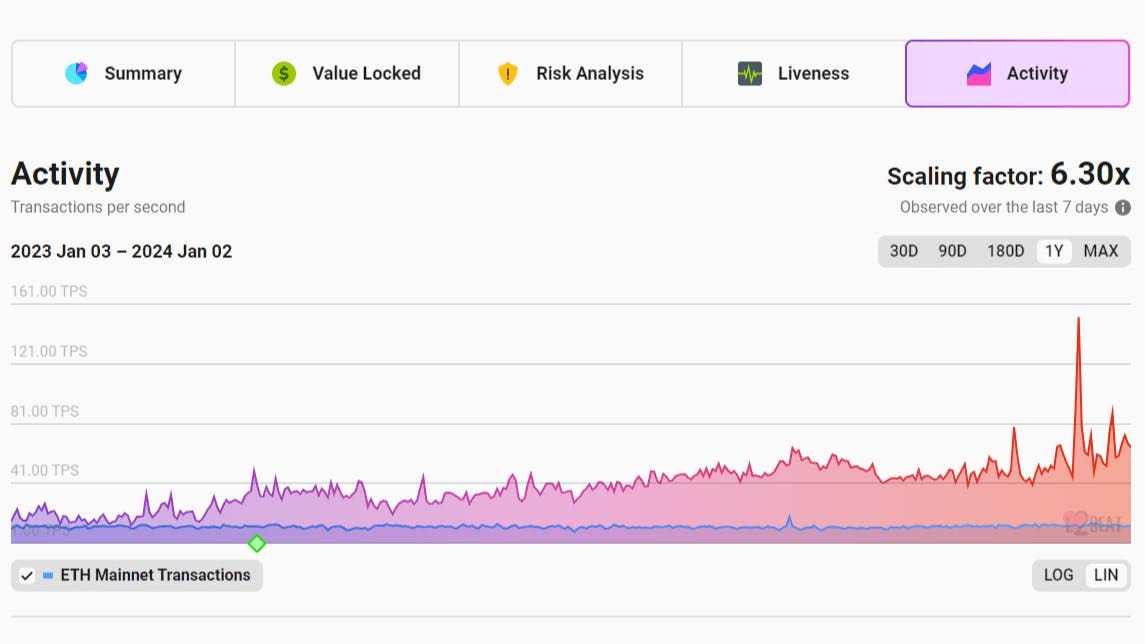

Below, you can see the transactions per second (tps) on Ethereum and L2s for the past year.

Ethereum tps stayed pretty constant throughout the year. However, we may notice a significant increase in L2 txn/s.

This data shows that Ethereum’s strategy of outsourcing execution/activity to rollups has been successful.

That is why we like $ETH and we are getting leveraged exposure to the its price 💸

To wrap up the analysis, here is a summary table of the key metrics and ratios of $ETH and $SOL.

Key Takeaways

ETH is far ahead in terms of total value locked and has managed to scale its slow blockchain thanks to L2s that are performing very well (see Arbitrum and Optisim)

SOL in the last year has grown a lot and is confirming itself as the leading blockchain in terms of masses.

In terms of valuation, ETH is very attractive based on revenue multiples, fees, and fees/incentives, while SOL objectively has a really performing blockchain.

Whenever you’re ready

That’s it for today.

Whenever you’re ready, here’s how AIP Premium can help you:

Tactical trades: short term bets that leverage hot narratives and market trends.

Bitcoin Beaters: undervalued blockchains we think will outperform BTC in the long term.

Micro Quality Altcoins: high-growth micro altcoins we think are willing to be tomorrow's market leaders.

P.S.

Given the high demand for our New Year Offer, we have decided to extend it for the next 24 hours.

Cheers!