In partnership with

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Most Important Charts of 2024”

If you haven’t yet, subscribe to get access to this post, and every post.

In today's newsletter:

💡 The 5 Fastest Growing DeFi Protocols

📣 Messari State of DePIN 2024

📈 New ATH for DEX to CEX volume

Let’s dive in!

💡 Insight

The 5 Fastest Growing DeFi Protocols

This week, we’re taking a look at some protocol that are dominating the market in terms of annualized fees (> $100M).

Here are the 5 fastest growing DeFi protocols:

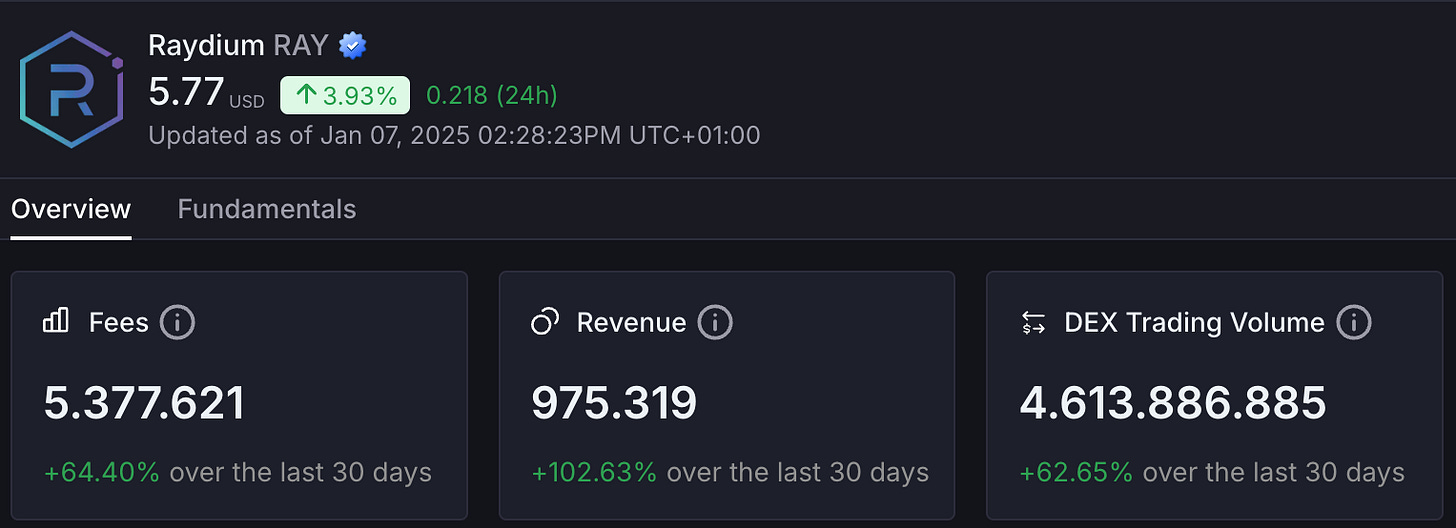

1. Raydium ($RAY)

Raydium is an automated market maker (AMM) decentralized exchange (DEX) on Solana that offers a decentralized exchange where users can swap tokens that trade on Raydium through its permissionless liquidity pools.

Key Metrics:

Market Cap: $1.71B

Total Value Locked: $2.4B

Annualized Fees: $2B

24H Real Volume: $70.05M

Current price: $5.77

All-time high: $16.76 (down 65.42%)

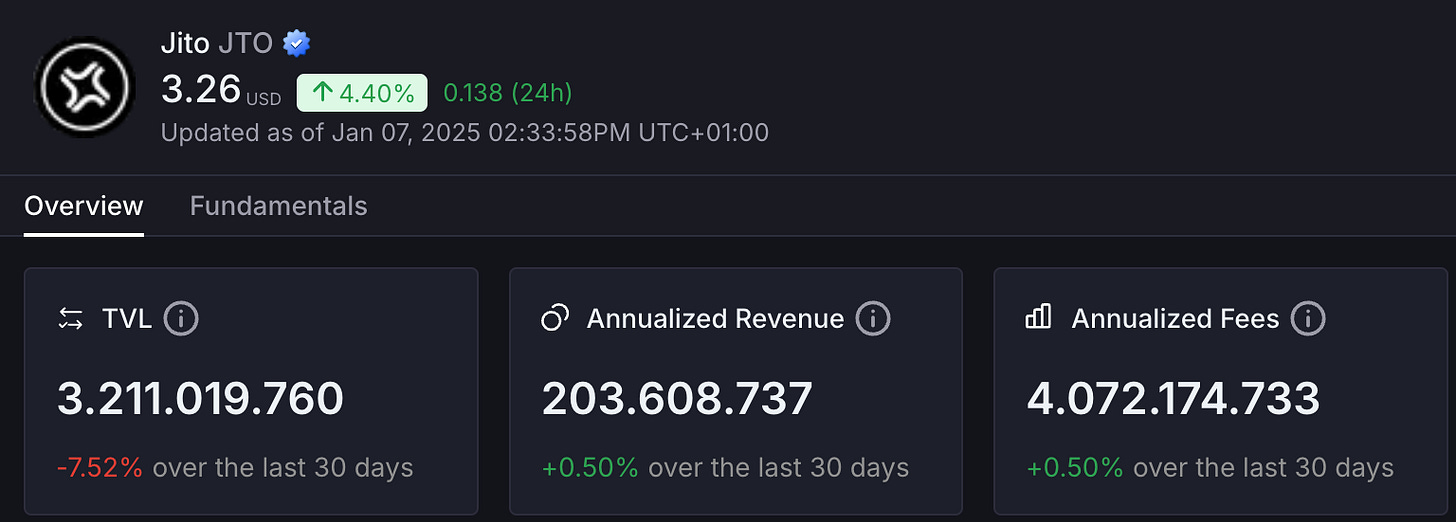

2. Jito ($JTO)

Jito is a Solana infrastructure company that provides a variety of services to developers, validators, dApps, and users. Jito Solana is Jito's version of the Solana client software that offers MEV protection, fast transaction landing, support for multiple transactions, and revert protection. Jito is also the creator of the JitoSOL liquid staking token, and the Jito Restaking protocol.

Key Metrics:

Market Cap: $902M

Total Value Locked: $3.2B

Annualized Fees: $1.5B

24H Real Volume: $25.7M

Current price: $3.25

All-time high: $5.26 (down 37.92%)

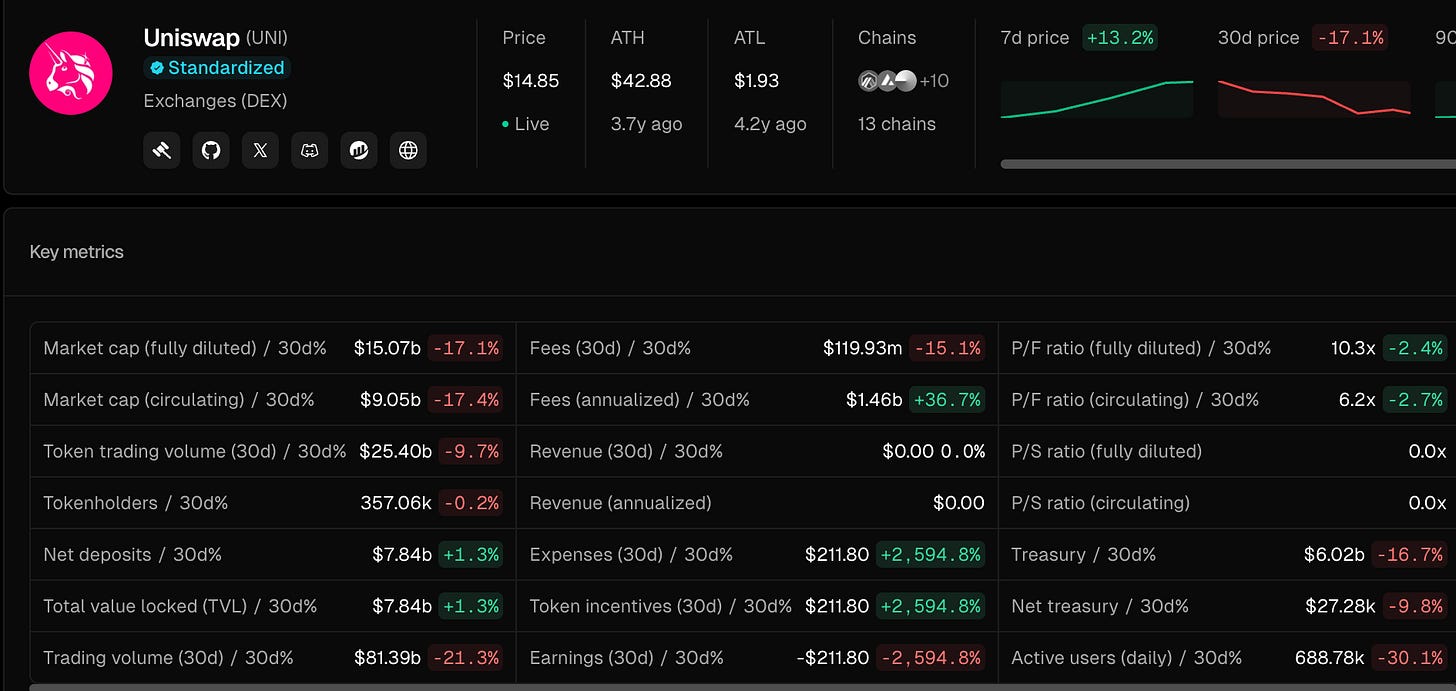

3. Uniswap ($UNI)

Uniswap is a decentralized finance (DeFi) protocol centered around its automated market-making (AMM) decentralized exchange (DEX) that sources liquidity for swapping crypto assets. The protocol comprises various immutable, non-upgradeable smart contracts, each with different features for the underlying AMM architecture.

Key Metrics:

Market Cap: $9B

Total Value Locked: $8.2B

Annualized Fees: $1.5B

24H Real Volume: $155M

Current price: $18.45

All-time high: $44.68 (down 66.89%)

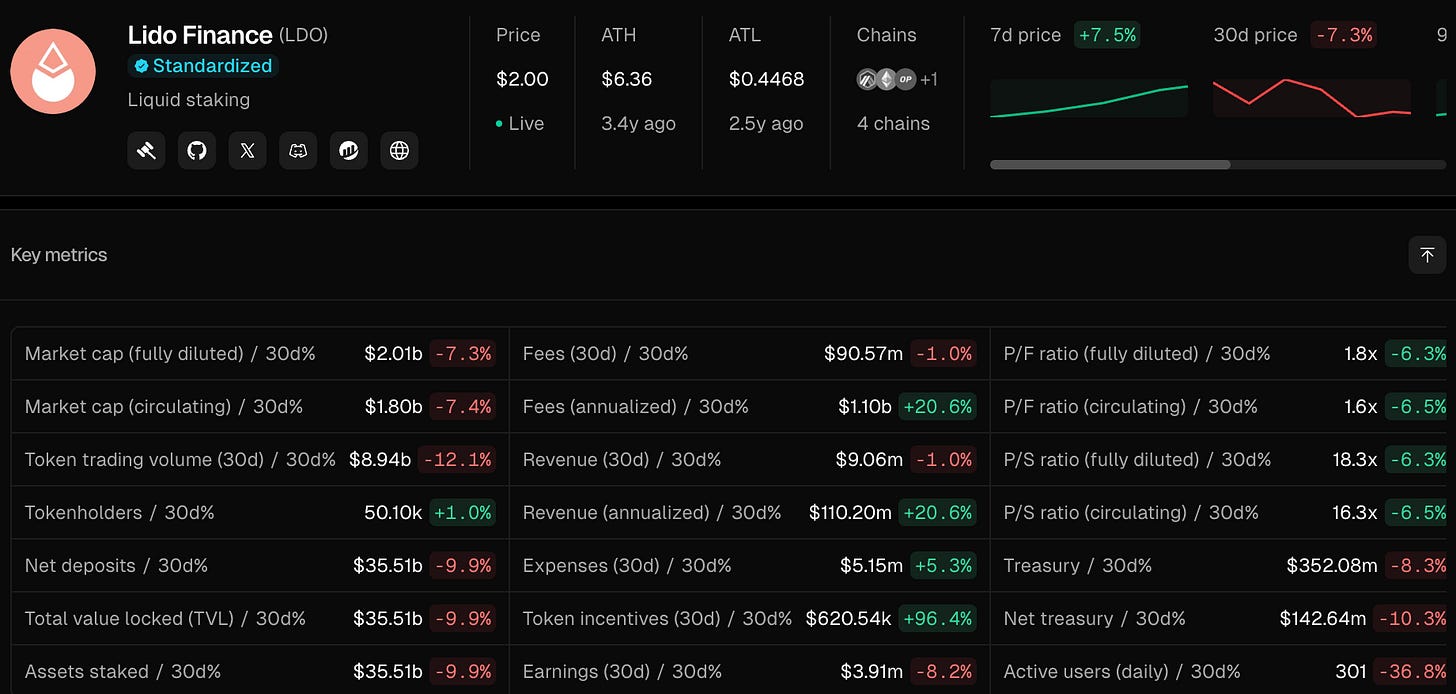

4. Lido ($LDO)

Lido is an open-source liquid staking protocol deployed on Ethereum and Polygon that allows users to stake ETH in exchange for a transferable utility token: stETH.

Key Metrics:

Market Cap: $2B

Total Value Locked: $35B

Annualized Fees: $1.3B

24H Real Volume: $63M

Current price: $2.00

All-time high: $7.22 (down 72.30%)

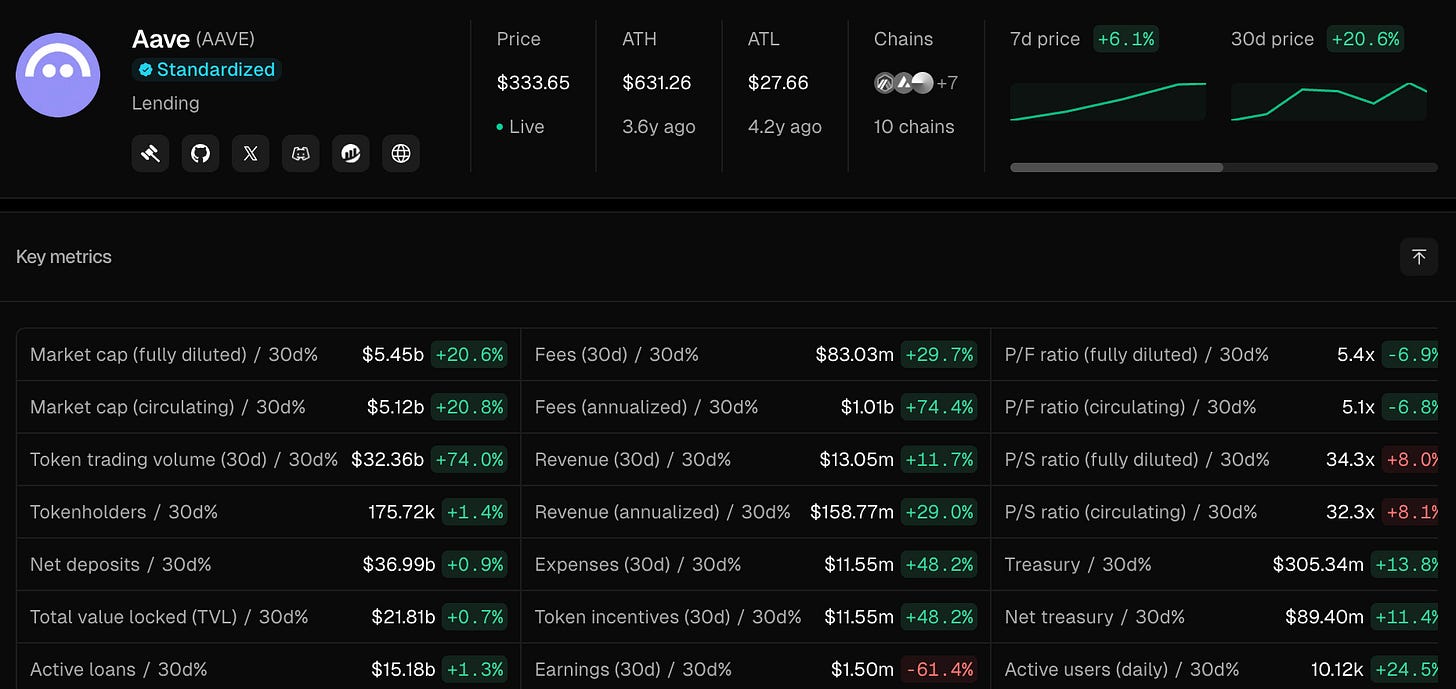

5. Aave ($AAVE)

Aave is a liquidity management protocol allowing users to borrow/lend crypto assets on supported networks, like Ethereum, Avalanche, and Arbitrum.

Key Metrics:

Market Cap: $5B

Total Value Locked: $22B

Annualized Fees: $1.01B

24H Real Volume: $209M

Current price: $332.81

All-time high: $657.35 (down 49.41%)

—

Protocol Comparison:

In partnership with

Small cap and micro cap stocks have been getting crushed over the last couple of years. There are a ton of gems that are trading at huge discounts.

Get under-the-radar stocks with huge growth potential. Every week in your inbox.

📣 Update

Messari State of DePIN 2024

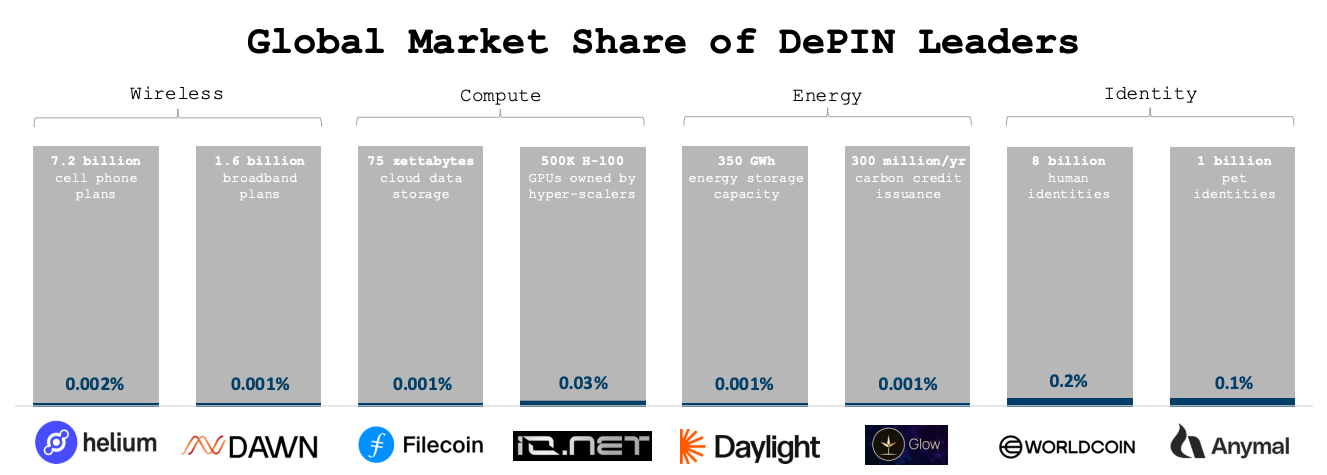

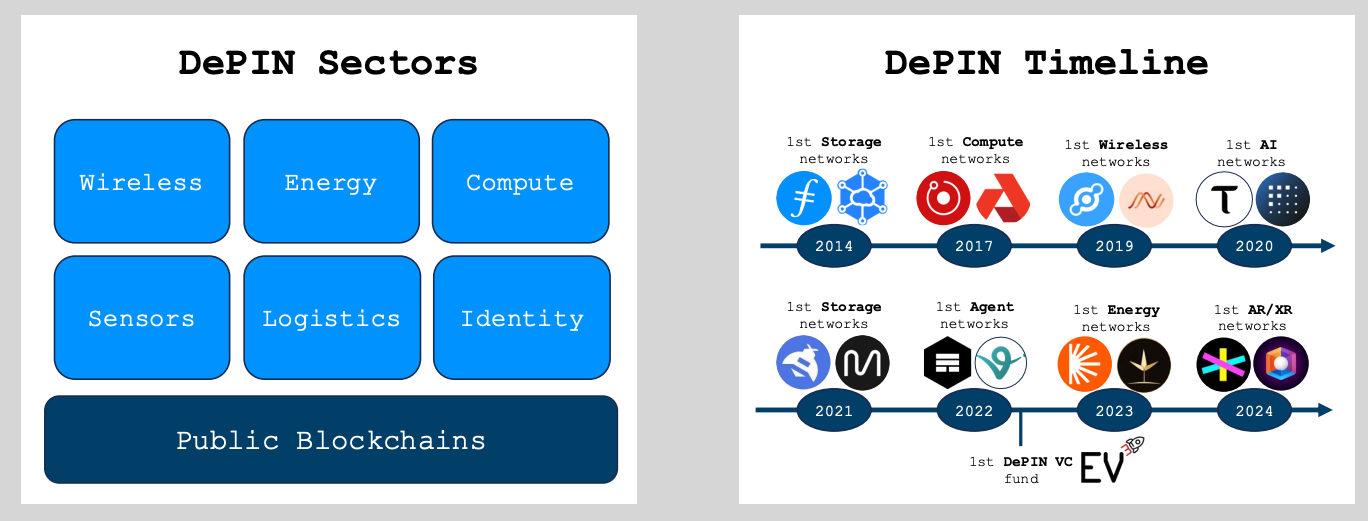

Dylan Bane, Messari's lead DePIN Research Analyst, and Salvador Gala, Co-Founder of Escape Velocity Ventures, have co-authored the 2024 State of DePIN. The 104-page report provides an in-depth analysis and review of the DePIN sector throughout 2024 and a forward-looking perspective on what lies ahead for DePIN in 2025.

This year's report covers macro trends in DePIN, AI x DePIN, Decentralized Wireless (DeWi), Decentralized Generative Energy (DeGEN), compute networks, sensor networks, identity networks, logistics networks, and more.

To read this report, you can download the PDF version.

Here are some key insights:

DePIN is in its earliest innings with <0.1% market share of $1+ end-markets.

With $50B of market cap across 350 tokens, the DePIN sector trades at ~100x ARR.

More than 13 million devices contribute to DePINs every single day.

DePIN "Chain Wars" accelerated in 2024 with Solana and Base taking market share from other L1S. Solana leads in network infrastructure, Base leads in consumer & marketplaces, and dedicated DePIN L1s carve out their own native onchain ecosystems.

Local governments are looking to DePIN to address infrastructure challenges.

The DePIN sector raised over $350 million across Pre-Seed, Seed, and Series A rounds.

📈 Signal

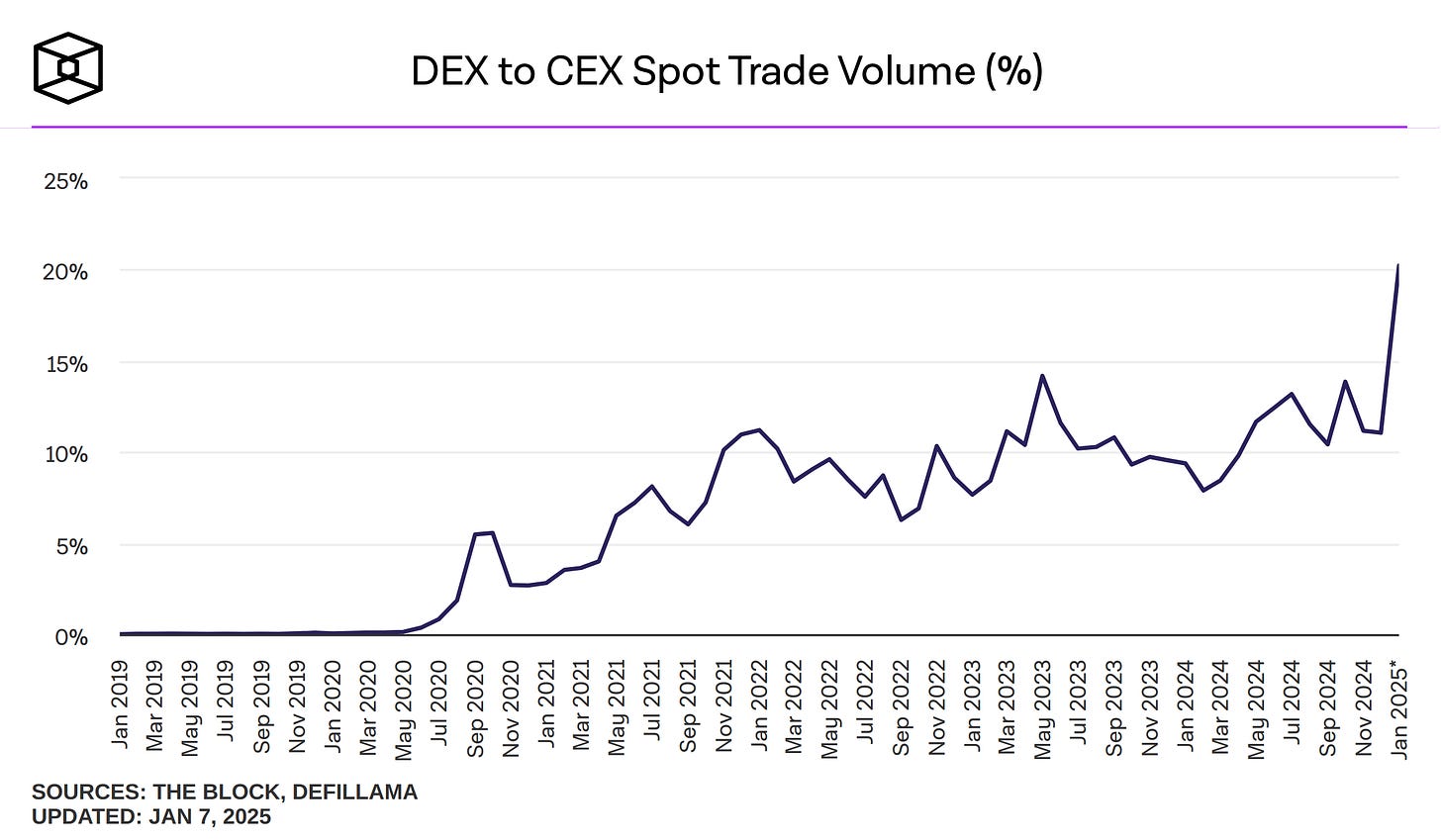

New ATH for DEX to CEX volume

The shift is clear, DeFi is gaining ground.

In the summer of 2020, the world of cryptocurrency witnessed a phenomenon that would later be dubbed the "DeFi Summer".

This period marked a significant turning point in the adoption and development of decentralized finance (DeFi) platforms.

→ 2025 could be the year for a DeFi Renaissance

About the chart

Monthly decentralized exchange volume divided by centralized exchange volume (as a percentage).

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

That’s all for today!

Cheers