The Blockchain Investing Guide (FREE)

A five-step process to pick high-quality protocols

Researching altcoins can be an endless task.

We now have 5.7 times the number of crypto tokens compared to the peak of the bull market in 2021.

There’s an infinite amount of information out there from an unlimited number of sources.

This leads to most investors underperforming the market, because they don’t manage their risk intelligently and end up losing money.

So how do you avoid this?

Well, don’t reinvent the wheel.

Let me explain this.

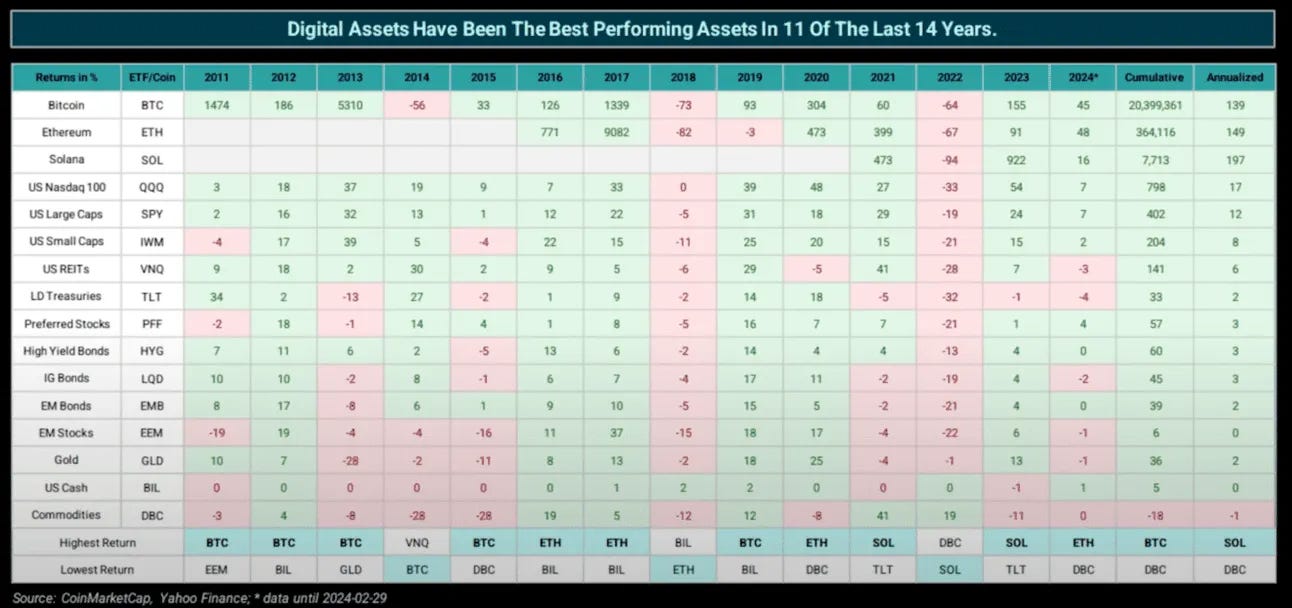

Crypto is already the best-performing asset in history.

Just holding the major protocols (BTC, ETH & SOL) - could have generated 150+ IRR%

And that’s a huge alpha compared to traditional asset classes like stocks.

You don’t need to go out and seek risky coins. You can just own quality blockchains.

Blockchains are the technology behind cryptocurrencies like Bitcoin, Ethereum, and Solana.

So, if you want to win in crypto on easy mode, you want to allocate much of your capital to Layer 1s and a bit to the rest.

Here’s a five-step process to pick high-quality protocols:

Step 1: Understand the Basics of Blockchain

Before diving into analysis, it’s essential to understand the foundational elements of blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers. Each block contains a list of transactions, and these blocks are linked together to form a chain.

Key characteristics of blockchains include:

Decentralization: No single entity controls the blockchain.

Transparency: All transactions are visible to anyone on the network.

Security: Cryptographic techniques ensure data integrity and security

The Consensus Mechanism

The consensus mechanism is how a blockchain network agrees on the validity of transactions. Different blockchains use different mechanisms, and understanding these can provide insights into their efficiency, security, and scalability.

Some of the most common consensus mechanisms are:

Proof of Work (PoW): miners solve complex mathematical problems to validate transactions.

Proof of Stake (PoS): validators are chosen based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

Delegated Proof of Stake (DPoS): stakeholders elect delegates to validate transactions and create new blocks.

Step 2: Recognize the differences among the leaders (BTC vs ETH vs SOL)

While the market may view Bitcoin as a competitor to Ethereum, I do not see it this way.

The two networks are fundamentally different and will ultimately serve different use cases.

Bitcoin is trying to be “internet money.” Its finite supply of 21 million coins and its deflationary nature have contributed to its status as digital gold and a store of value.

On the other side, Ethereum has already proven itself to be the dominant smart contract network. At its core, Ethereum offers a decentralized ecosystem where developers can build and deploy smart contracts and decentralized applications (DApps).

In other words, Ethereum sells block space which can be thought of as immutable accounting entries.

And what about Solana?

Many people think Ethereum is dying slowly because of the rise of better, cheaper alternatives like Solana.

It’s true - transactions on Ethereum can take 30 seconds and cost $10 on average.

On Solana, they cost $0.000069 and are near-instant.

So, Ethereum is expensive, yes. But it’s also highly decentralized and very secure.

Individuals who are moving million-dollar tokenized assets or locking hundreds of thousands of dollars in DeFi protocols won't be going to mind paying a few hundred dollars in transaction fees and waiting for thirty seconds.

In other words, Solana wants to become the king of "consumer" blockchain—a fast, cheap, and mobile-friendly alternative for everybody.

Step 3: Understand blockchain metrics

How can the value of a blockchain's native token be reliably quantified?

Because asset valuation is very subjective, we can do our best to estimate by doing fundamental analysis and letting the market confirm or invalidate our idea.

A good place to start is by identifying the key blockchain metrics in our due diligence process.

In traditional finance, you have to wait for the release of quarterly reports to see the financial statements of a company.

In crypto, you can check the data you want on-chain for any protocol in real-time.

That’s one of the major advantages that crypto has over TradFi.

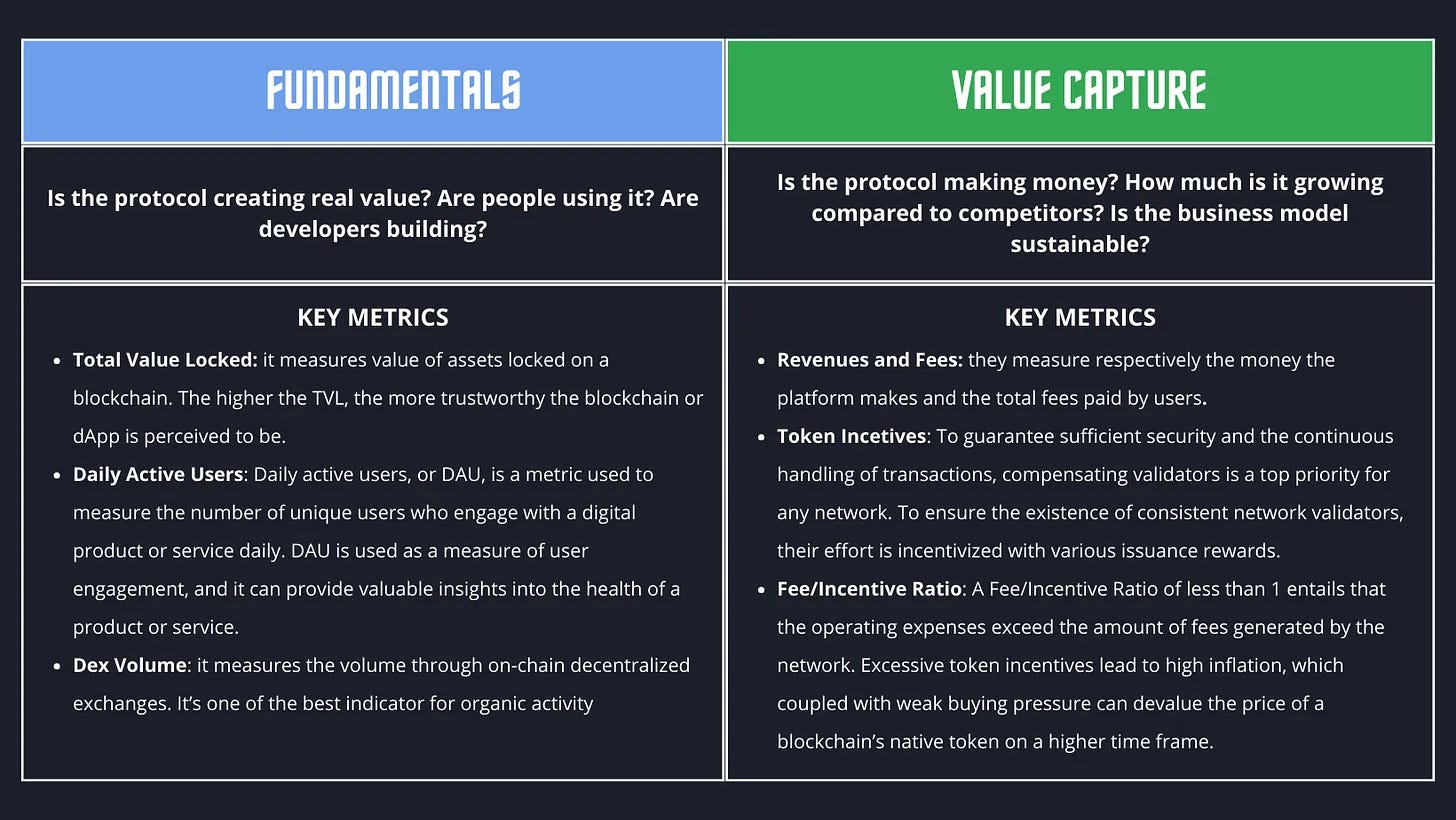

To simplify, blockchain quality metrics consist of 2 buckets:

You can find these and other useful metrics on platforms like Artemis, Growthepie, and Token Terminal.

Step 4: Use Ratios

Ratios can make your life a lot easier as an investor.

They can rate and compare one asset against another that you might be considering investing in.

In other words, they are a powerful way to invest wisely without the hassle of doing time-consuming fundamental analysis and research.

Most ratios are best used in combination with other metrics, especially network trend indicators.

Here are 9 ratios every blockchain investor should know:

Step 5: Pick the best protocols

Once you’ve gathered the right data, you need to set benchmarks in order to understand which protocols are best-in-class, great, average and below average.

This process allows you to pick quality protocols and allocate your capital accordingly.

Take action 🚀

📈 Get undervalued blockchains in your inbox, every month

If you want to level up your crypto journey, consider subscribing to the premium package.

By subscribing, you get access to our monthly ratings where we share the best blockchains to buy based on our value investing framework which aggregates fundamental metrics & value capture metrics discounted by the market multiples.

Moreover, by upgrading to Premium, you’ll get also:

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

Hope to see you on the inside!

Cheers!

L.