The Current State of Crypto in 10 Graphs

Hey Investor 👋🏻

welcome to a free edition of Altcoin Investing Picks.

Today I want to share 10 graphs to help you navigate the crypto market these days.

Let’s dive in!

Top Chains Performance (30d)

Gainers ⬆

Mkt Cap: $MNT (+48.9%), $GNO (+7.1%), $BNB (+4.8%)

Total Value Locked (TVL): $BTC (+66%), $MNT (+15.7%), $BNB (+12.3%)

Daily Transactions: $BTC (+96.5%), $SUI (+21.8%), $NEAR (+14.7%)

Losers ⬇

Mkt Cap: $ACA (-41.3%), $STRK (-37%), $APT (-33.3%)

Total Value Locked (TVL): $ACA (-48.4%), $EGLD (-28.6%), $SEI (-27.5%)

Daily Transactions: $EGLD (-50.6%), $STRK (-42.8%), $AVAX (-34.4%)

The Current State of Crypto in 10 Graphs

Glassnode & Coinbase dropped The 'Guide to Crypto Markets', a quarterly series to provide a detailed analysis of the key developments in crypto markets.

Here are 10 graphs that caught our attention from the report:

1. Bitcoin Dominance rose from 50% to 52%

Altseason, which is usually triggered by the halving, tends to reduce the BTC dominance in favor of new altcoins. This is not yet happened, therefore there’s still a lot of room to grow.

2. Crypto Correlations

Crypto has historically shown very low correlations with traditional asset classes, indicating that it can provide a meaningful source of idiosyncratic risk in many different portfolios.

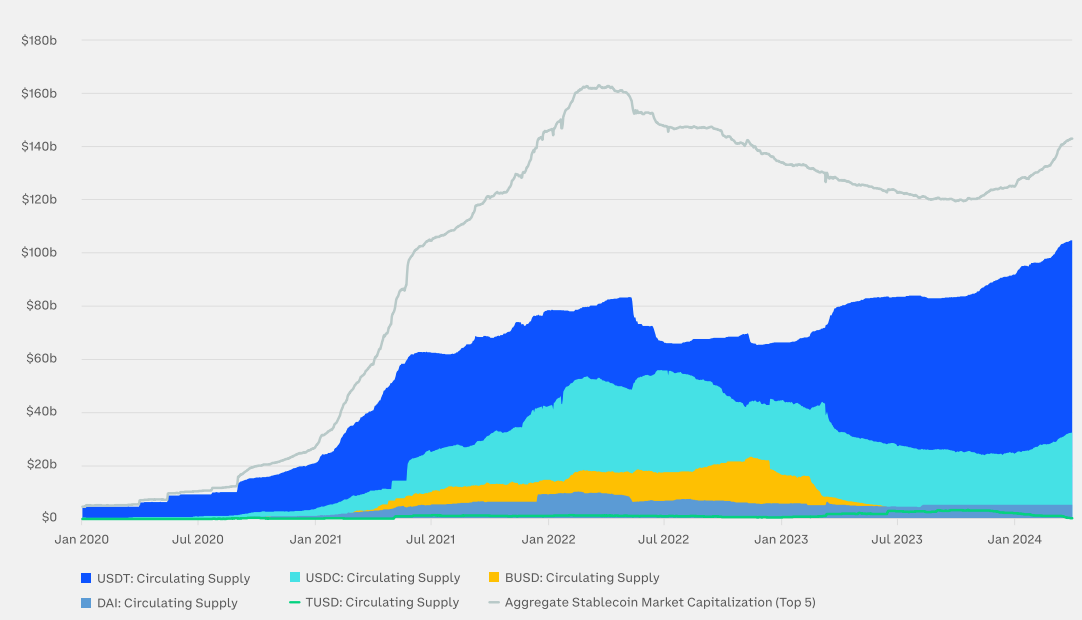

3. The supply of stablecoins rose more than 14% in the first quarter

An important metric to consider when assessing stablecoins is the amount and nature of reserve assets they hold. The supply of stablecoins rose more than 14% in the first quarter as market participants continued to increase their usage.

4. BTC Price Performance Since Halving

This chart measures the total return of BTC during each of the Halving cycles. Within 12 months following the prior 3 Halvings, the prices:

Gained more than 1,000% after the first Halving (red line)

Gained more than 200% after the second Halving (blue line)

Gained more than 600% after the third Halving (green line)

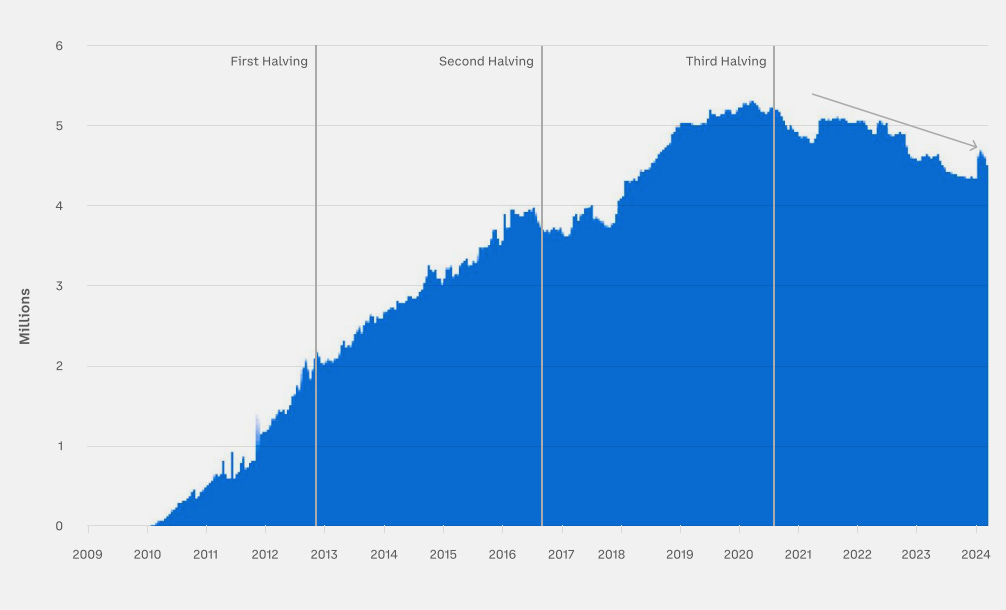

5. BTC Available Supply

The difference between the token’s current circulating supply and the illiquid supply (lost wallets, very long-term holdings, locked up) determines the amount of available bitcoin supply.

After its peak in early 2020, the BTC available supply has fallen to around 4.6M BTC which is a major shift heading into the fourth Halving and differs from the steadily rising trend in available supply that was observed during the previous three Halvings.

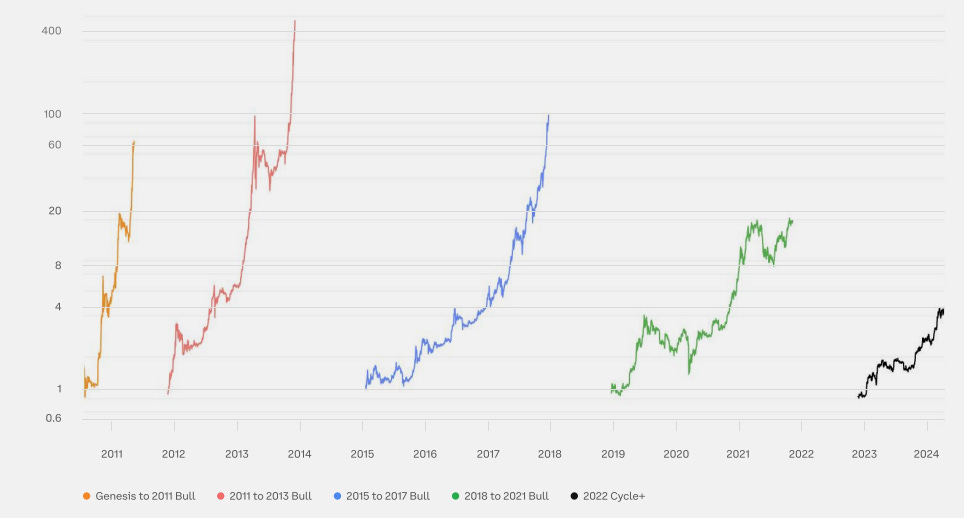

6. Bull Market Cycle Performance

Bitcoin historically exhibited exponential gains during bull markets that have seen the price rally multiples off of the lows. The current bull market cycle, which began in November 2022, has seen prices reach ~4x the lows. As is seen in this chart, the two prior bull markets (2015-2017 and 2018-2021) saw prices rise 100x and 20x respectively.

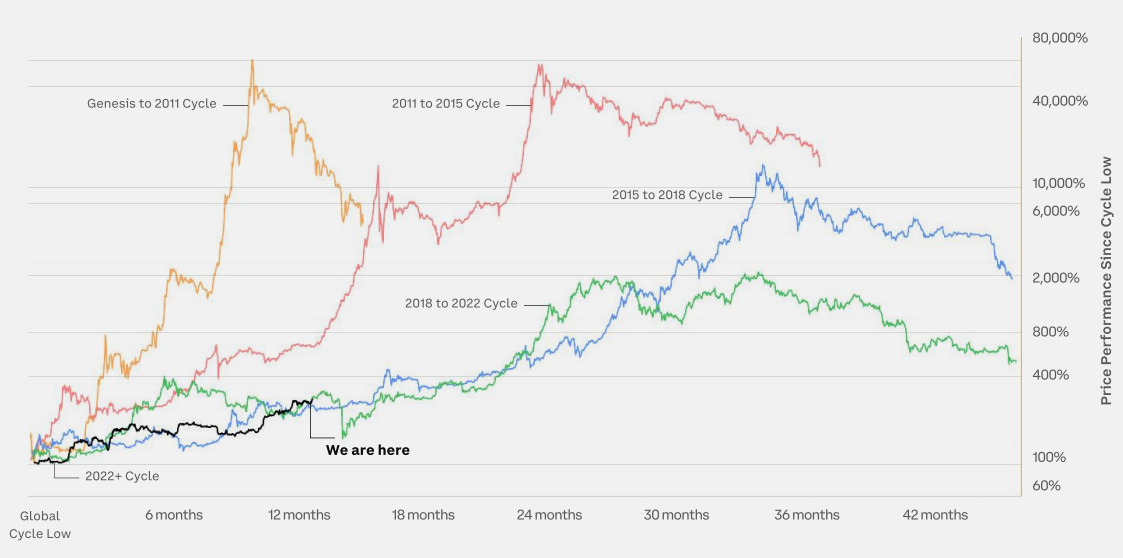

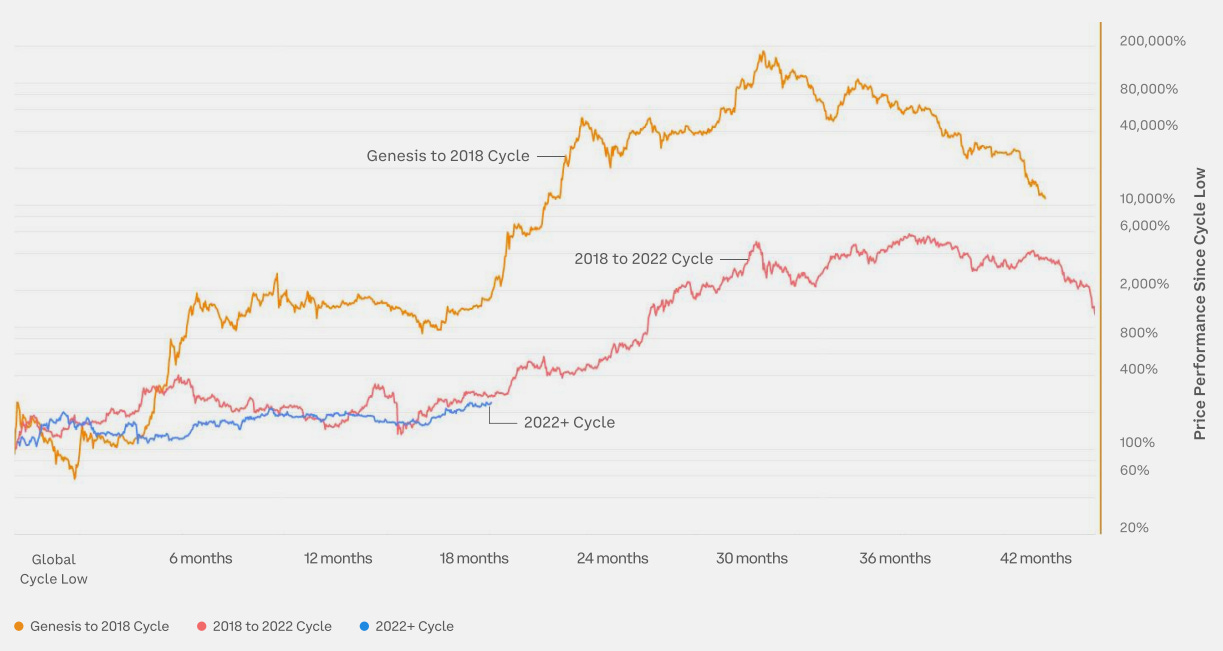

7. BTC Price Performance Since Cycle Low

Bitcoin has completed four cycles that each included both bull and bear markets. The chart shows how the current market cycle, which began in 2022, compares to the previous cycles. In the current cycle, BTC is up 400%+ in the 17 months since its cycle low. The current cycle most closely resembles the one from 2018-2022, which ended with BTC up 1,000% 24 months after the low.

8. ETH Price Performance Since Cycle Low

Ether has completed two cycles that each included both bull and bear markets. This chart shows how the current market cycle, which began in 2022, compares to the previous cycles. In the current cycle, ETH is up 200%+ in the 17 months since its cycle low. The current cycle most closely resembles the one from 2018-2022, which saw ETH rise 400% 24 months after the low.

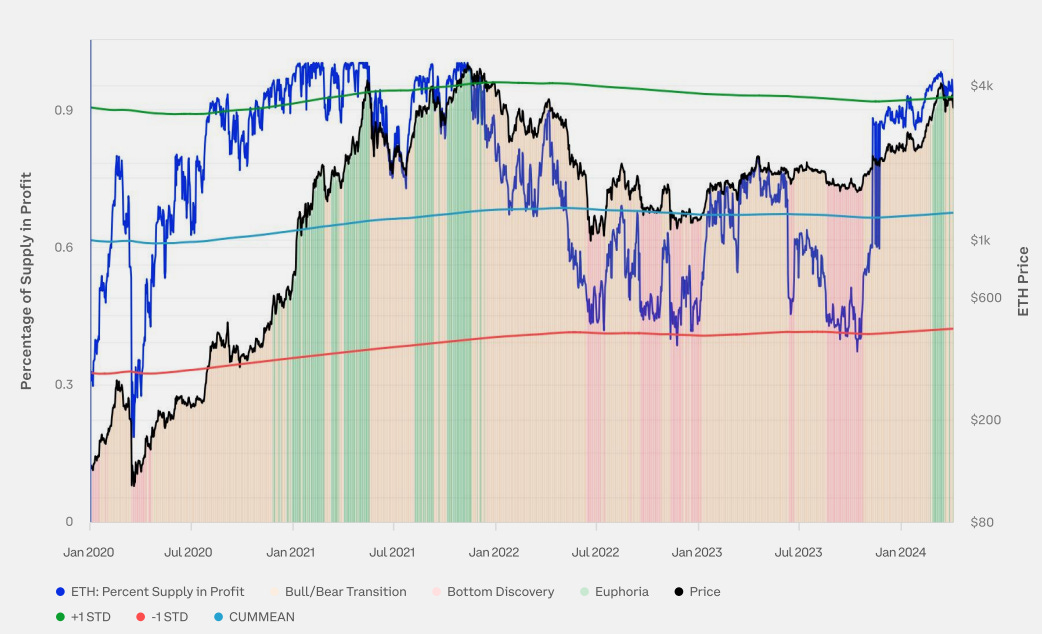

9. ETH Supply Profitability State

Looking at supply profitability can help shed light on where crypto prices are in the current market cycle, as previous crypto market cycles have been characterized by three phases:

Bottom Discovery: In the last stage of a bear market, an extended period of price depreciation causes the share of supply in loss to rise (Percent of Supply in Profit < 55%).

Euphoria: When a parabolic price uptrend is in play during a bull market, the share of supply in profit dominates (Percent of Supply in Profit > 95%).

Bull/Bear Transition: The transition periods between Bottom Discovery and Euphoria, when supply profitability is closer to equilibrium (Percent of Supply in Profit between 55% and 95%)

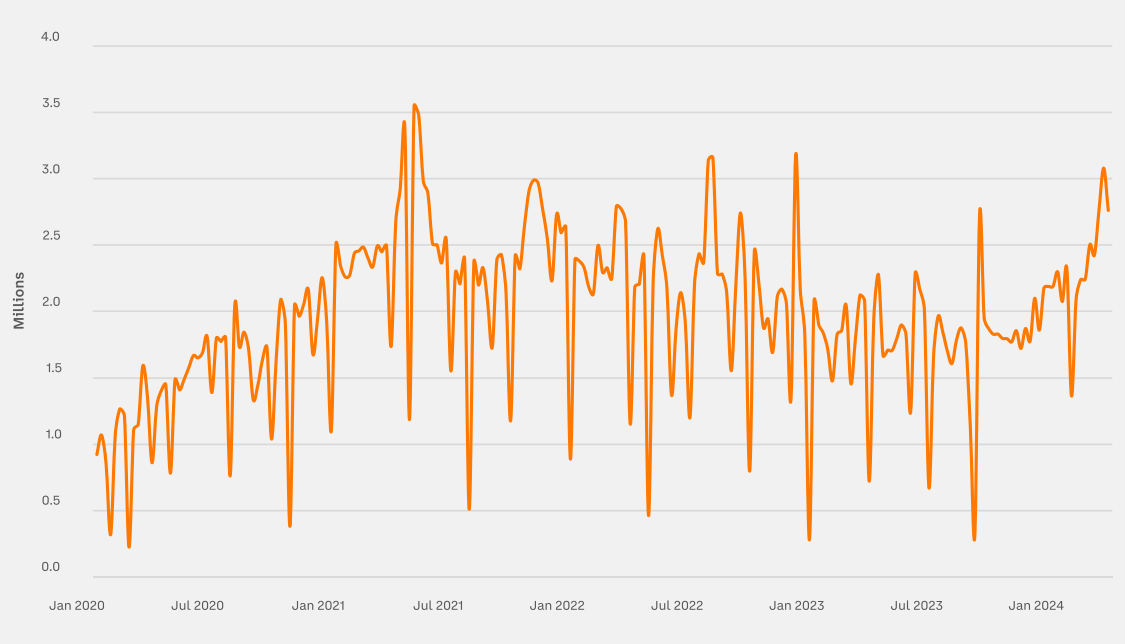

10. ETH Weekly Active Addresses moved 26% higher

Active addresses moved 26% higher in the first quarter as network activity picked up amid the rally in prices and Ethereum’s successful Dencun upgrade.

That’s all for today!

Thanks for reading

P.S. Whenever you’re ready

If you want to level up your crypto journey, consider subscribing to the premium package.

You’ll get weekly picks, tactics, and access to our watchlists and ratings.

Here are some of our most popular premium posts: