Well, here we are once again. Bitcoin went from $68,000 on November 10, 2021 down to currently $47,000 on December 10, 2021. By doing that, Bitcoin dragged most altcoins along with it because Bitcoin currently dominates 40.7% of the whole cryptocurrency market.

So, what do we do when this happens? In this post, I will discuss what to do in these situations, give examples of the best practices during a downwards trending market, and conclude by sharing how to view crypto-investments for sustainability.

WHAT TO DO

What we should not do is sell. It is a counter-intuitive action, but it is exactly what will save our investments from being drained. Say I bought 1 Bitcoin when it was $50,000 and the market immediately goes down to $40,000 the next day. If I sell that 1 Bitcoin at $40,000 I will be losing $10,000! It doesn’t make sense for me to sell my 1 Bitcoin if the market does not go above $50,000.

Instead, since the market went down to $40,000 I would buy more Bitcoin because it’s actually cheaper. The point is do not sell when the market is down! If you can, buy more because we are getting it at a discount. With crypto, I strongly recommend adding Bitcoin, Ethereum, or Litecoin when the market is bleeding.

In the next section I will give some examples to explain further.

EXAMPLES

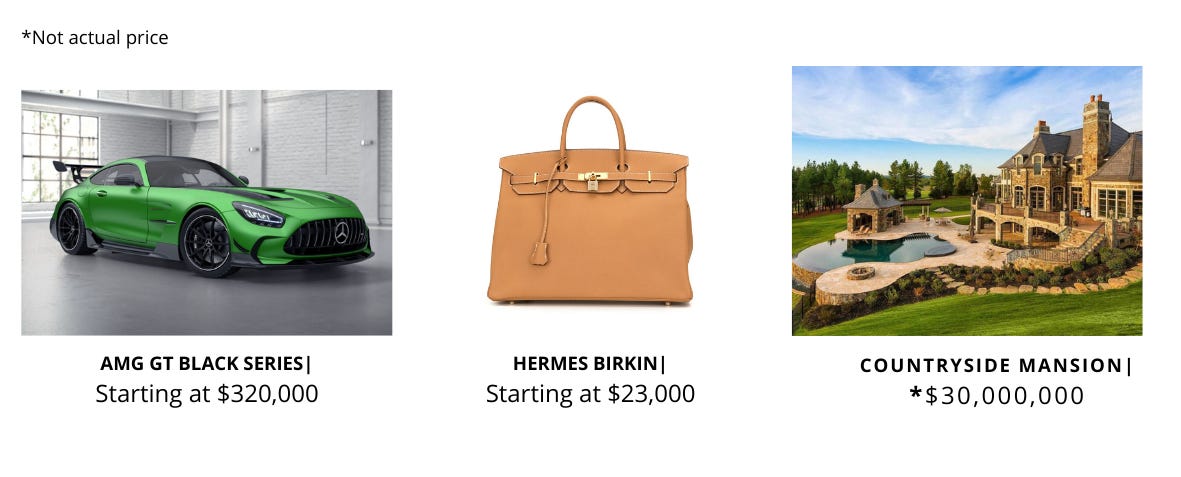

Let’s consider the above 3 commodities:

Perhaps you have been eyeing this beautiful 2021 AMG GT Black Series and have $350K saved up. Suddenly, something happens to the exotic car market where instead of the AMG GT Black Series being worth $320K or more, it’s now worth only $200K. Knowing that this exact model is a limited run vehicle, and should appreciate in value over time, wouldn’t $200K be a bargain?

Or perhaps your wife has always wanted the Hermes Birkin but you just couldn’t afford it at $23,000. Over night, something happens to the luxury purse market and now the Hermes Birkin is only $10,000. Considering that the Hermes Birkin will appreciate in value over time, wouldn’t $10,000 be a bargain?

Maybe you and your fiancé are ready to buy a country side mansion. Your budget is $20 Million and you see this exquisite countryside mansion that you must have, but it’s $10 Million over budget. A week later, the real estate market tanks and the countryside mansion’s price is now only $15 Million. Knowing that real estate is an appreciating asset over time, wouldn’t $15 Million be a bargain?

Similarly, when the crypto market is down, we are essentially given a chance to buy more cryptocurrency for less. Knowing that crypto appreciates overtime.

In the next section, we will look at the price of Bitcoin, Ethereum, and Litecoin within 12 months apart.

MINDSET TO HAVE WHEN INVESTING IN CRYPTO

Below you will find charts of BTC, ETH, and LTC 12 months apart:

Looking at these charts, it’s clear that all 3 cryptocurrencies would have given over 100% return each within 12 months. That means if you invested $100 in either BTC, ETH, or LTC 12 months ago, today that same $100 will be worth more than $200 minimum.

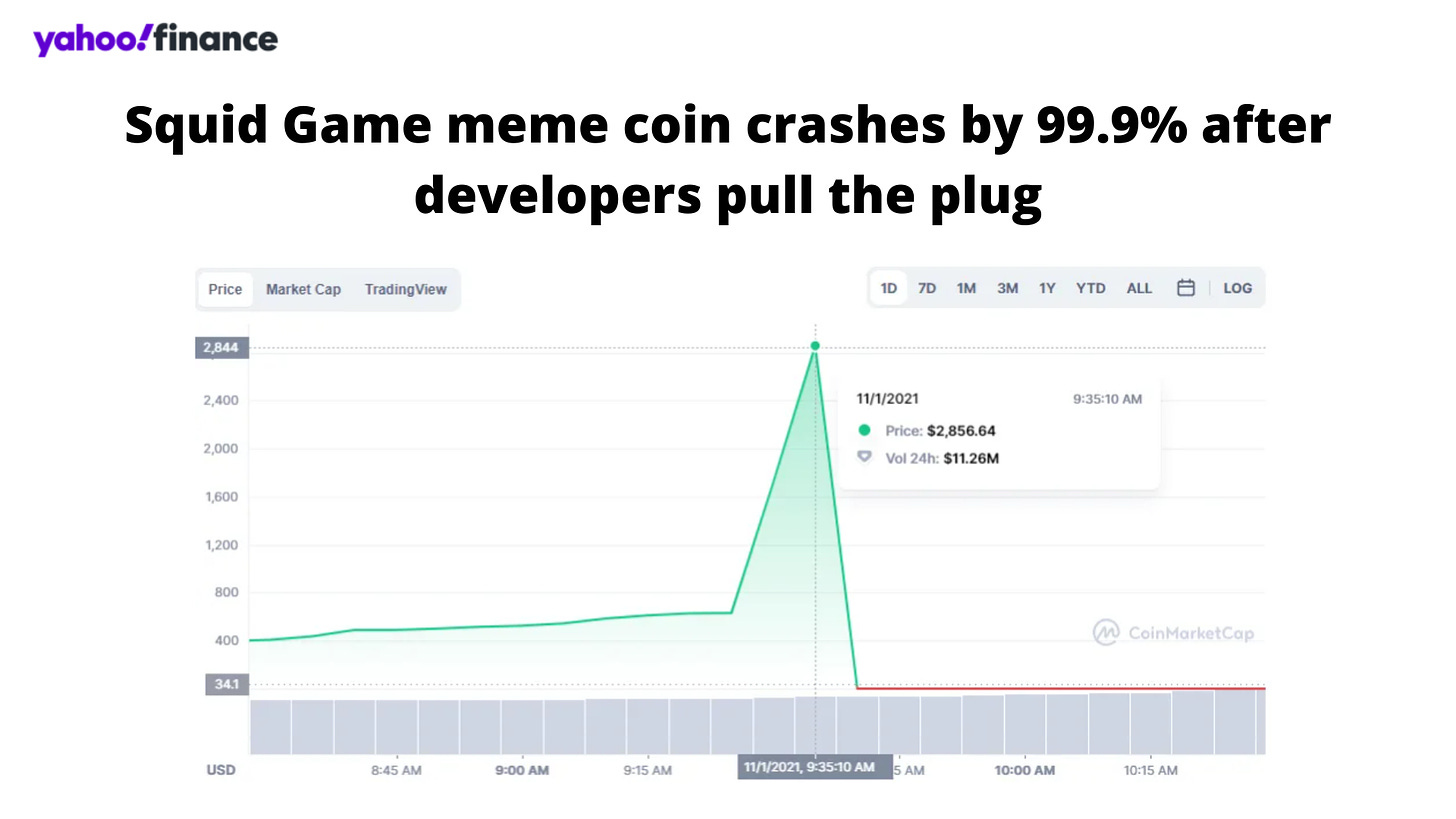

With this in mind, we should treat our crypto investments with a long-term mindset and not a “get rich quick” scheme. Be careful when you start seeing the media talking about certain cryptocurrencies, especially when the overall crypto-market is on an uptrend. Stay away from meme coins like Dogecoin, Safemoon, Shiba Inu and many others because they don’t have any real utility.

Yes, you can make quick easy money on meme coins, but you can just as easily lose ALL of it within a few seconds with no hope of that crypto going back up in price - that’s called a rug pool. A great example of this was the Squid Game meme coin. The price got hyped up, and within a matter of a few minutes the ones most likely hyping this meme coin sold all their Squid Game coins, which essentially allowed them to make money, and the ones who invested in this meme coin to lose most of it. The chances of Squid Game meme coin going up is zero-to-none at the moment.

CONCLUSION

Cryptocurrency is a great opportunity to build wealth. It is a level playing field for anyone to build financial security for the next decade. However, it is volatile and risky. Knowing what to do, or where to look for advice is difficult, because we don’t know what is anyone’s true intentions behind giving crypto-advise. One thing is for sure, cryptocurrency is one of, if not, the best performing asset within the last decade. The best part is that this is still just the beginning! Be smart, and play the long game.

Liked this post?

We send out two new Altcoin Project reports every week with research and analytics for just $7/month.

Support us by joining our premium subscribers community:

Join our *NEW* Altcoin Investing Community, here.