When in doubt, zoom out

PLUS: 5 Revenue-Machine Protocols, $1B of crypto has been liquidated & more

Welcome to another free edition of Altcoin Investing Picks.

I hope you enjoyed our last issue ”The Current State of Crypto in 7 Graphs”

In today's newsletter:

💸 5 Revenue-Machine Protocols

🚨 $1B of crypto has been liquidated

📈 Alpha Signal: $BTC Mayer Multiple

Top Chains Performance (30d)

Gainers ⬆

Mkt Cap: $BTC (-0.4%), $ICP (-2.0%), $FLOW (-2.1%)

Total Value Locked: $AXL (+87.7%), $MNT (+27.6%), $STX (+23.4%)

Daily Active Addresses: $SEI (+1,841.1%), $TON (+68.8%), $APT (+38.4%)

Losers ⬇

Mkt Cap: $GNO (-33.5%), $FTM (-24.6%), $OSMO (-22.9%)

Total Value Locked: $INJ (-24.3%), $SUI (-22%), $BTC (-21.4%)

Daily Active Addresses: $INJ (-86.1%), $MATIC (-42.7%), $SUI (-39.2%)

💸 5 Revenue-Machine Protocols

While narrative and sentiment certainly play a huge role in short-term price action for tokens, longer market cycle’s should shift back to fundamentals.

With the influence of institutional investors this cycle and their traditional processes of evaluation, protocols with solid fundamentals may see substantial returns as the bull run continues, making the industry more mature and thus increasing its longevity.

In today’s issue, we’re mapping out protocols which are actually making money to help you identify blue-chip tokens to add to your portfolio:

1/ Lido Finance ($LDO)

Lido is primarily a liquid staking solution for Ethereum and Polygon. Products offered include liquid staking derivative token contracts and other auxiliary smart contract infrastructure to support native token staking services.

Market Cap: $894M

Fees (Annualized): $1.10B

P/F Ratio: 0.8x

Down from ATH: -84.52%

1Y ROI: -40.22%

1Y ROI vs BTC: -68.63%

2/ Uniswap ($UNI)

Uniswap is a decentralized finance (DeFi) protocol centered around its automated market-making (AMM) decentralized exchange (DEX) that sources liquidity for swapping crypto assets. The protocol comprises various immutable, non-upgradeable smart contracts, each with different features for the underlying AMM architecture.

Market Cap: $3.95B

Fees (Annualized): $779.41M

P/F Ratio: 7.7x

Down from ATH: -87.37%

1Y ROI: -6.68%

1Y ROI vs BTC: -50.82%

3/ Jito ($JTO)

Jito is a liquid staking solution for Solana. The protocol’s smart contracts allow users to stake SOL on Solana to receive a corresponding liquid staking derivative token, JitoSOL.

Market Cap: $276M

Fees (Annualized): $478.52M

P/F Ratio: 0.6x

Down from ATH: -56.64%

1Y ROI: /

1Y ROI vs BTC: /

4/ Aave ($AAVE)

Aave is a liquidity management protocol allowing users to borrow/lend crypto assets on supported networks, like Ethereum, Avalanche, and Arbitrum.

Market Cap: $1.36B

Fees (Annualized): $386.49M

P/F Ratio: 3.7x

Down from ATH: -84.87%

1Y ROI: +50.93%

1Y ROI vs BTC: -20.45%

5/ MakerDAO ($MKR)

MakerDAO is a non-custodial stablecoin protocol built on Ethereum founded by Rune Christensen and launched in 2015.

Market Cap: $1.78B

Fees (Annualized): $326.29M

P/F Ratio: 5.5x

Down from ATH: -69.08%

1Y ROI: +54.61%

1Y ROI vs BTC: -18.46%

🚨 $1B of crypto has been liquidated

A few days ago, ETH fell -20% in a day and Bitcoin below $50,000.

According to CoinGlass, total crypto liquidations over the last days have reached $1.12 billion with about $936 million of that belonging to long traders expecting a further price hack in their trades.

Here are 3 reasons why crypto crashed:

Trump presidency odds are decreasing

Japan raised its interest rates

Stock market correction

Does this change anything?

No.

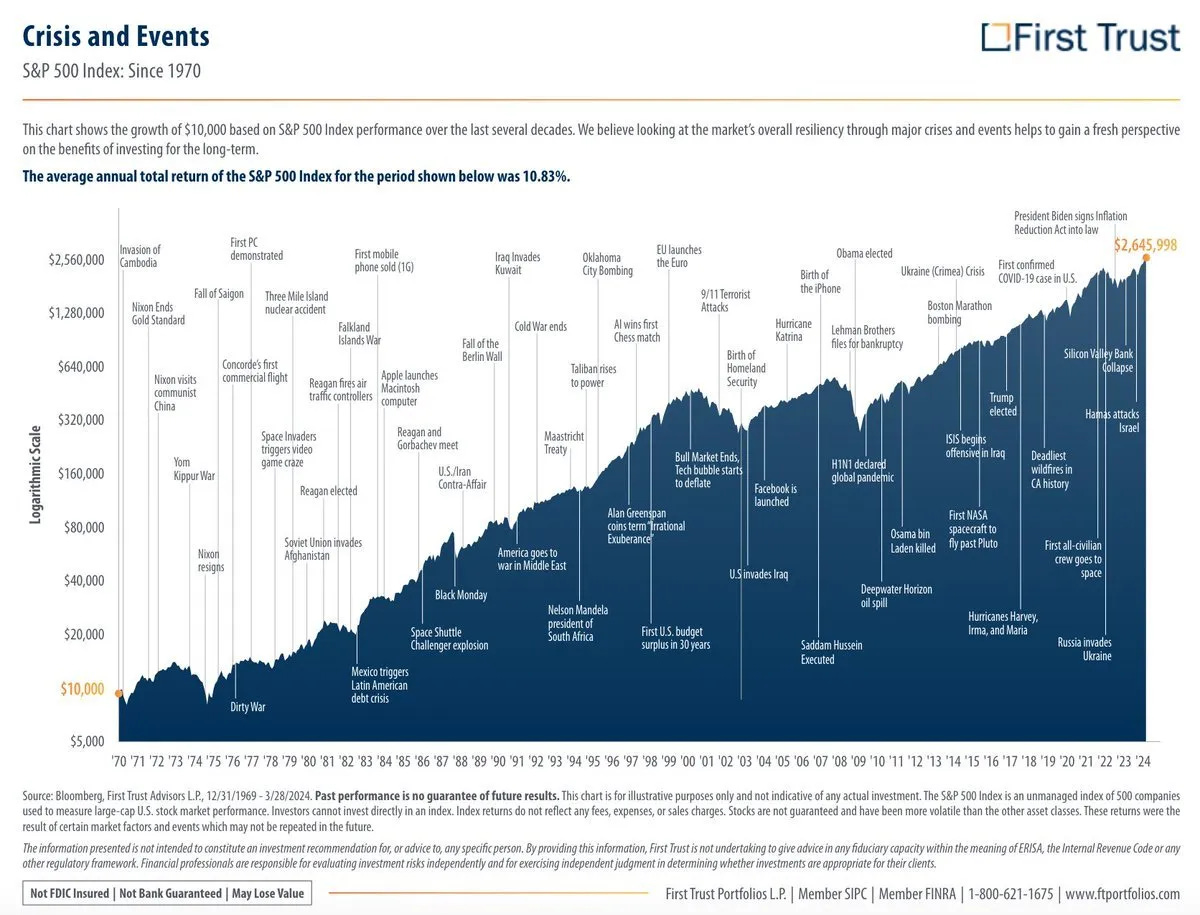

Corrections are perfectly normal, especially in crypto.

But should you actually be worried about this?

It depends on your time horizon. If you are investing for next week or next month, you better pay very close attention to the short-term gyrations of the market.

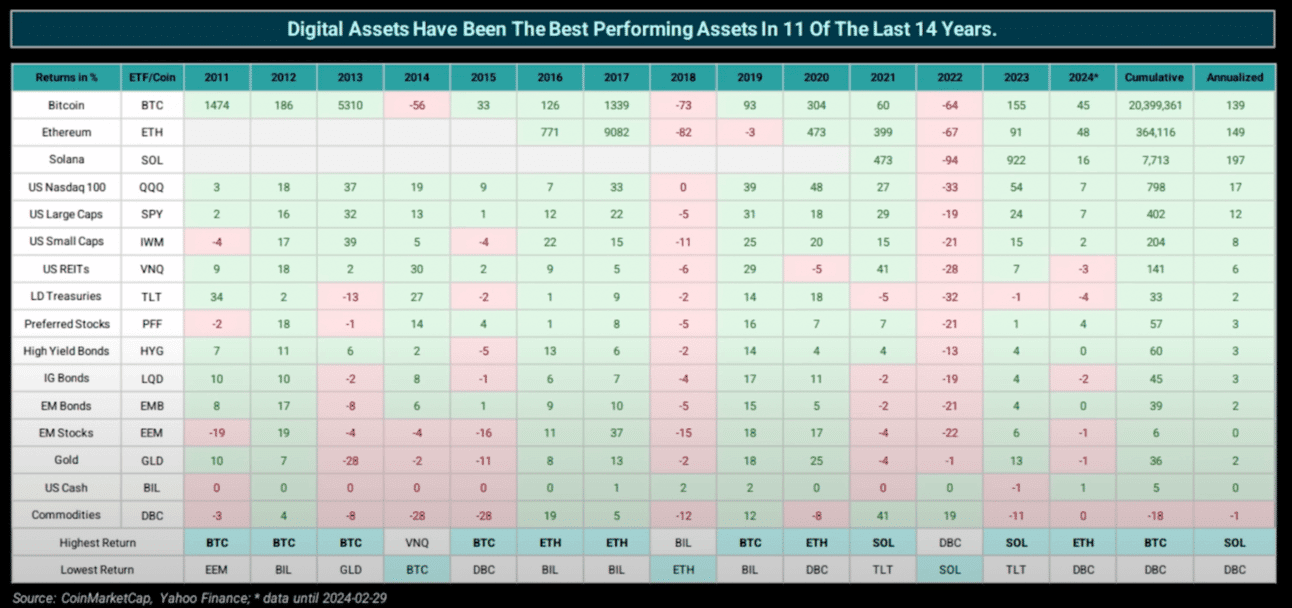

So, when in doubt, zoom out:

#1

#2

#3

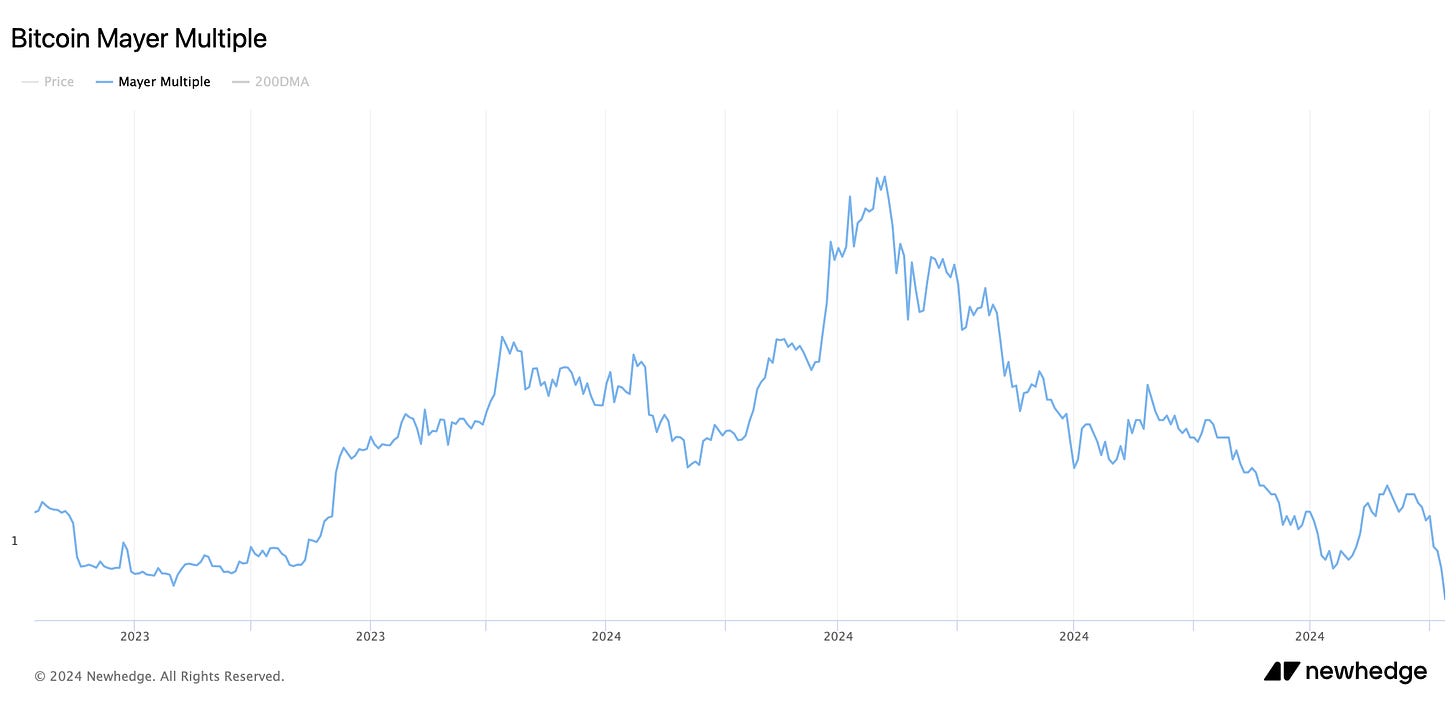

📈 Alpha Signal: $BTC Mayer Multiple

The Mayer Multiple measures the difference between the current price of bitcoin and the 200-day moving average. According to Trace Mayer, a value of 2.4 or more is considered a speculative bubble.

👉🏻 Current level: 0.88

👉🏻 Average level: 1.36

👉🏻 Bubble level: 2.4

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package. By upgrading to Premium, you full access to our entire library of analysis, picks & portfolios.

Here’s what premium subscribers got lately:

And here are some of our most popular premium posts:

That’s all for today!

Cheers