Hey everyone, The Altcoin Investor here 👋🏻

Welcome to our free weekly newsletter where you get crypto insights, trends, and investment ideas.

I hope you enjoyed last week’s issue “How to build a profitable crypto portfolio”

The past month has been outstanding for the crypto market.

Now the main question is, where is it heading next?

To answer this, today I’ll share 6 charts & insights that illustrate the current levels of institutional & retail interest in crypto, market fundamentals, trends and more.

Let’s dive in👇

Before we get started: Memes did their job!

Remember last week? I hope you followed our analysis on Meme Coins.

We have selected the best memes we think might be the next Shiba Inu or Dogecoin.

And some 6 of them are up more than 100% in the last 7 days!

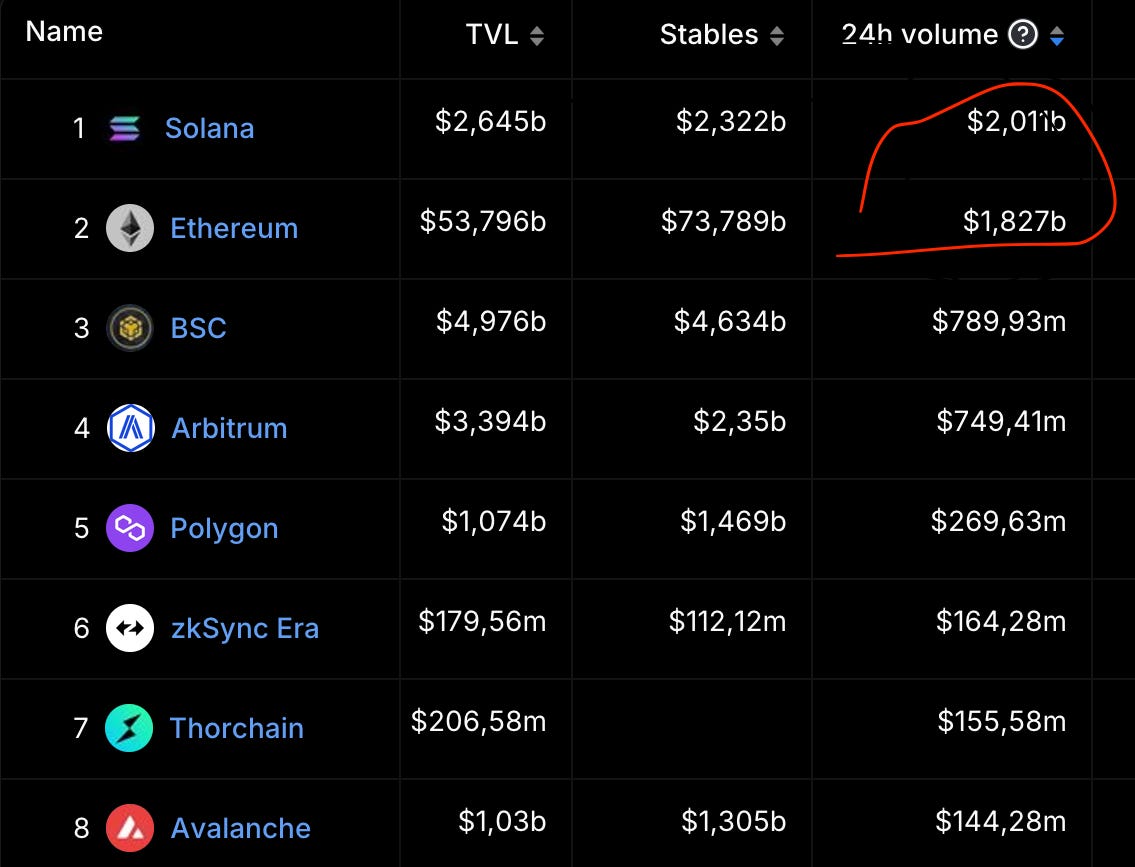

1. Solana Overtakes Ethereum In 24h DEX Volume

DEX Volume measures the volume through on-chain decentralized exchanges and it’s one of the best indicators for organic activity.

We use this metric (among others) to determine blockchain ratings.

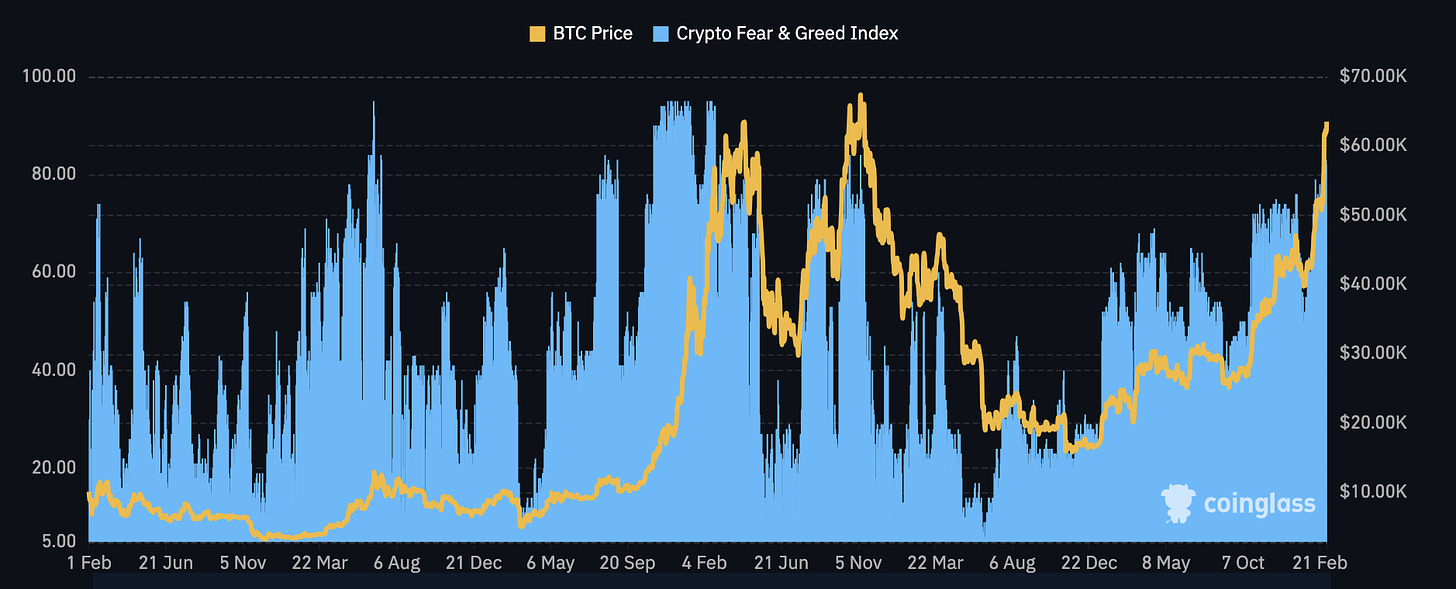

2. Fear & Greed Index

We’ve definitely entered into an extremely greedy phase of the market.

Only 2 other times the index has been above 80.

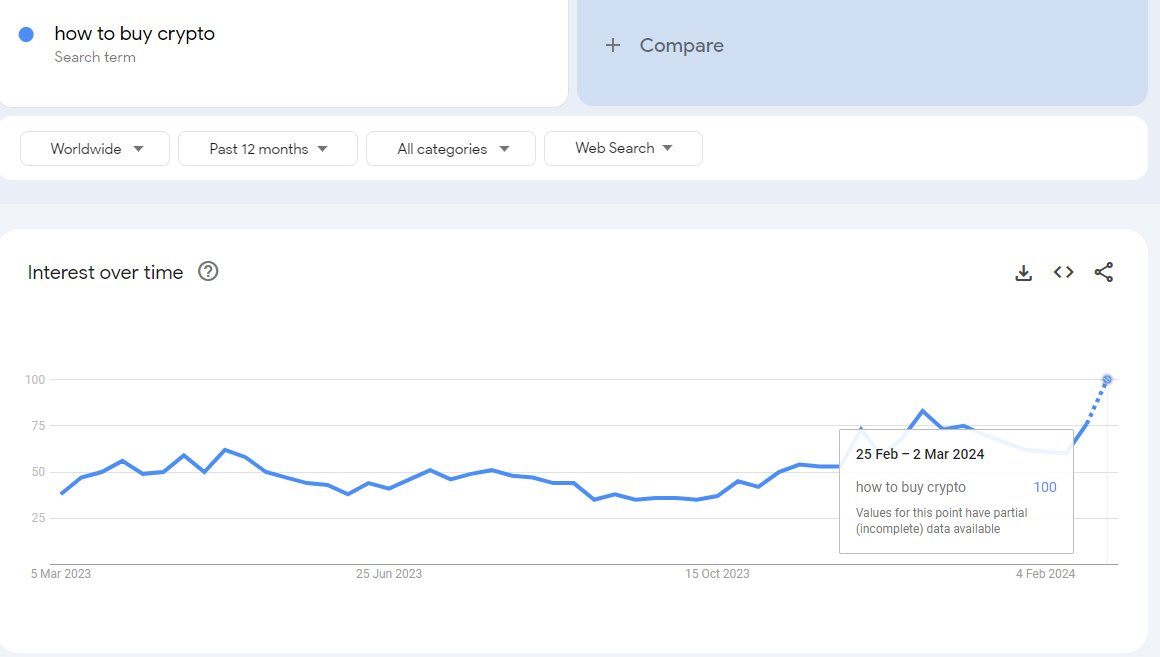

3. Google Search Traffic for "How to buy crypto" is finally starting to go up

Quick reminder: It is important to know where you stand in the information stream otherwise people will dump heavily on you

4. Stables are back to 2023 levels

Since the beginning of the year, the total stablecoin market cap increased by $10 billions and reached the levels of a year ago.

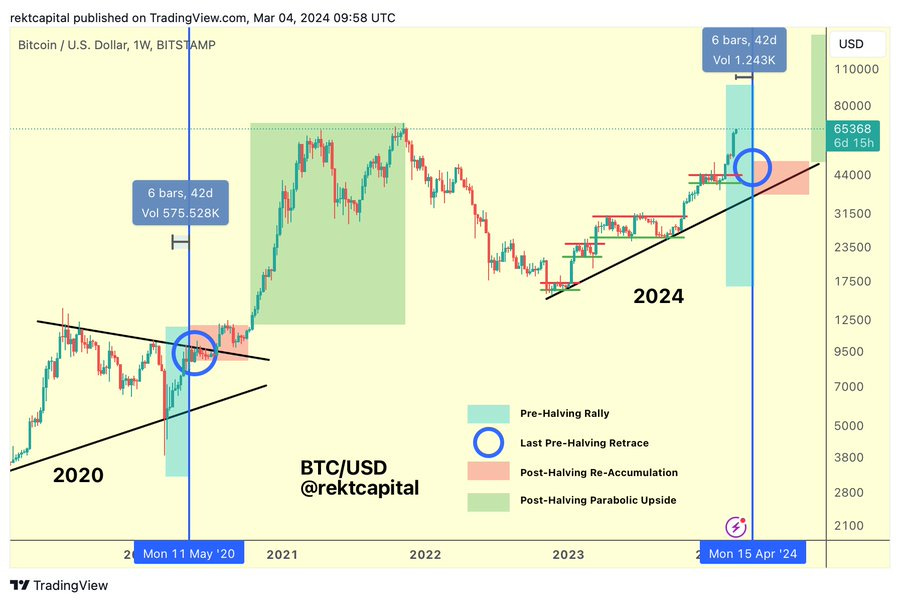

5. Are we in the Pre-Halving Rally Phase?

~60 days before the Halving, a Pre-Halving rally tends to occur (light blue)

Now, Bitcoin is approximately halfway through its Pre-Halving Rally phase In anticipation of the Halving, investors "Buy the Hype" in an effort to "Sell the News".

Short-term traders and speculators "Buy The Hype" several weeks before the Halving in anticipation of making a profit from this hype-fuelled rally

Then these speculators "Sell The News" to realise that profit, contributing to a Pre-Halving retrace which occurs only a handful of weeks before the Halving event itself

6. Bitcoin MVRV Ratio is currently sitting at just over 2

It means Bitcoins Market Value is currently 2x its "Realized Value."

In the last cycle, the MVRV ratio peaked at 7.6. In the prior cycles, it peaked out much higher.

That’s all for today

Thanks for reading!

Whenever you’re ready

If you want to level up your crypto strategy and take advantage of the latest opportunities, upgrade your subscription with more analysis & picks:

4x+ Micro Altcoin Picks: micro projects we think are willing to be tomorrow's market leaders.

2x+ Tactical Trade Ideas: short-term bets to make profits from narratives and trends.

1x Value Investing Analysis: undervalued blockchains we think will outperform the market.

1x Monthly Market Analysis: our view on the current market situation supported by data-driven analysis.