Portfolios

Problem

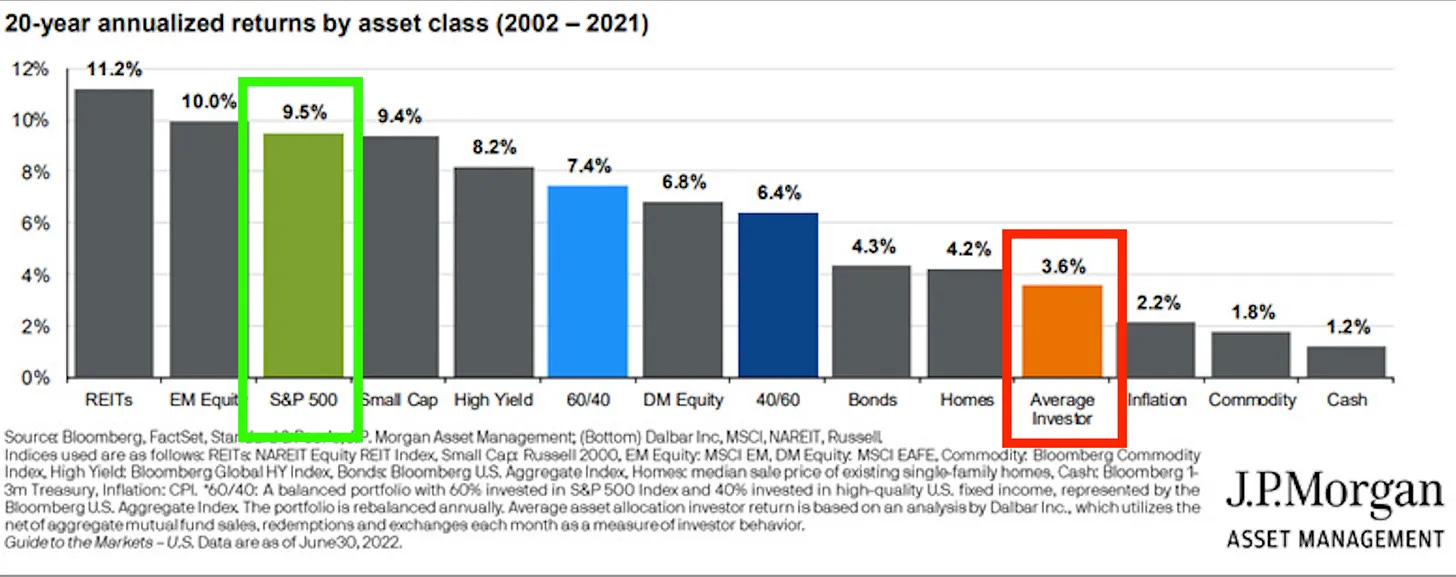

Statistically, more than 95% of investors underperform the market.

The main reasons?

Lack of clear financial goals

Trying to time the market

Making emotional investment decisions

Lack of patience

This study by JP Morgan shows that the average investor achieved an annual return of 3.6%, while the S&P 500 returned 9.5% over the past 20 years.

Why should it be any different in crypto?

While I believe that investors can outperform the market by buying undervalued blockchains, narrative-based tokens & micro altcoins, I also know that successful investing requires planning, consistency, and method.

Solution

Rule-based portfolios are typically driven by predetermined rules, often focusing on strategies such as strategic asset allocation and tactical asset allocation.

Asset allocation is crucial because it determines the overall risk and return profile of a portfolio, making it one of the most significant factors in investment performance.

The concept of rule-based portfolios relies on the idea that a disciplined and structured approach can remove emotional decision-making and ensure consistency in achieving investment objectives.

Our Altcoin Portfolios

#1 Degen Portfolio

Thesis: if you to maximize the post-halving bull run with a diversified & aggressive approach.

Risk Level: High

Timeframe: 1-2 years

Strategy: tactical portfolio

#2 Protocols & Products

Thesis: if you want to win in crypto on easy mode, you hold a lot of these types of assets.

Risk Level: Medium to Low

Timeframe: 5+ years

Strategy: buy & hold

#3 Web Interoperability

Thesis: A cross-chain ecosystem is the only way that blockchain applications and crypto protocols can have a true vision of reaching their full market potential and unlock the liquidity and value present on other chains.

Risk Level: Medium to High

Timeframe: 5+ years

Strategy: buy & hold

#4 Micro Altcoins

Thesis: Micro Altcoins carry the potential for massive returns that don’t exist in other asset classes. Not even in the major tokens.

Risk Level: High

Timeframe: 5+ years

Strategy: buy & hold